Cronos (CRO) declined in May by another 18%. Bearish momentum seems to be approaching critical levels. On-chain data shows that long-term holders are growing increasingly unwilling to sell at the current low prices. Will they inadvertently trigger a Cronos price rebound?

Cronos (CRO) has been stuck in a downward trend for three consecutive months. As unrealized losses pile up, investors now appear unwilling to sell. How could this impact CRO price in the coming days?

Cronos Long-Term Investors Are Holding Firm

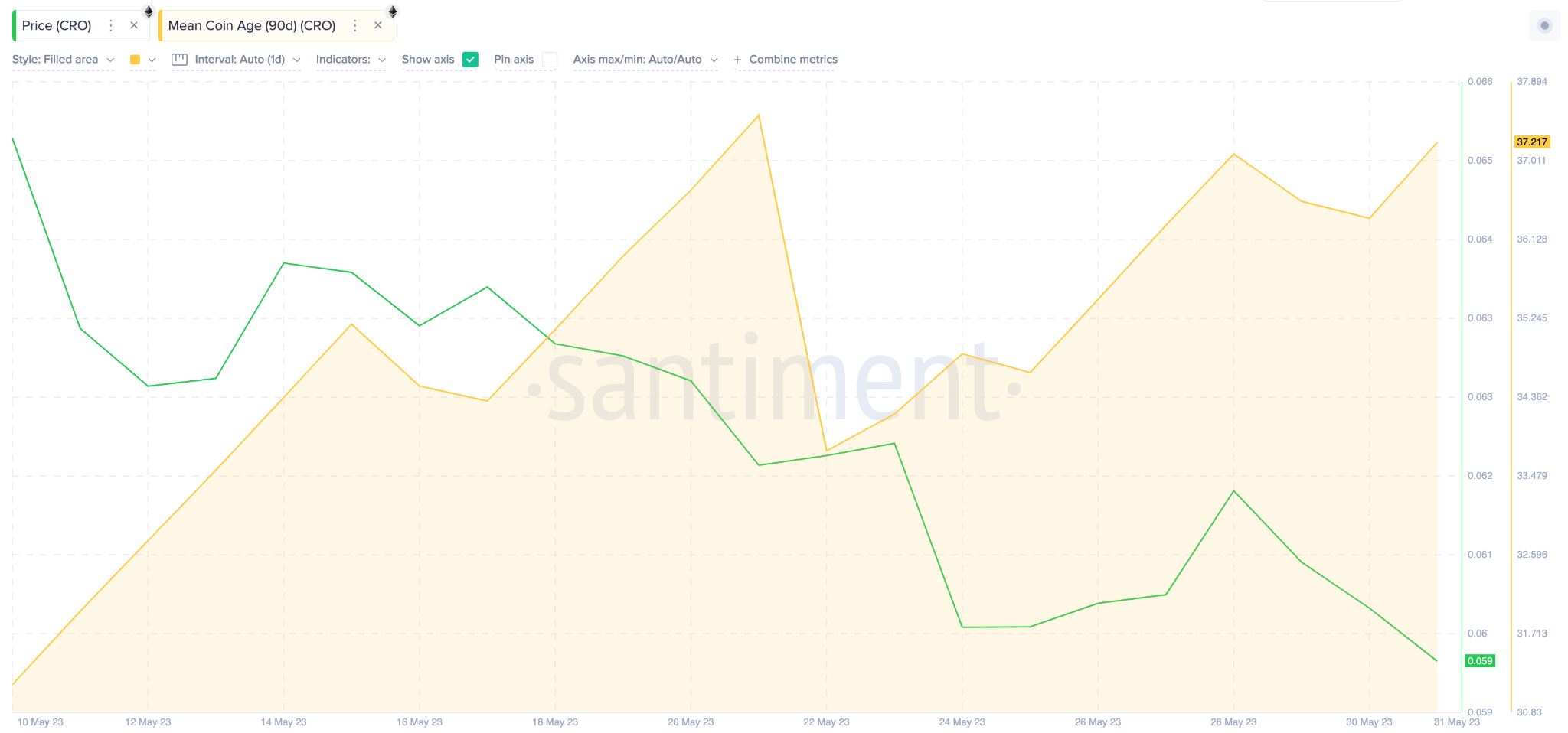

As the bearish momentum lingers, long-term investors on the Cronos network now appear to be holding out for future gains. The rising Mean Coin Age is a key indicator of this.

In simple terms, Mean Coin Age evaluates how long coins in circulation have stayed in their previous wallet addresses.

Between May 8 and June 1, CRO Mean Coin Age increased by 21% from 37.13 to 33.38.

When Mean Coin Age rises considerably, tokens stay longer in their existing wallet addresses. As seen above, Cronos holders’ investors stave off selling to avoid huge book losses.

If the trend continues, they could sell off the Cronos market supply and inadvertently trigger a price rebound.

Investors Are Turning to Staking Options

As CRO prices continue to drop, holders now appear to be turning to yield-bearing protocols to mitigate their losses. The chart below shows that CRO holders have staked an additional 5.6 million tokens (0.022% of the total circulating supply) between May 8 and June 1.

Supply in Smart Contracts tracks the portion of a cryptocurrency’s circulating supply that investors have locked up in staking protocols. When holders lock up tokens, it reduces the volume available to be traded on crypto exchanges.

If Cronos investors continue to increase their stakes at this rate, the CRO stands a chance to defend the $0.059 resistance.

CRO Price Prediction: Potential Rebound to $0.07?

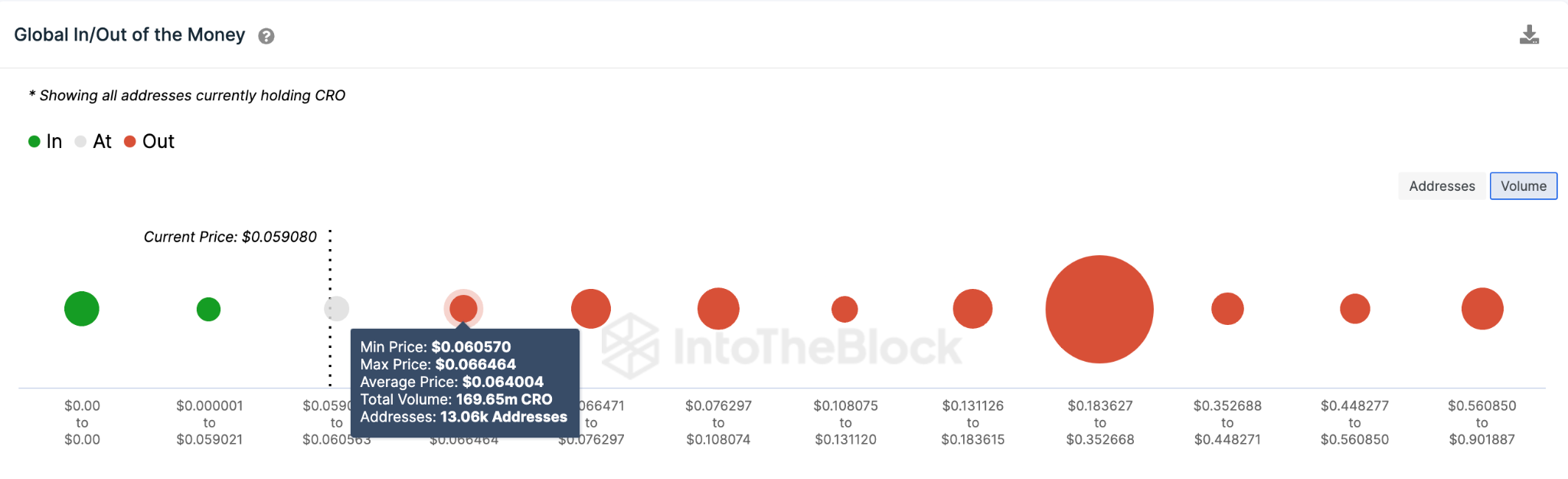

Considering the increased staking activity and the long-term holders unwilling to sell, CRO price might rise toward $0.07 in the coming days. IntoTheBlock’s Global In/Out of The Money Around Price (GIOM) data, suggests CRO will face its initial resistance around $0.064.

As highlighted below, 13,000 investors that bought 170 million CRO at an average price of $0.064 could mount a sell-wall. However, if that resistance level is breached as expected, the price could rise further toward $0.07

On the other hand, the bears could invalidate the bullish price prediction if CRO unexpectedly drops below the critical $0.059 support zone.

But, the 2,000 investors that purchased 18.5 million CRO at an average price of $0.0.59 will likely prevent the drop. Although unlikely, CRO could retrace further toward $0.050 if that support level is breached.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.