Cronos (CRO) retraced 12% after testing $0.075 on March 20 as markets reacted to US authorities’ crackdown on Centralized Exchanges. With network growth trending downwards with price, can the bulls stop the slump?

Cronos (CRO) is an EVM-compatible blockchain network created by Crypto.com. The native coin appears to have hit a snag amid recent media FUD.

Scrutiny from global financial regulators has culminated in a turbulent Q1 for centralized crypto exchanges. On March 20, the U.S. Securities and Exchange Commission (SEC) issued a Wells notice to Coinbase barely weeks after Kraken was fined $30 million and ordered to halt staking services. After the Commodity Futures Trading Commission (CFTC) charged Binance at the close of March, CRO wobbled below $0.070.

On-chain data shows how CRO investors appear to be reacting cautiously to the recent negative media spotlight surrounding centralized exchanges.

Cronos Network Growth Enters Free Fall

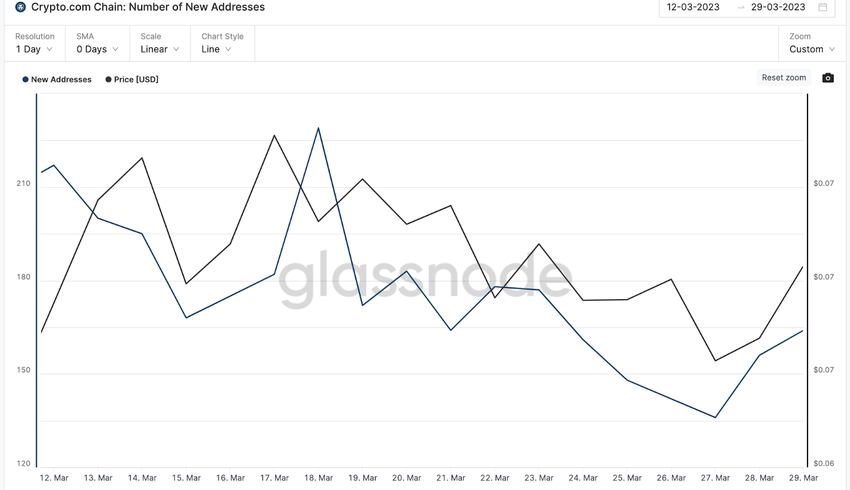

Worryingly, the number of new users joining the Cronos network has slowed since the price dropped below $0.070 on March 18. The downtrend appears to have been exacerbated by the growing media FUD surrounding Crypto.com as the SEC cracked down on popular centralized exchanges.

According to Glassnode, the number of Cronos’ new wallet addresses has declined by 27% in the last two weeks. Since its recent local high of 229 on March 18, it has dwindled to 167 as of April 3.

When network growth declines on a blockchain, it implies a downtrend in the adoption of its core services. Ultimately, the underlying native coin may struggle to find new demand.

In recent weeks, Cronos’ failure to attract new users has been linked to crypto investors turning to decentralized exchanges. If centralized exchanges lose ground to DEX’s, then CRO may struggle to break out of its bearish momentum.

Notably, the abrupt decline in the supply of CRO in on-chain smart contracts also confirms this bearish stance. On March 21, a few days after the Coinbase Wells notice hit media newsdesks, Cronos witnessed a sharp drop in the supply of coins locked in the smart contracts.

Between March 21 and April 4, Cronos users have unstaked nearly 21 million CRO (0.83% of circulating supply) worth approximately $1.4 million.

A sharp decline in the supply of a blockchain native coin locked in smart contracts is a bearish signal. It could mean that newly unstaked coins may soon hit the market for trading. In an attempt to front-run this, CRO investors may sell off their holdings prematurely, leading to prolonged selling pressure.

CRO Price Prediction: Failure to Hold $0.065 May Prove Costly

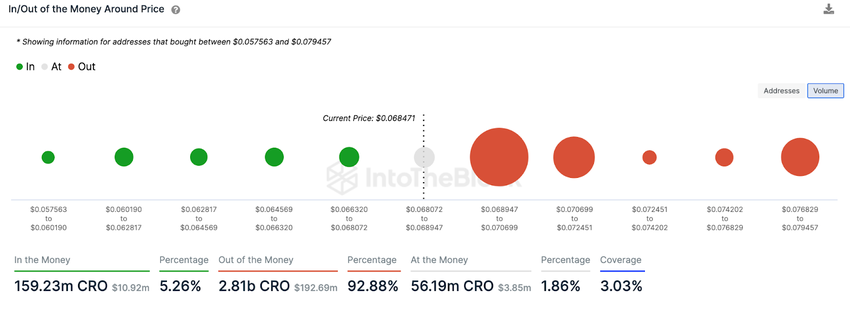

IntoTheBlock’s In/Out of Money Around Price (IOMAP) data shows that CRO will have difficulty breaking above the $0.068 resistance. At that zone, there is a massive supply of 1.7 billion CRO held by 4,800 addresses.

Furthermore, the price is likely to retrace toward $0.065. At the $0.065 zone, 4,200 addresses holding 34 million coins can offer some support. Failure to hold this support could prove costly for the bulls as CRO can enter a downtrend to $0.058.

Yet, the bulls can turn things around if CRO can break above $0.070, where 4,800 addresses bought their 1.7 billion CRO.

If that happens, it could trigger a network-wide accumulation and a prolonged rally toward $0.079. At this zone, another significant resistance of 11,000 addresses holding 494 million coins lies in wait.