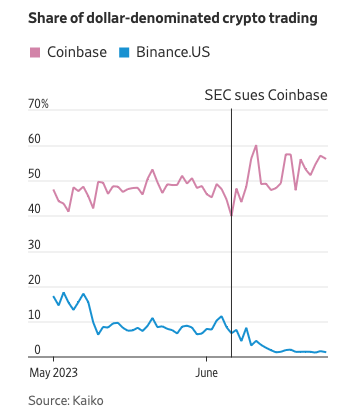

Coinbase and Binance have lost market share to international exchanges Kraken and Bitstamp since the US Securities and Exchange Commission (SEC) sued Coinbase.

Kraken’s US crypto trading volumes has grown to 29%, while Bitstamp, another international exchange with a US presence, has seen its slice of American volumes increase to 9%.

Coinbase Share Falls 11% While Fighting the SEC, Binance Drops to 1%

The SEC recently filed lawsuits against Coinbase and Binance for offering unregistered securities and violating business registration requirements.

As a result, Coinbase’s share of US crypto trading volumes has fallen from 62% in January to 51% on June 18. Binance.US, the American arm of the global exchange, has seen its market share shrink to about 1.15% since March.

A partner at investment firm Wilshire Phoenix, Wade Guenther, said exchanges differentiate themselves through the breadth of their token offerings. Kraken and Bitstamp hope to benefit from improved investor interest and any rise in crypto prices. However, they also face enforcement risk after the SEC recently updated its list of cryptos classified as securities.

Coinbase Files Motion to Dismiss Lawsuit

Coinbase filed a motion to dismiss the SEC lawsuit, arguing the SEC cannot expand powers Congress gave it in 1933. Its argument is based on the principle of statutory interpretation that, in interpreting administrative law, courts will presume Congress will not delegate major economic or political issues to executive agencies.

In other words, Coinbase is saying that courts should reject the SEC’s attempts to expand the ambit of the Securities Act of 1933. The Act allowed the agency to impose civil enforcement actions but not redefine securities laws to regulate crypto.

The SEC said it takes no position on Coinbase’s intention to file the motion but will oppose an actual filing. A pre-motion hearing will take place on Thursday.

Find out the difference between Binance and Binance.US here.

In addition to the SEC, the US Commodity Futures Trading Commission has charged Binance with granting US firms illegal access to its derivatives trading desk. These companies may have provided the exchange with crucial liquidity for smooth daily operations.

Binance CEO Changpeng Zhao recently denied claims Binance was losing executives en masse after the lawsuits. After failing to secure a license from Dutch regulators, the exchange recently offloaded its Dutch clients to a rival.

Got something to say about Coinbase and Binance losing market share or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.