Two prominent financial analysts have declared their confidence in asset management firm Charles Schwab joining the Bitcoin exchange-traded fund (ETF) race by launching one sooner rather than later.

Nate Geraci, President of the ETF Store, confidently asserts that the launch of a Bitcoin ETF shortly is an inevitable outcome.

Charles Schwab Expected to Enter the Bitcoin ETF Race

In a post on X (formerly Twitter), Geraci declared his alignment with ETF analyst Eric Balchunas. He endorsed the optimistic claim that Charles Schwab is poised to launch a Bitcoin ETF soon, presenting an offering:

“They may shock the world & offer something that’s 10bps in a few months.”

Basis points are used to express the ETF expense ratio. Investors can then use this to compare the firms offering the same product to see which has the lowest fees.

Read more: What Is A Bitcoin ETF?

Putting this in perspective, several firms that have already introduced Bitcoin ETFs charge more than this. BlackRock levies 20 basis points, while Fidelity charges 39 basis points, and VanEck also applies a 25 basis points fee.

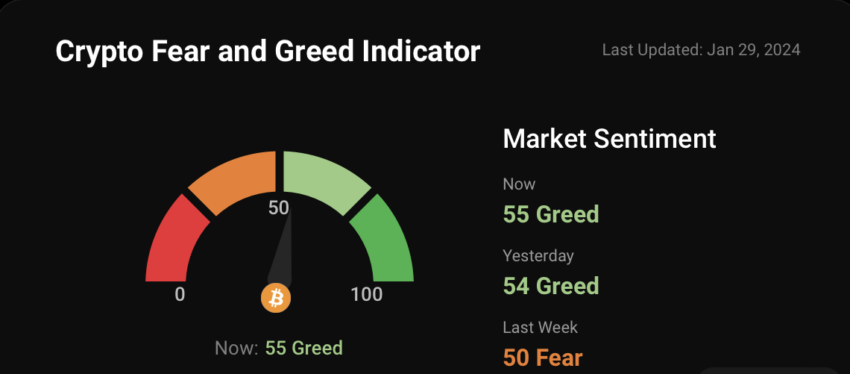

Despite a noticeable decline in Bitcoin’s price since the introduction of Bitcoin ETFs, there’s a perceptible shift towards a slightly more positive sentiment in the market. The Coinstats Fear and Greed Index indicates an increased optimism among investors, currently at 55 (greed).

Journey to Approval Did Not Come Without Challenges

The crypto industry faced a lengthy journey to secure approval for spot Bitcoin ETFs. Although the SEC approved Bitcoin Futures ETFs in 2021, the path for spot Bitcoin ETFs was fraught with challenges. However, 11 firms ultimately received approval for listing and trading the product.

Read more: Bitcoin Price Prediction 2024/2025/2030

Meanwhile, Gary Gensler, the Chair of the SEC and a prominent crypto critic, explicitly denied approving or endorsing Bitcoin:

“While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin.”

However, uncertainty pervades the industry as two pro-crypto political candidates for the upcoming US election have recently withdrawn.

Ron DeSantis, on January 22, cited a lack of a clear path to victory as his reason, while Vivek Ramaswamy dropped out on January 16 for similar reasons.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.