Chainlink (LINK) has retraced 5% since the start of April. But fresh community development and strong on-chain fundamentals give hope for an impending recovery. Can the Chainlink price finally break the $8 resistance?

On April 5, LINK lost ground by 2% to spark mild bearish concerns. The team later published a statement that revealed that twenty-five web3 projects had joined the Chainlink Build developer ecosystem. With crypto whales and long-term holders now positioning for future gains, it is only a matter of time before an upswing occurs for the Chainlink price.

Chainlink Whales are Regrouping

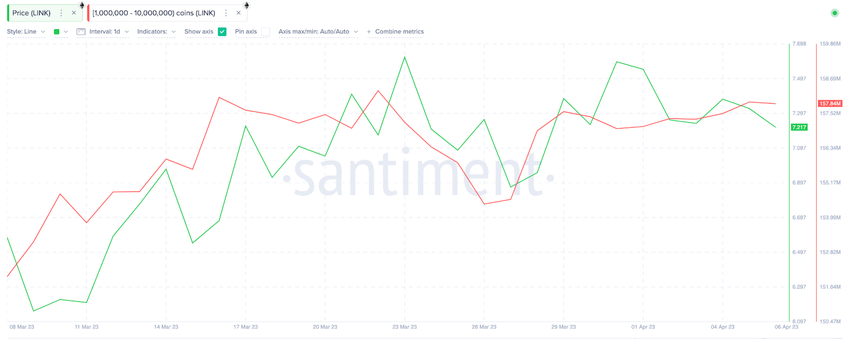

After a late-March sell-off, large investors are showing renewed interest in the Chainlink ecosystem. According to on-chain data provided by Santiment, a savvy group of whales with balances between 1 million to 10 million LINK tokens are currently re-upping their holdings.

The chart below shows how they booked some profit as Q1 2023 drew to a close. But between March 26 and April 6, they added nearly 3.4 million tokens to their bags.

The newly added tokens are worth about $24.4 million at current prices. Such sizable inflow suggests that confident institutional investors are growing confident of future price gains. And considering how the whales have often aligned their accumulation patterns to the price action in the past 3 months, LINK holders can expect some upside.

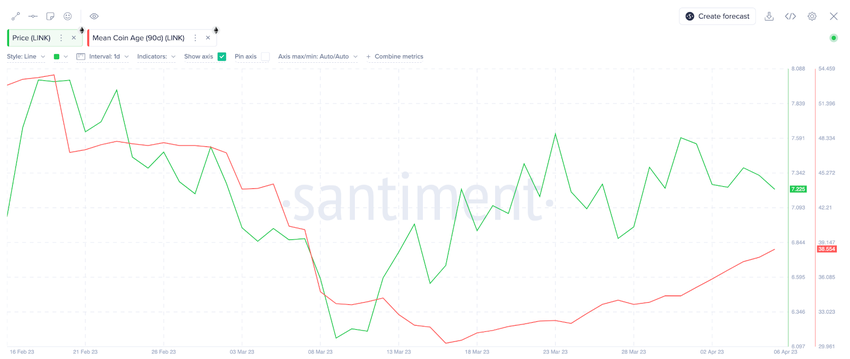

Likewise, the uptrend in Mean Coin Age on the Chainlink network poses another bullish signal. After a significant cliff-off in March, long-term holders now appear to be positioning for future gains.

As shown below, since the recent low of 30.26 recorded on March 16, Chainlink Mean Coin Age has surged 26% to reach 38.2 on April 6.

Mean Coin Age tracks the number of days crypto tokens on a network have spent in their current wallet addresses. When it rises, it suggests that long-term investors are HODLing in anticipation of a future upswing.

In summary, LINK could soon enter a prolonged rally if long-term holders and the price-savvy large investors remain optimistic.

LINK Price Prediction: $8 is Within Reach

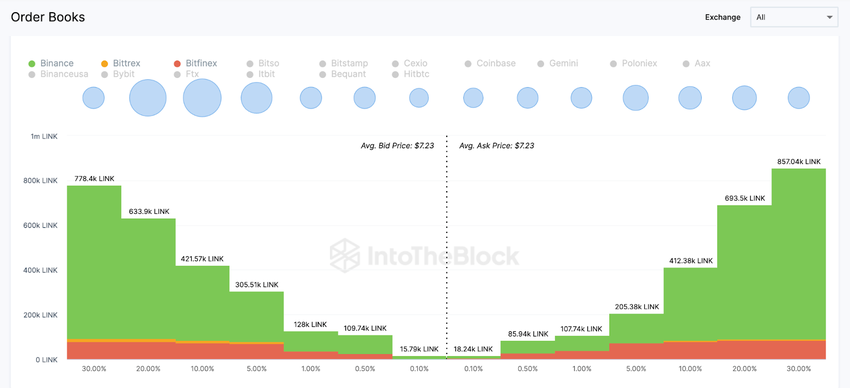

IntoTheBlock’s Exchange-Market depth chart presents data-driven insights suggesting that Chainlink will likely break above $8.

As shown below, LINK buy orders significantly outweigh sell orders around the 5% range of the current prices up till the price goes up by 5%. This means that LINK will face minimal resistance as it approaches $7.60. Around that zone, traders have put up 205,000 tokens for sale.

And if the bulls can push aside resistance, LINK could rally toward $8.64, where a much larger sell-wall of 693,000 tokens could mount a roadblock.

Conversely, the bears can flip the narrative if LINK loses the 5% resistance around $6.88. But the 305,000 buy-wall could stop the slump. But if support breaks, LINK could downsize further toward $6. At that point, the 630,000 open buy orders will likely halt the slump.