Chainlink (LINK) is currently facing bearish woes and could react to them by noting a price drop. This is essential for the altcoin to initiate a recovery that could help gain the losses noted recently.

Investors are exhibiting short-term pessimism, which aligns with the predicted outcome for the LINK price.

Chainlink Investors Could Make a Move Soon

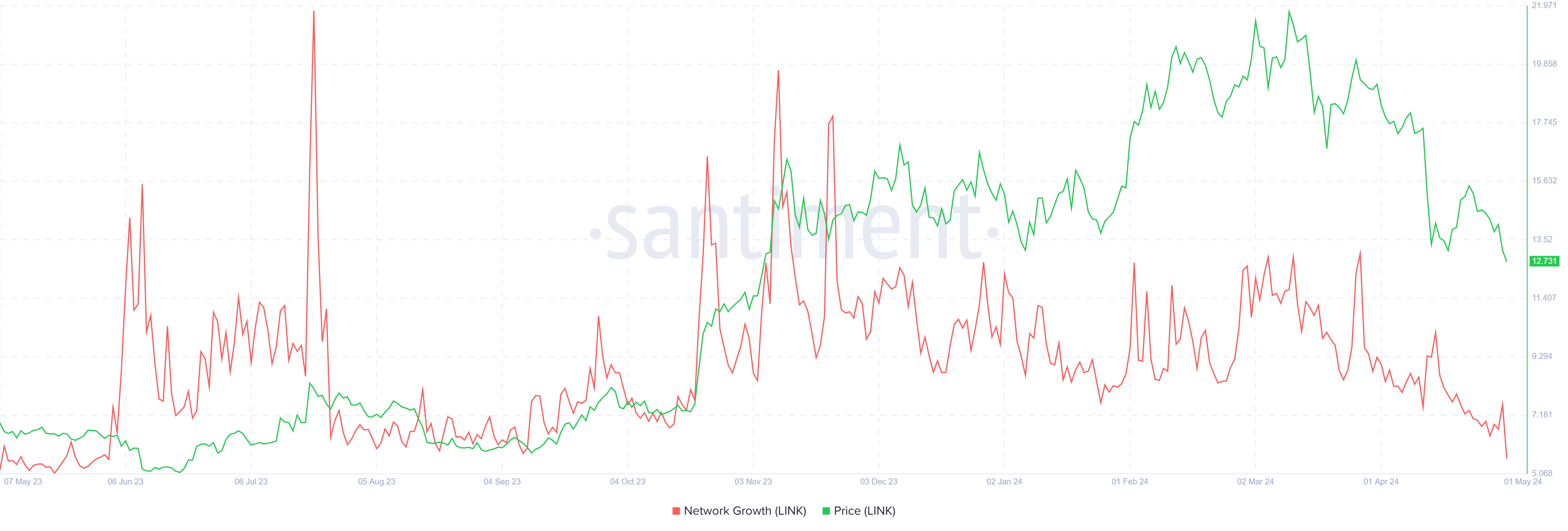

LINK price is anticipating a decline, and the network is not keen on changing the outcome. The recent correction eliminated any incentive for new investors to jump aboard the Chainlink train. This is evident in the network growth, which has dipped to a yearly low.

Network growth is calculated based on the rate at which new addresses are formed on the network. This data determines whether or not a project is losing traction in the market.

Given Chainlink’s network growth is so low, it seems probable that LINK is not attracting any new users at the moment. This could negatively impact the price of the token.

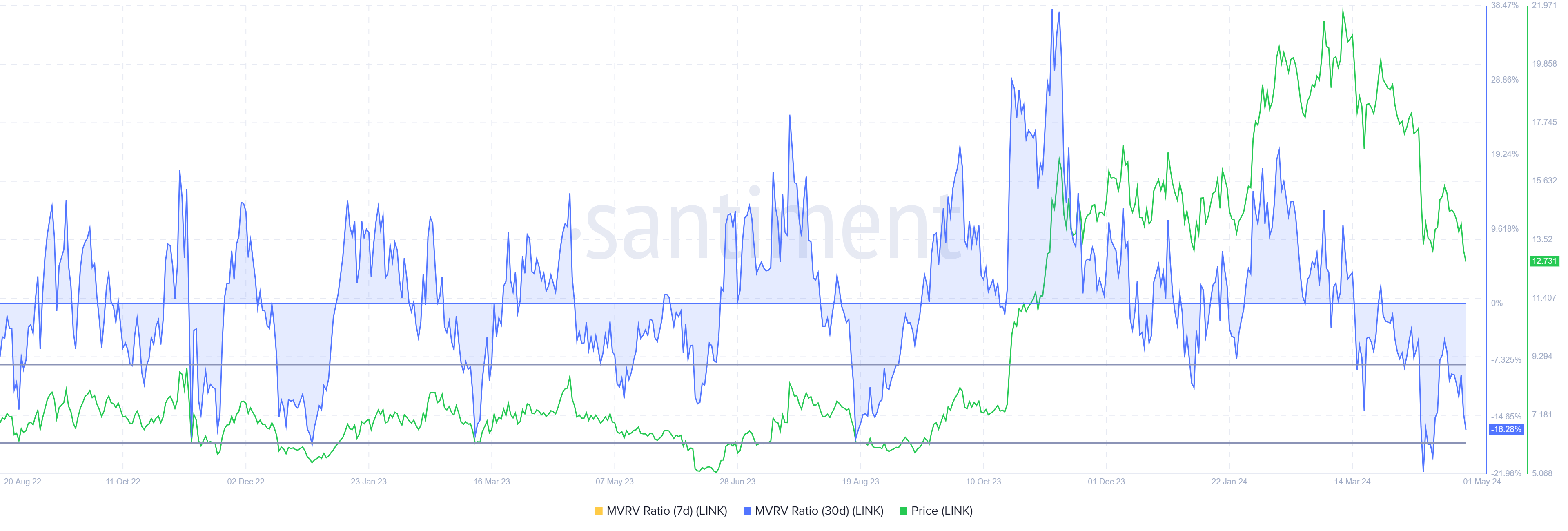

Secondly, LINK is highly undervalued at the moment, based on the Market Value to Realized Value (MVRV) ratio. This, however, is a bullish development.

The MVRV ratio measures investor profit/loss. Chainlink’s 30-day MVRV at -16% signals losses, potentially prompting accumulation.

Historically, LINK price recovery occurs at -7% and -17% MVRV, labeling it an opportunity zone. Nevertheless, there is still some room before LINK investors purchase the token right now to initiate a recovery.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

LINK Price Prediction: Key Levels to Watch

LINK price, trading at $12.7 at the time of writing, is below the support of $13.2. This is a crucial level because it coincides with the 23.6% Fibonacci Retracement.

Further decline is likely should LINK fall below the support at $12.7. Considering the market conditions, LINK will potentially drop to $11.7 before bouncing back up.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

However, if the support at $12.7 remains intact and Chainlink reclaims 23.6% Fibonacci Retracement as support, it could initiate a recovery. This would invalidate the bearish thesis and enable a rise to $14.8 and beyond.