Bankrupt crypto lender Celsius is restaking its withdrawn staked Ethereum, further elongating the staking activation queue.

21Shares researcher Tom Wan said bankrupt Celsius Staked 396,000 Ethereum during the first two days of this month.

$1 Billion in On-Chain Flows

Blockchain analytical firm Arkham Intelligence corroborated this, saying the bankrupt lender’s asset movements have totaled almost $1B in on-chain flows.

The deposits are coming after Celsius withdrew most of its staked ETH on Lido. Although the withdrawal was part of its restructuring plan, the firm is not exiting ETH staking and is only changing how it stakes.

Celsius Withdrawals

Celsius has been very busy since the Shanghai upgrade in April. BeInCrypto reported that it initially unstaked 6,000 ETH from the Beacon Chain before withdrawing all its staked ETH on Lido Finance.

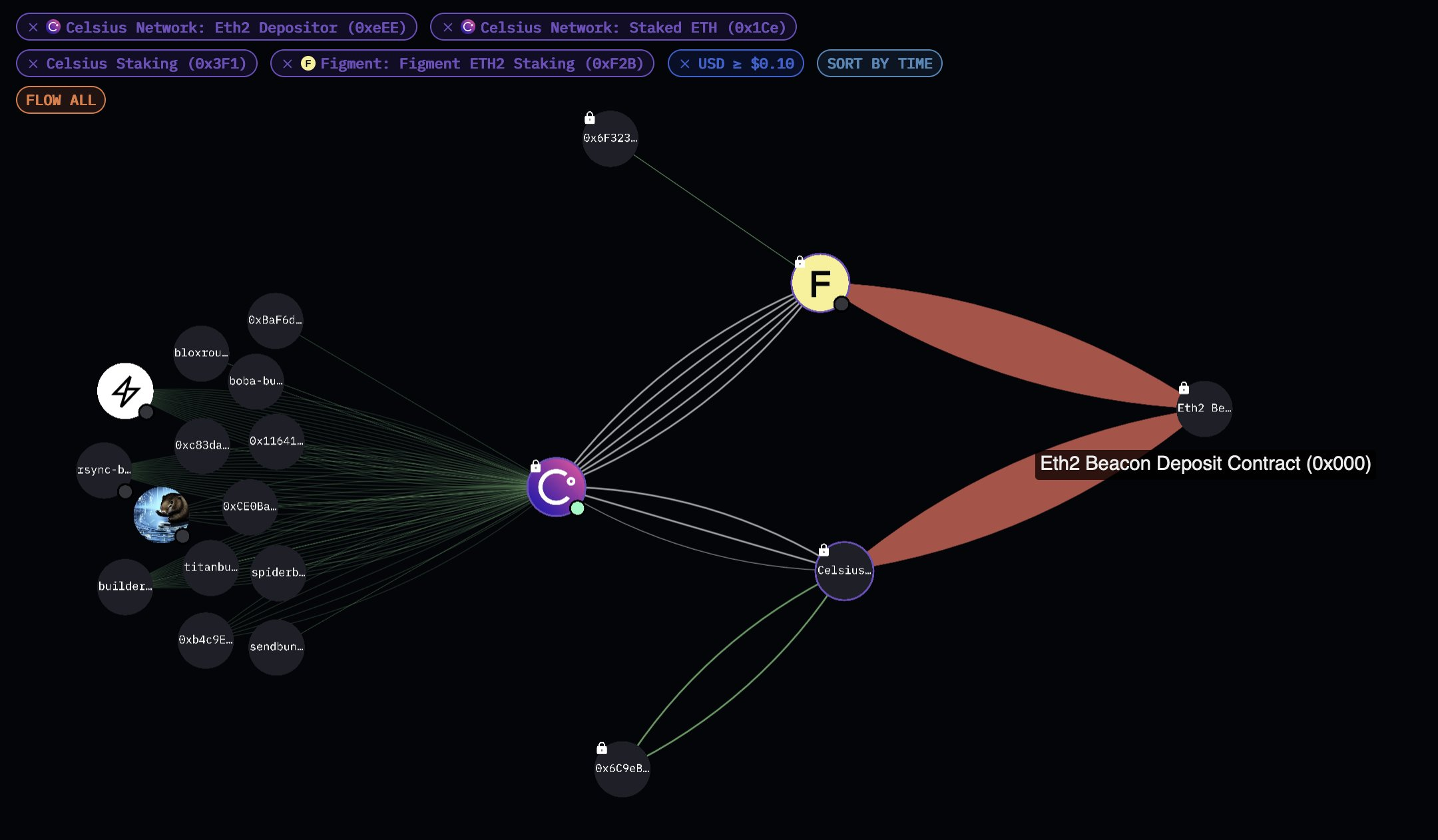

This makes the lender one of the most active entities in the industry since withdrawals were enabled. So far, it has withdrawn 428,000 ETH from Lido and has 32,000 ETH still awaiting withdrawals from the staking protocol. Additionally, Celsius uses institutional staking provider Figment for its ETH staking activities.

Restaking Activities

After holding the withdrawn ETH in its unstaking wallet for about two weeks, Celsius sent the funds into two deposit wallets, marked Celsius’s ETH2 Deposit and “Staked ETH.”

Blockchain data shows the Staked ETH wallet was used to stake via Figment, while the ETH2 Deposit wallet is for its staking pool. The lender sent 46% of the 428,000 ETH to each wallet, leaving the remaining 8% valued at $60 million in its Unstaking wallet.

Celsius had deposited $374 million into Figment and sent $371 million into its Beacon Deposit Contract. It now holds about 57,000 ETH worth $108 million.

Ethereum Validators Queue Gets Longer

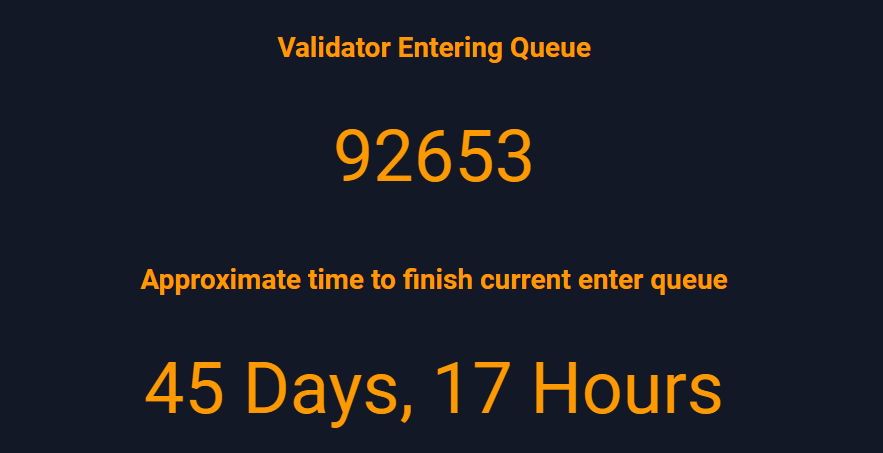

Meanwhile, Celsius’ large deposits have further congested the queue to add new validators on Ethereum. According to Wenmerge, 92,761 validators are entering the line, and the approximate time to finish the queue is now 45 days and 17 hours.

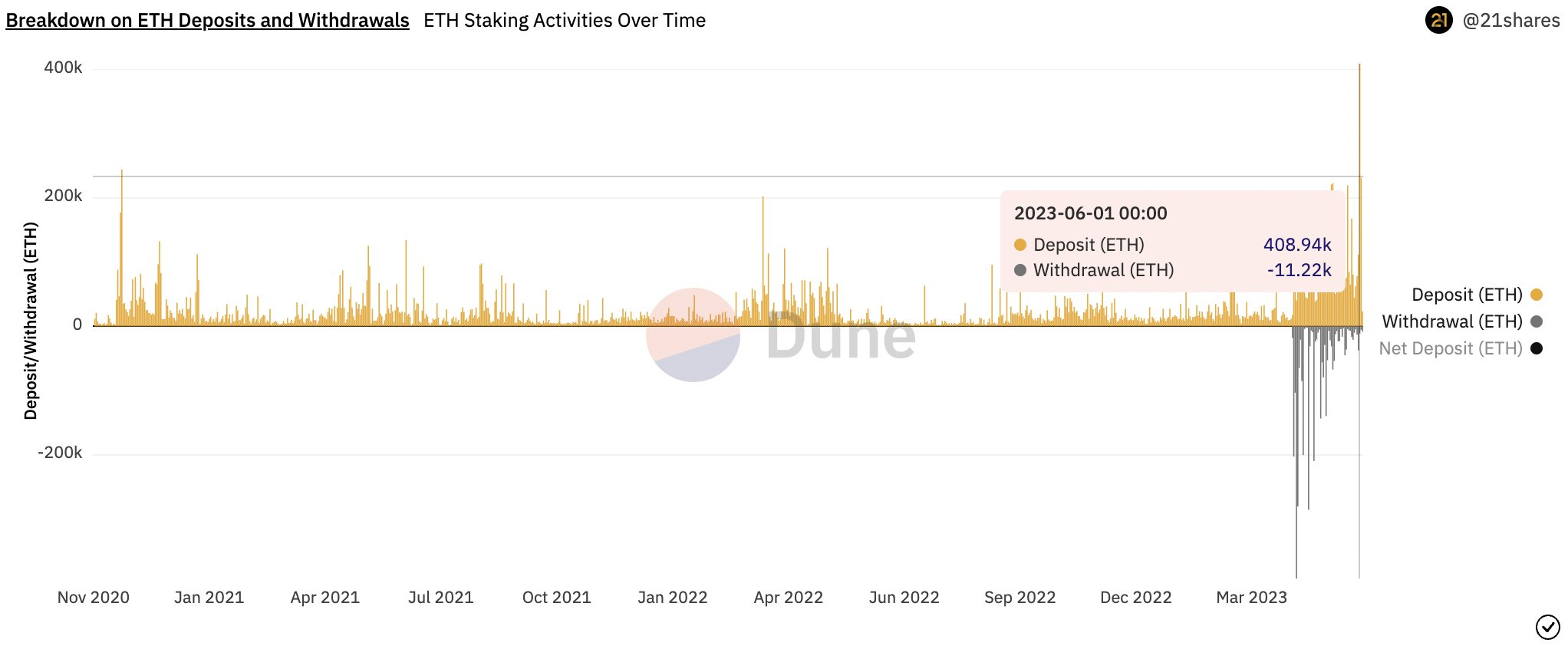

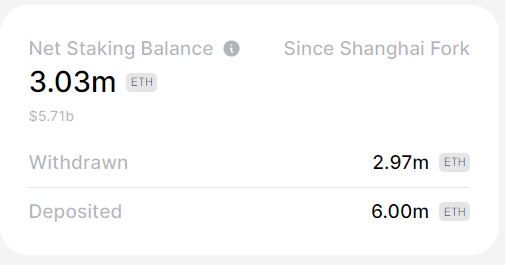

This is unsurprising, considering the rate at which deposits have outpaced withdrawals since the Shanghai upgrade. Token Unlocks data shows that 6 million ETH has been deposited since the Shanghai upgrade. The net staking balance is 3.03 million ETH as of press time.

Read More:

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.