In the upcoming week, the crypto market may witness significant sell-offs in digital assets, with notable bankrupt entities like Celsius, FTX, and Alameda Research resuming fund movement.

Moreover, the impending release of an additional $400 million worth of new tokens during the week adds to the potential market turbulence that could further contribute to an anticipated sell-off.

Watch Out for Celsius, FTX, and Alameda

During the past week, Celsius Network transferred over $125 million in Ethereum to various exchanges. Around $95.5 million in ETH was sent to Coinbase and another $29.73 million to FalconX.

Despite these transfers, Celsius retains a substantial reserve of 539,000 ETH, equivalent to $1.40 billion. On-chain data from Arkham Intelligence reveals the lending platform holds additional assets, including 9,799 BTC valued at $420.46 million in its wallet.

Meanwhile, the two firms in Sam Bankman-Fried’s failed crypto empire — FTX and Alameda Research — have also resumed transferring funds to centralized exchanges. Last week, these entities executed transfers of $28.2 million in digital assets, including 402.6 Wrapped Bitcoin, 3,200 Ethereum, 602,000 Pendle, and 9.03 million People. Like Celsius, FTX and Alameda retain approximately $1.2 billion in EVM assets.

Read more: Why These 5 Altcoins Could Drop Due to a Spike in Profit-Taking

Still, observers have suggested that these asset movements potentially signal impending sales by these firms as part of their commitment to making affected customers whole.

$400 Million in Tokens to be Unlocked

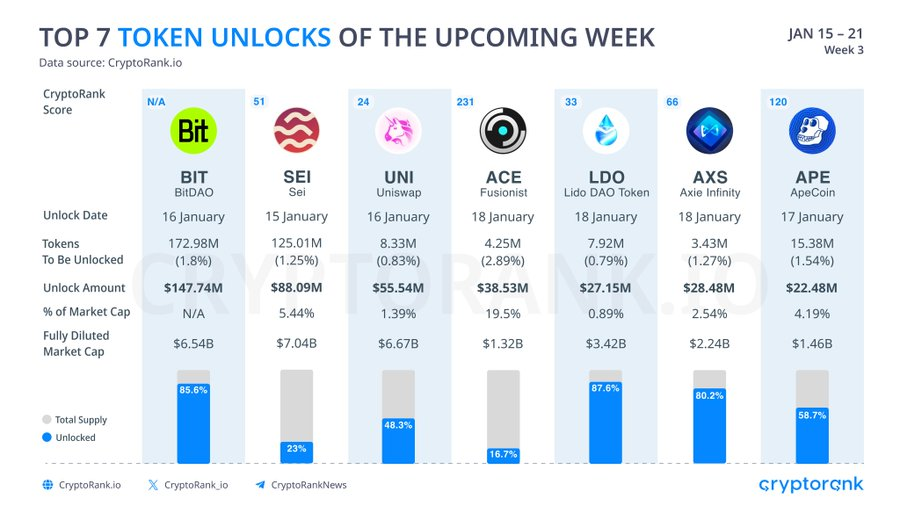

Separately, crypto analytical platform CryptoRank noted that seven projects, including BitDAO, Sei, Uniswap, Fusionist, Lido DAO Token, Axie Infinity, and ApeCoin, will unlock $407.7 million worth of digital assets.

Leading the lineup is BitDAO, set to unlock 172.98 million tokens valued at $147.74 million. Remarkably, this release accounts for 1.8% of its total token supply.

Read more: Top 10 Cheapest Cryptocurrencies to Invest in January 2024

Among the other notable tokens scheduled for release are SEI with a value of $88.09 million, UNI tokens at $55.54 million, ACE at $38.53 million, LDO at $28.48 million, AXS at $27.15 million, and APE at $22.48 million. This planned development in token unlocking will further influence the crypto market in the coming week.