Celer Network (CELR) price jumped 30% on April 16 as markets reacted to new community initiatives and product launches. Increased daily traction and a spike in whale trading activity seem to be major drivers of the current price rally. Can the Bulls make a run for $0.35?

Celer Network is a unique blockchain protocol that enables developers to create different DeFi, GameFi, NFTs, or Governance projects optimized for interoperability and liquidity efficiency. On April 13, the team announced expanded coverage of its zkSync ecosystem.

With users now able to bridge popular smart contract-driven alts like BNB, MATIC, and AVAX, it’s no surprise that multiple on-chain data have been flashing green signals for a CELR price rally in the past week.

SponsoredCeler Network Sees Surge in User Engagement

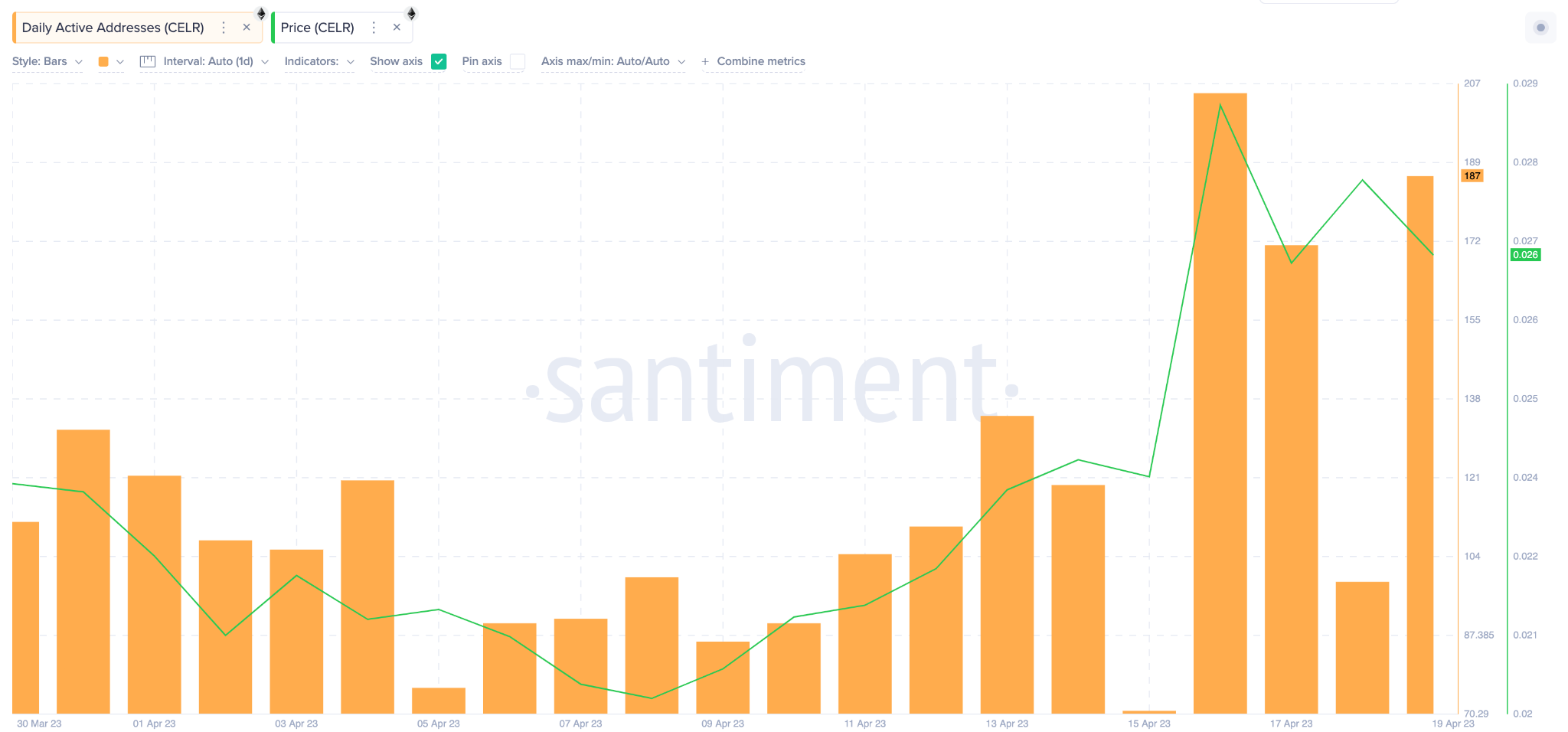

The recent price rally recorded on Celer Network (CELR) has coincided with a comparable increase in the number of users interacting on the network. After a slow start in April, Daily Active Users on Celer Network have increased by nearly 150% in the past two weeks.

Daily Active Users (DAU) measures the number of unique addresses that interact on a blockchain network. The Santiment chart below depicts how CELR DAU increased from 76 on April 5 to 187 addresses on April 19.

9.

When more users are using a network, it indicates increased demand for the network’s underlying services. This increased demand can also attract more investors and traders, leading to a positive feedback loop of demand and adoption.

Hence, if Celer Network can maintain the current uptrend in user engagement, investors can expect a prolonged CELR price rally.

Celer Whales Are Getting Locked-In

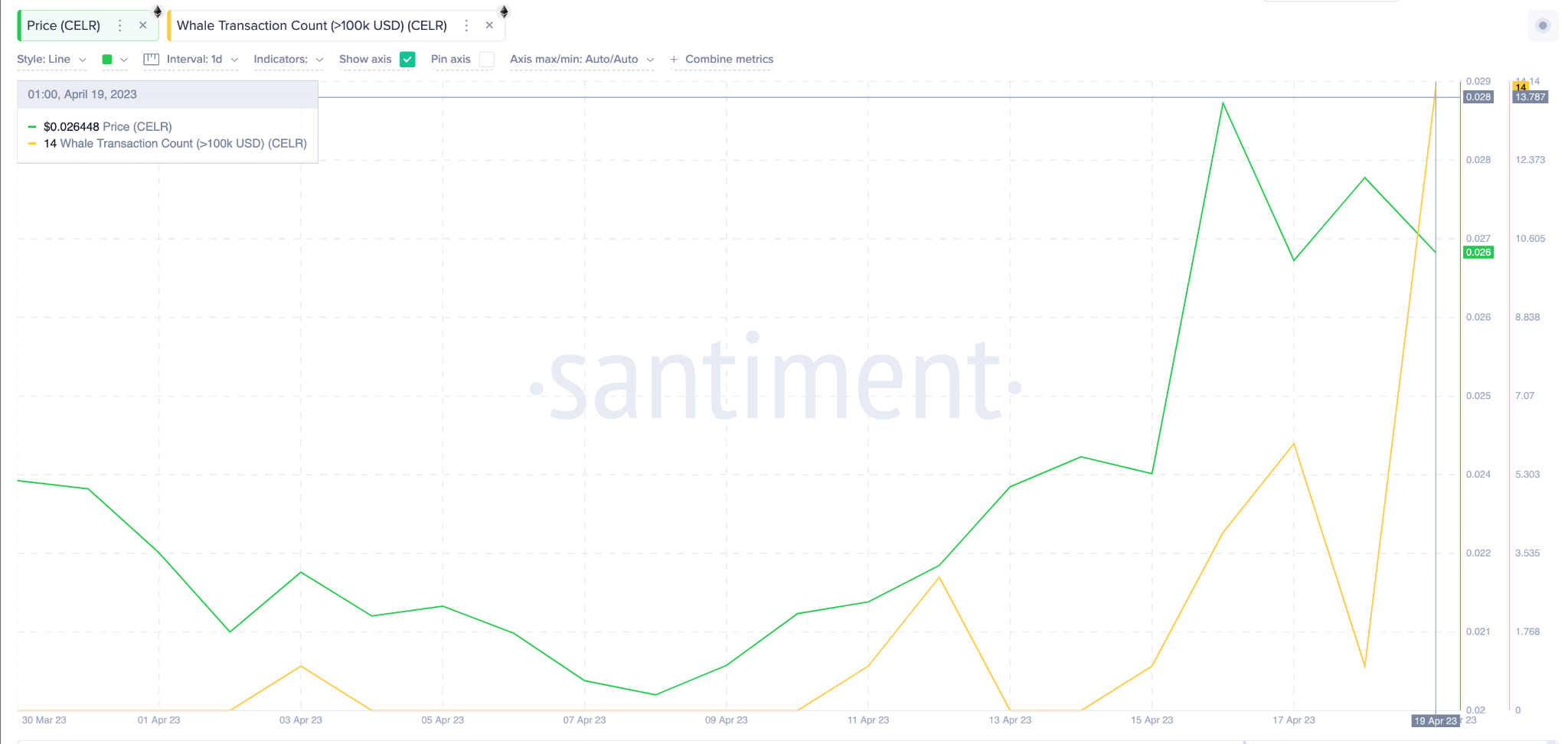

Similarly, CELR appears to be again drawing the attention of large institutional investors. After recording only 1 transaction worth at least $100,000 in the first 10 days of April, CELR whale transactions picked up in the past week

The Santiment chart above shows how whales have frantically increased their bets on CELR since April 11. The 14 Whale transactions recorded on Celer Network on April 19 marked the first time it hit double-digits since January.

Sponsored

Generally, an increase in whale transactions is a a positive signal for cryptocurrency’s price prospects. It suggests growing interest from large investors and can potentially lead to increased demand.

Also, the increased whale transactions provide higher liquidity in the market, making it easier for traders to buy and sell CELR. If the trend is maintained, it can lead to a more stable price over time as the market becomes less prone to large fluctuations.

SponsoredCELR Price Prediction: Will the $0.30 Resistance Cave?

With significant bullish momentum building in the market, CELR looks set to break the $0.30 resistance level. However, IntoTheBlock’s Global In/Out of Money data, 559 addresses that bought 98 million CELR tokens at an average price of $0.28, could look to prevent this.

If the CELR crosses that level, the next resistance zone is at $0.44. At that price point, 2,000 addresses could take some on their holdings of 245 million tokens.

Still, things could take a bearish turn if CELR losses its current support level of around $0.25. But the 930 addresses holding 3.4 billion CELR tokens at an average price of $0.25 could shore up the price.

If that defense line caves, there is a stronger support level at $0.20, the average price that 1,600 addresses paid 691 million CELR.