Cardano’s (ADA) much-anticipated Chang hard fork has put some of its holders in gains in the past 24 hours. Transactions involving the altcoin have returned more gains than losses during that period.

However, this may be temporary as the altcoin eyes its August 5 low.

Cardano Upgrade Puts Holders in Profit

As reported earlier, Cardano’s Chang hard fork, which occurred on September 1, was a “sell the news” event. Its whale investors reduced their holdings by selling large amounts of ADA after the upgrade was implemented, putting downward pressure on the price.

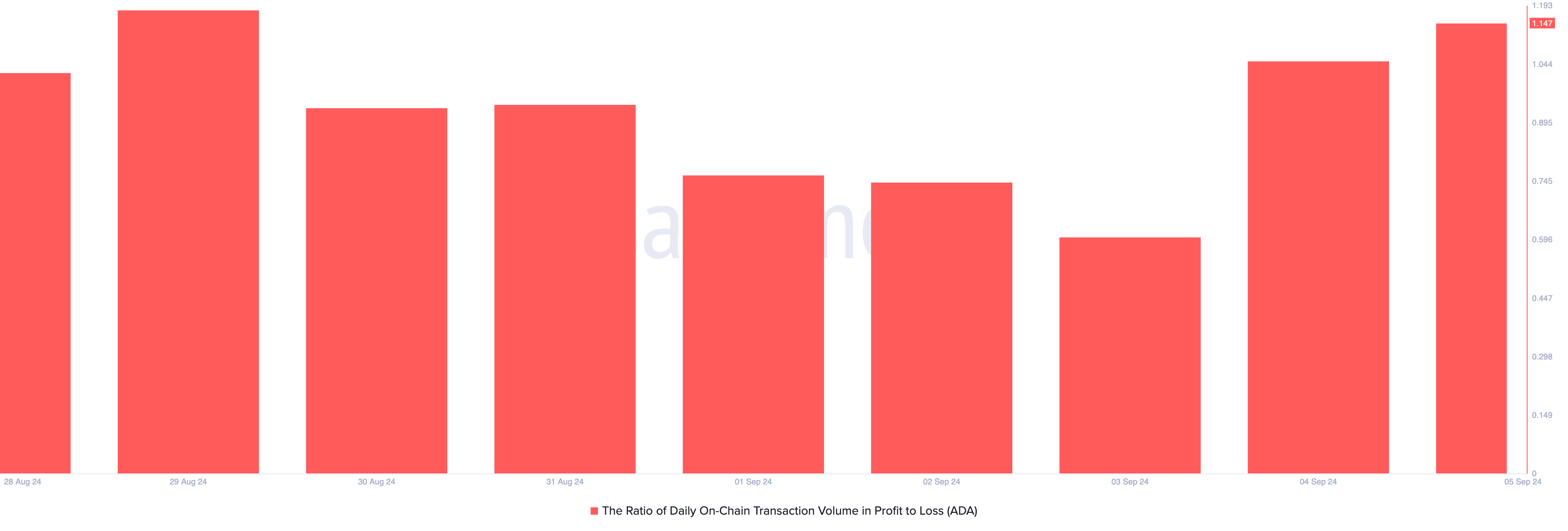

However, the tides have since changed as daily transactions involving the altcoin have begun to yield profits. This is evident in ADA’s positive ratio of daily transaction volume in profit to loss. On Thursday, this sits at 1.15, indicating that for every ADA transaction that ends in a loss, 1.14 transactions have returned a profit.

The reason for this is not far-fetched. ADA’s price decline has slowed over the last 24 hours, giving traders an opportunity to sell for profits if they bought at lower prices. ADA is currently trading at $0.32, reflecting a 0.39% uptick in that time frame.

While this may prompt a rally in new demand for ADA, traders must understand that its current uptick may be shortlived as indicated by the coin’s negative price daily active address (DAA) divergence. This indicator, which tracks whether a corresponding network activity supports an asset’s price movement, is -30.93% at press time.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

When an asset’s price climbs while its price DAA divergence remains negative, it suggests only a few unique addresses are actively trading. This is usually interpreted as a warning sign that the price uptick is due to speculative activity or trading by a small group of investors or whales who are artificially inflating the asset’s price.

ADA Price Prediction: The Troubles Are Far From Over

Although ADA has logged some uptick over the past 24 hours, it is still trailed by bearish bias. This is clear from the position of the dots of its Parabolic Stop and Reverse (SAR) indicator. At press time, these sit above ADA’s price.

When this indicator, which helps identify an asset’s trend direction and potential reversals, is set in this manner, it signals a continued market decline. This suggests that the asset’s price has been falling, and the downtrend may persist.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

If this trend continues, ADA’s value could revisit its August 5 low of $0.27. However, if the altcoin witnesses a spike in new demand, its price may rally toward $0.39, invalidating the bearish projections above.