The Cardano (ADA) price action offered no relief to holders as the price continued to fall under a massive bearish trendline.

The Cardano price action has been quite dull as of late, with ADA currently trading near long-term lows at $0.328. It is down over 1.86% since its daily opening and has suffered a 15% loss in the last 30 days.

With ADA prices now down a total of 89.6% from its September 2021 all-time high of $3.15, many ADA holders are sitting on a loss.

The Cardano price is currently back to oscillating near its January 2021 price levels, and there is considerable movement in the market.

Over 25 billion ADA moved

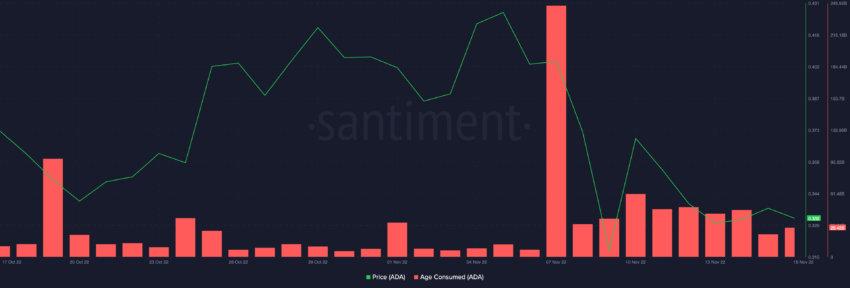

The bearish price action that Cardano followed seemed to put some old coins back in circulation. Age consumed metric for ADA presented that after the Nov. 7 crash, a considerable amount of old coins have been on the move.

On Nov. 16, over 25 billion ADA were moved, while on Nov. 15, around 22 billion ADA were moved.

Spikes on the Age Consumed graph signal a large number of ADA moving after being idle for an extended period of time. This could either point to redistribution, selling, or a mix of the two.

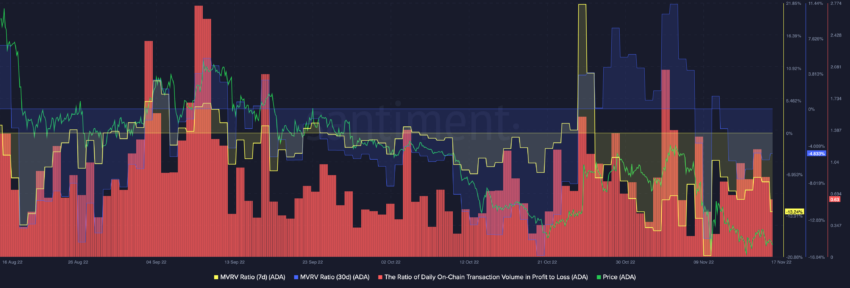

The reason behind coin moving could be ADA’s Supply in Loss, which has considerably increased in the long term. The daily on-chain volume in loss has been consistently high, however, in comparison to September, there’s been some improvement.

Even though on-chain transactions in profit saw a slight rise due to short-term participants making profits, the Market Value to Realized Value (MVRV) ratio was still in the danger zone. The continued decline of the MVRV means that more participants would realize losses if they sold their ADA holdings.

Ecosystem growing but development low

After making a new all-time high on Nov. 2, the Cardano development activity indicator has slowed down and continues to trend lower.

Despite the low development activity, weighted sentiment showed that the Cardano community still had a positive outlook.

One reason behind the positive growing weighted sentiment indicator could be the ecosystem growth that Cardano has shown.

A Nov. 14 Tweet from Cardano founder Charles Hoskinson shows that the Cardano ecosystem is growing rapidly. By Nov. 14, 2022, the platform hosted 3.6 million wallets and launched over 100 projects. Furthermore, around 1,000 other related projects were in progress.

Cardano price prediction

However, it is pretty clear that even though ecosystem growth plays a key role in price action, the larger market momentum has weighed down prices.

ADA on-chain metrics suggest slow price growth in the mid and short-term timeframes. In the case of short-term bullish price action, ADA could potentially increase to retest the $0.40 level. On the other hand, if ADA prices continue falling, the next major support level is found near $0.15.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.