Cardano founder Charles Hoskinson believes that algorithmic stablecoins would help to achieve Satoshi Nakamoto’s vision for Bitcoin. According to him, banks will always let users down.

Hoskinson was reacting to Kraken’s CEO Jesse Powell’s observation that USDT’s value increased following the decline of rival USDC. According to Powell, this price movement showed that the crypto market was losing faith in US-based financial products.

In response, Hoskinson tweeted that he “believes that algorithmic stablecoins…are the most essential research stream to fully realize the original vision of Bitcoin.”

What Are Algorithmic Stablecoins?

Algorithmic stablecoins are stablecoins designed to hold their peg through mathematical equations and incentives. Usually, these stablecoins are uncollateralized, and an algorithm controls their supply.

The defunct Terra UST was the most successful algorithmic stablecoin. At its peak, UST was a top three stablecoin, and its marketing supply reached over 17 billion. Eventually, the stablecoin witnessed a death spiral event that saw it lose its peg and led to its eventual demise.

Since then, several iterations of algorithmic stablecoins have emerged to varying degrees of success.

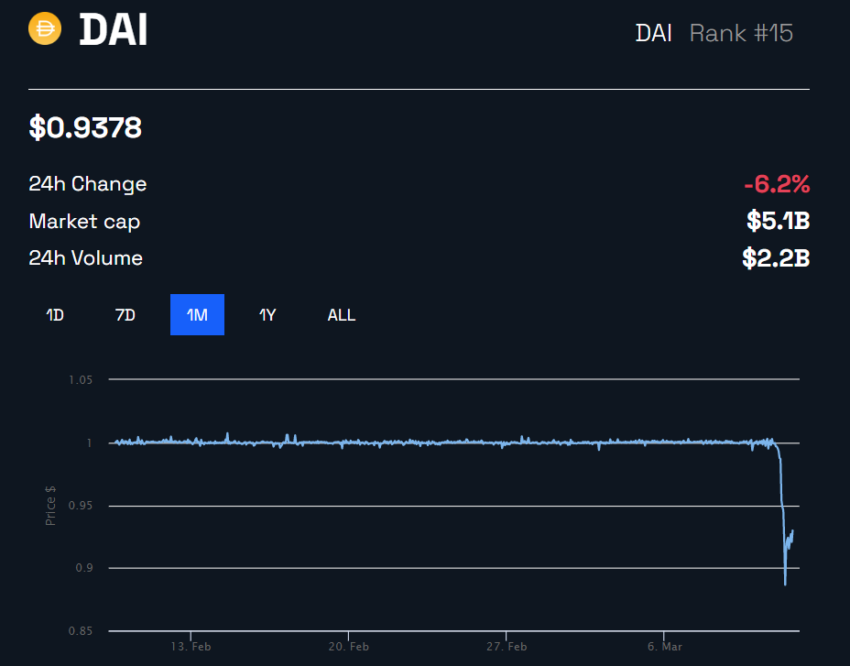

For context, Cardano-based overcollateralized stablecoin DJED has maintained its peg and is trading at a premium of $1.01 in the face of USDC struggles. Meanwhile, other algorithmic stablecoins exposed to USDC, like FRAX and DAI, have lost their pegs. DAI has dropped 6% in the last 24 hours to $0.93, and FRAX is down 10% to $0.90.

Recently, BitMEX’s co-founder Arthur Hayes also suggested a new stablecoin backed by Bitcoin called NakaDollar (NUSD). He said this stablecoin would remove the crypto market’s dependency on stablecoins with U.S. dollar reserves.

Hoskinson Chastises Federal Reserves

Meanwhile, Hoskinson has also criticized the federal reserve’s rejection of Custodia bank. He said the authorities “felt that full reserve banks like Custodia aren’t fit for purpose and introduce risk into the markets. So they’d rather have Circle’s assets in fractional reserve banks like SVB because it’s safer.”

In a separate tweet, the Cardano founder also added:

“Banks will always let you down as long as they are fractional reserve.”

Custodia bank CEO Caitlin Long said her bank had likewise been denied and disparaged in its attempt to get regulated by the authorities. According to the bank chief, the financial regulators’ approach towards crypto has stifled good actors and failed to protect investors.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.