Cardano (ADA) has surged by 25% in just three days, breaking the $0.43 barrier for the first time since July.

This impressive rally is driven by heightened activity from large Cardano holders, an increase in the average coin holding duration, and rising demand for the altcoin.

Cardano Is in High Demand

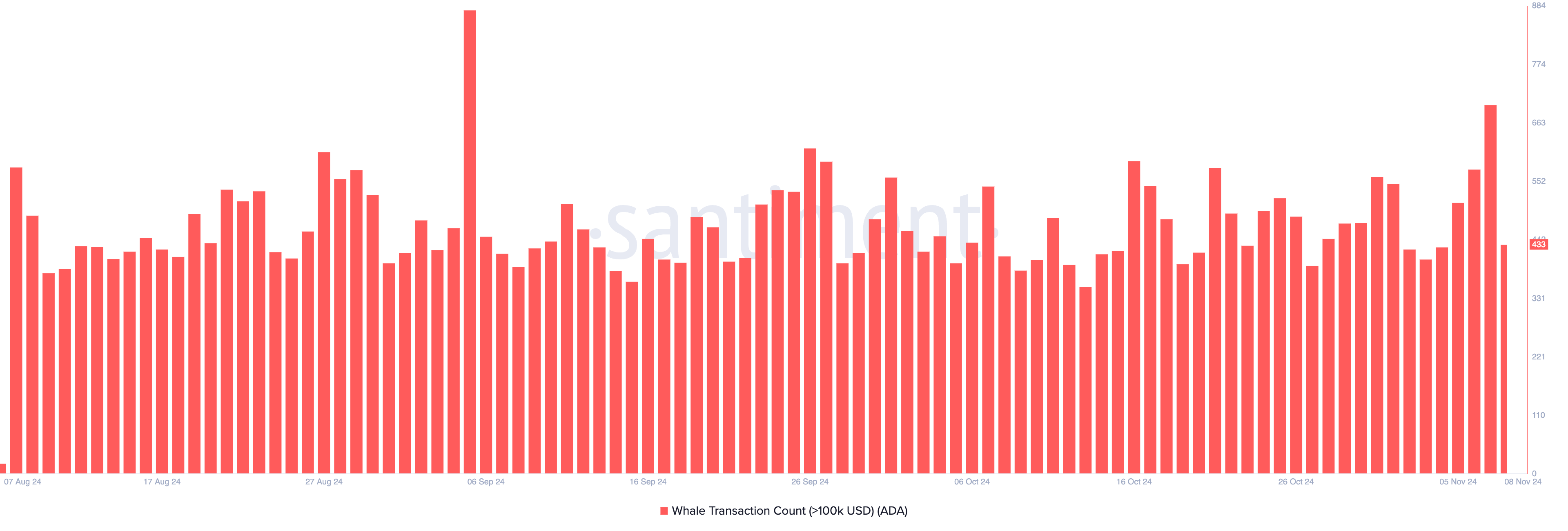

Santiment’s data has revealed a surge in Cardano whale activity over the past few days. According to the on-chain data provider, the daily count of ADA transactions exceeding $100,000 has skyrocketed. On Thursday, there were 697 of those transactions. This represents the coin’s single-day highest count since September 5.

An uptick in whale activity — large-scale transactions by entities holding significant amounts of an asset — often signals increased interest by key market players. These large transactions indicate growing confidence from large investors, who may be buying in anticipation of a potential price increase due to broader market trends, as in Cardano’s case.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

When whales ramp up their accumulation, they often trigger increased demand from broader market participants. This trend aligns with Cardano’s recent spike in coin holding time, which soared by 139% in just one week.

The coin holding time metric tracks how long investors retain their tokens before selling or trading them. A prolonged holding period generally signals a bullish sentiment, showing that investors are willing to hold onto the asset longer. The 139% increase in ADA’s holding time reflects rising optimism among holders about its short- to near-term growth prospects.

ADA Price Prediction: Pay Attention to the $0.40 Price Level

Cardano currently trades at $0.42. It has successfully broken through the key resistance at $0.40 — a level that has held strong since July, with every previous attempt to surpass it met by intense selling pressure.

Should the current uptrend persist, the $0.40 level will likely flip into a solid support floor, propelling a Cardano price jump toward $0.47, a price point last seen in June.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

However, if the $0.40 level fails to hold as support and the retest proves unsuccessful, the coin’s price could drop back to $0.31. This will invalidate the possibility of a Cardano price jump in the near-term.