Cardano (ADA) dropped to $0.27 on August 5 during a broader market sell-off that triggered over $1 billion in liquidations. As the market stabilized, ADA rebounded by 19%, bringing its price back to $0.37.

The coin’s current technical setup points toward further potential gains.

Cardano Puts Holders in Gains

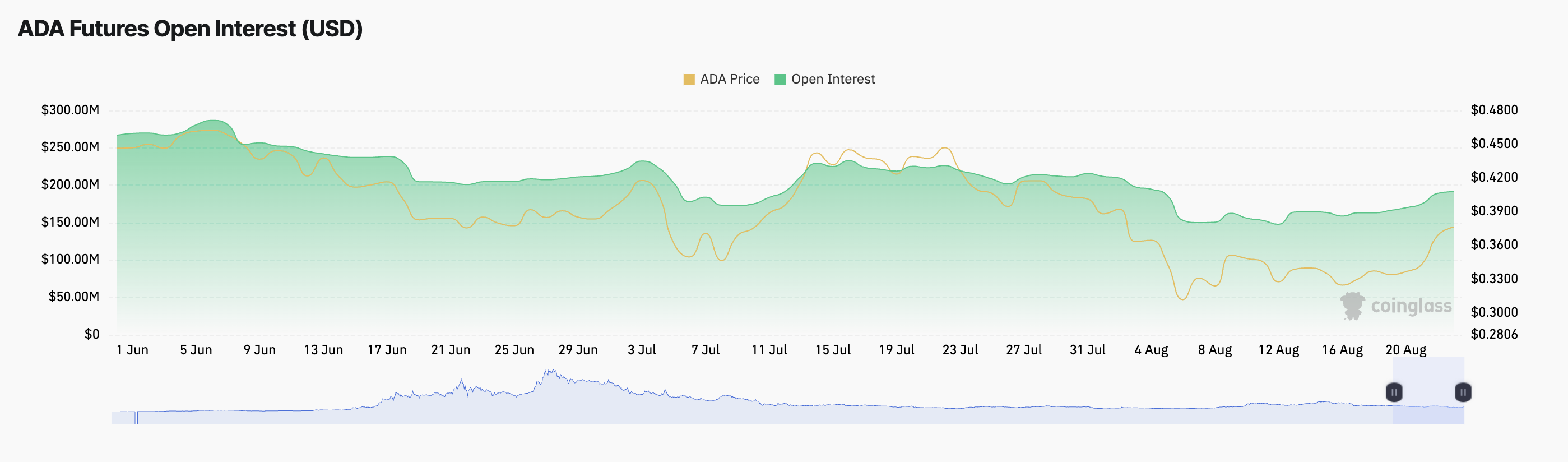

Cardano’s futures open interest has surged by 21% in the past week, now reaching $191 million, according to Coinglass data. Futures open interest measures the total number of unsettled futures contracts, and an increase indicates that more traders are entering new positions.

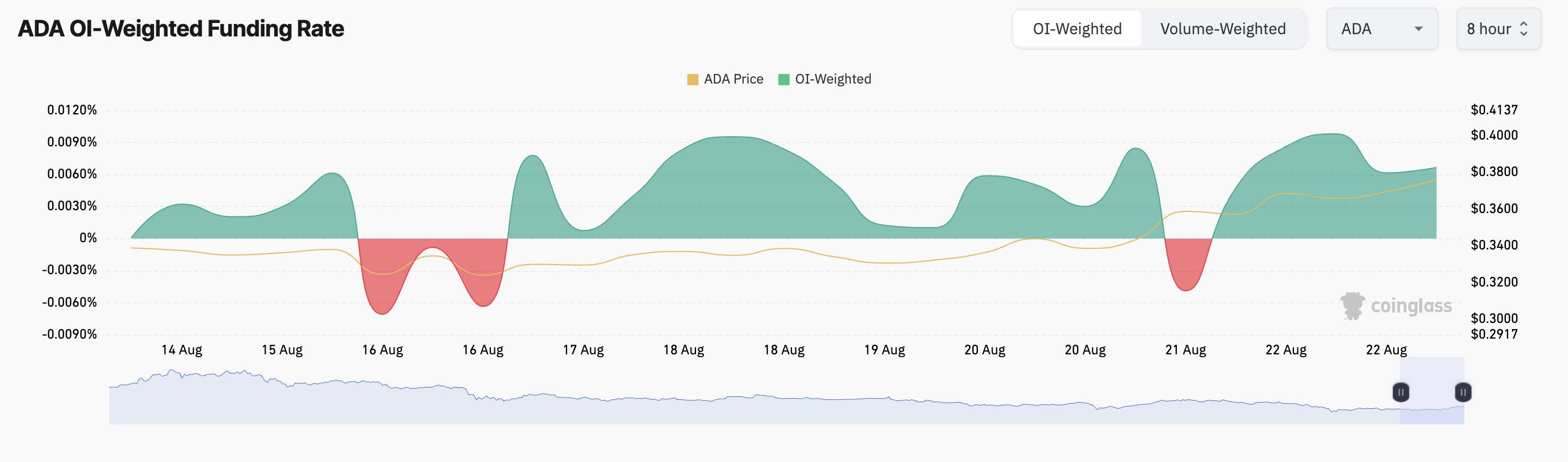

The predominantly positive funding rates for ADA over the past seven days show that most of these traders are favoring long positions. Currently, the funding rate sits at 0.0067%, suggesting that more traders expect ADA’s price to rise rather than fall.

Funding rates are used in perpetual futures contracts to keep contract prices in line with spot prices. Positive funding rates mean higher demand for long positions, indicating bullish sentiment in the market.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

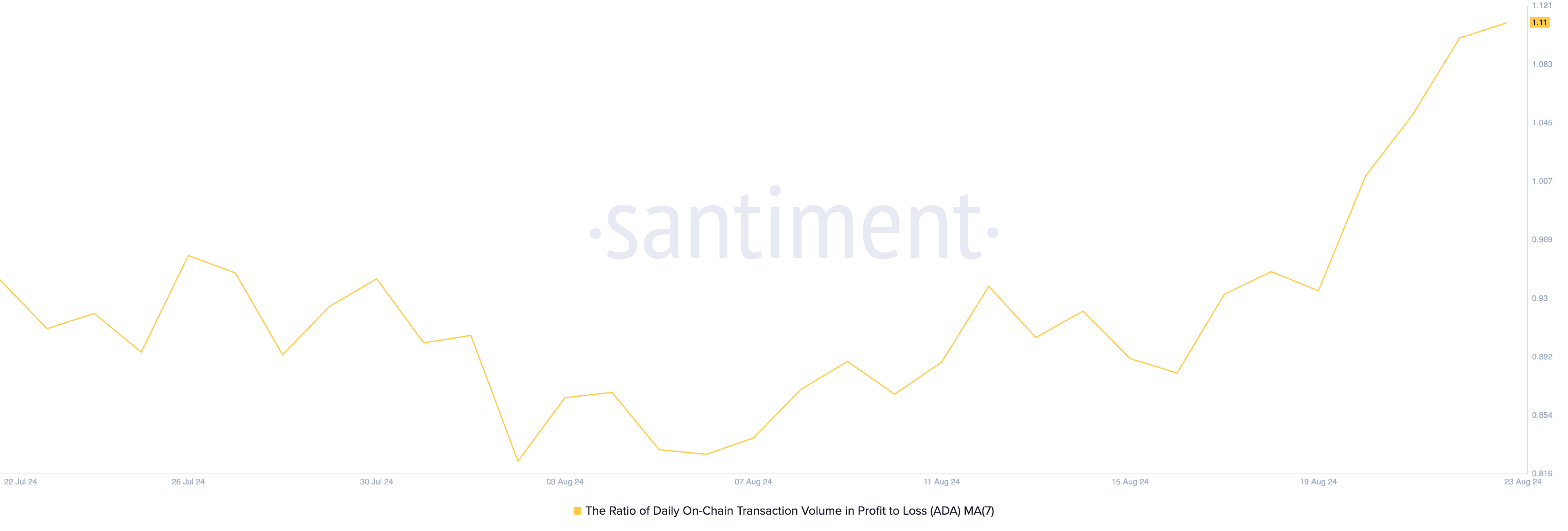

The rise in ADA demand this past week is linked to profitable trading activity. The daily ratio of transaction volume in profit to loss reveals that more ADA transactions have been profitable.

With a ratio of 1.11 at present, this means that for every losing transaction, 1.11 transactions result in profit, reinforcing optimism around ADA’s price potential.

ADA Price Prediction: Rally to 60-Day High Possible

Cardano’s key momentum indicators on the one-day chart highlight growing buying pressure. The Chaikin Money Flow (CMF) is showing a positive value of 0.11, indicating increased liquidity inflow into the ADA market. A CMF above zero typically signals strong buying pressure, suggesting that the current rally could be sustained.

Additionally, ADA’s Relative Strength Index (RSI) is currently at 58.24, indicating that buying activity is outweighing selling pressure. If this trend holds, ADA may retest its two-month high of $0.40.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, if profit-taking picks up and the trend reverses, ADA’s price could drop by 27% to revisit the $0.27 level. This potential downside highlights the importance of monitoring market momentum and trader sentiment.