Cardano (ADA) has dropped out of the top ten cryptocurrencies by market capitalization, replaced by Tron (TRX), which saw a 14% rise over the past week.

In contrast, ADA only gained 2% during the same period and is currently trading at $0.34. Cardano’s slip in rankings mirrors the broader market downtrend of this past week. At $2.1 trillion, the global cryptocurrency market capitalization has declined by 2% over the past seven days.

Cardano Loses Highly Coveted Spot

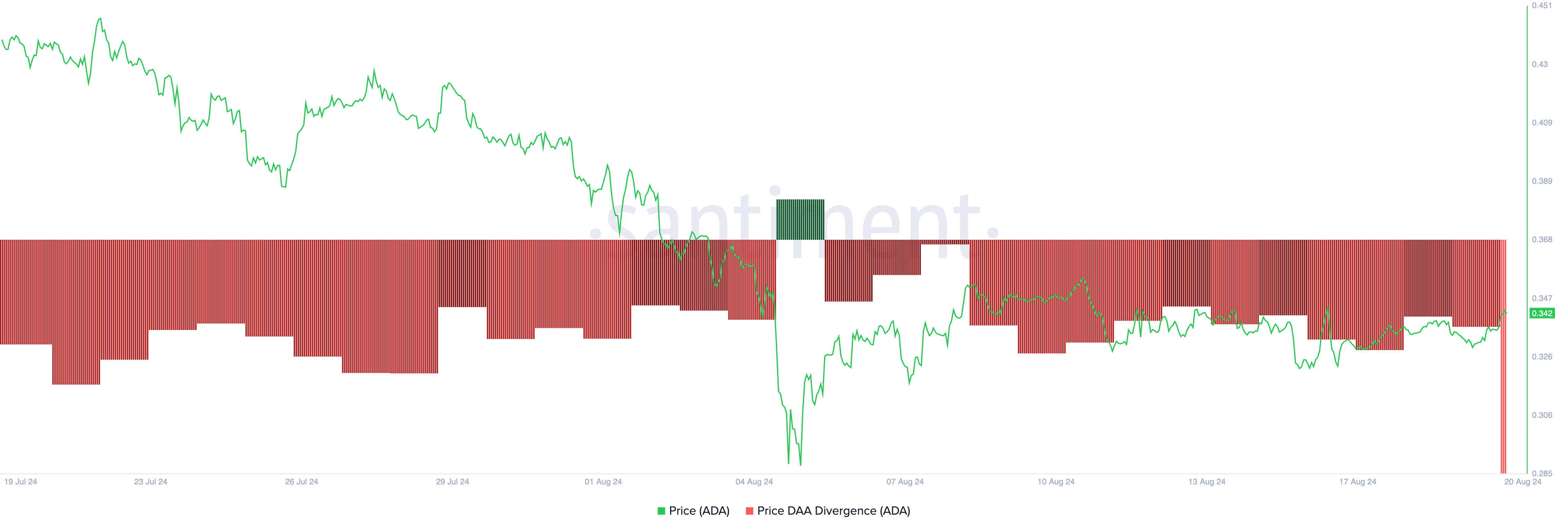

On-chain data shows a significant weakening in ADA’s market over the past 24 hours, reflected by a sharp decline in the asset’s price-daily active address (DAA) divergence, which is now at its lowest level in over 90 days.

The price-DAA divergence compares an asset’s price changes with shifts in daily active addresses to gauge if network activity supports the price. Currently, ADA’s price-DAA divergence is at -41.41%.

In the past 24 hours, ADA’s price increased by 2%, while its price-DAA divergence declined. This suggests only a small number of unique addresses are participating in transactions relative to the price. Traders usually see this as a warning of speculative activity or manipulation by a limited group of investors.

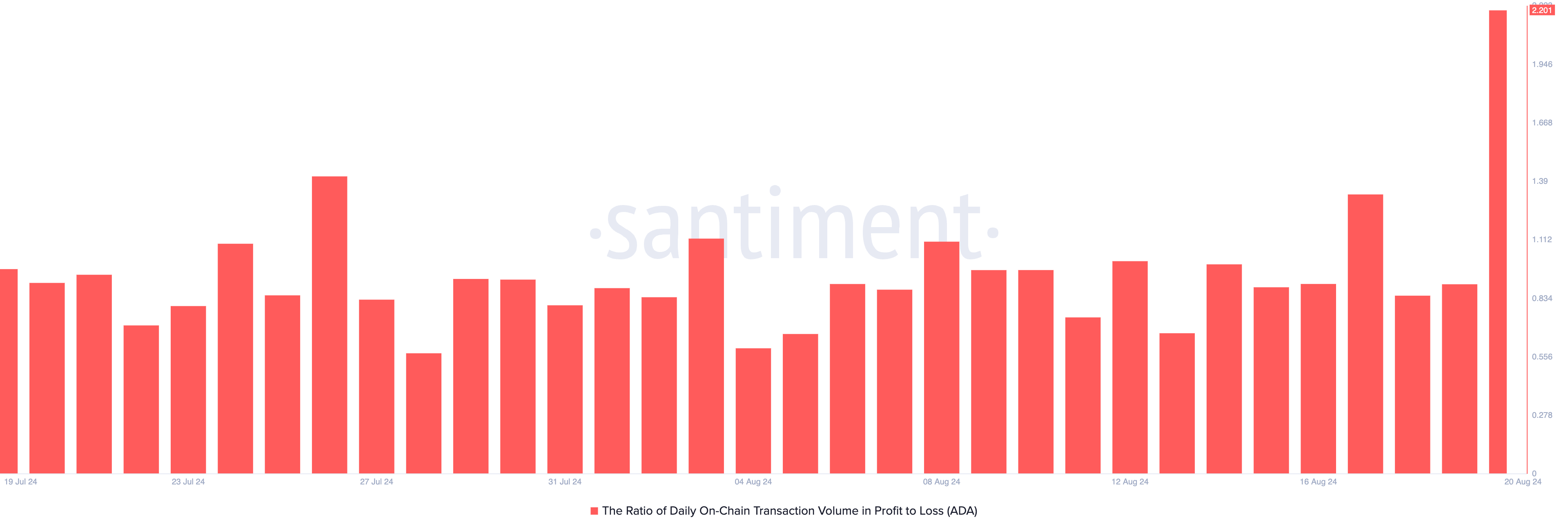

Despite the modest price jump, the daily on-chain transaction volume in profit versus loss has peaked. At press time, this ratio is 2.20, marking the highest level since January 2023, according to Santiment.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

This indicates that for every ADA transaction that has ended in a loss, 2.20 transactions have returned a profit.

ADA Price Prediction: Coin Prepares for Liftoff

As assessed on a one-day chart, ADA’s movements reveal its price attempt to cross above its 20-day exponential moving average (EMA). This moving average tracks an asset’s average price over the past 20 trading days.

When an asset’s gears to rally above this key level, it suggests it may be entering a short-term bullish phase. Crossing above the 20-day EMA is a bullish indicator, showing potential momentum for continued price growth. If ADA maintains this trend, it could see a price rally toward $0.40.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

However, if it changes course and declines, the coin’s value may plummet to $0.27, a low it last traded at during the general market downturn of August 5.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.