Cardano’s (ADA) price meets the criteria to initiate a recovery; however, the chances of a successful rise are bleak.

This is because ADA holders are not coming forward regarding participation, creating a deviation in interest and performance.

Cardano Investors May Have to Choose

Cardano’s price is conflicted as to what lies ahead for it. On the other hand, the third-generation cryptocurrency is seeing an opportunity to accumulate. This is derived from the short-term Market Value to Realized Value (MVRV) ratio.

The MVRV ratio assesses investor profit and loss. Currently, Cardano’s 7-day MVRV stands at -12%, indicating losses, which may lead to a surge in buying pressure. Historically, ADA MVRV between -6% and -18% usually signals the start of rallies, marking an opportunity zone for accumulation.

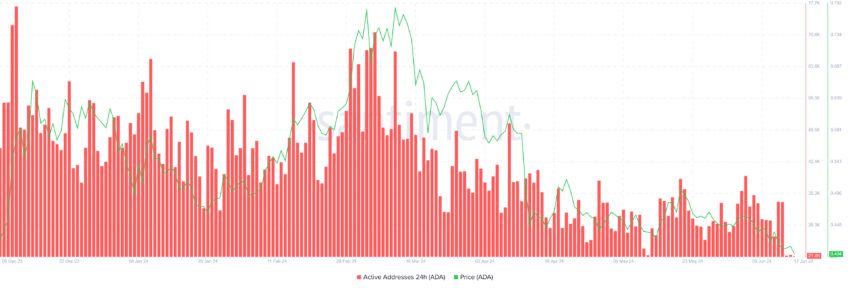

However, the lack of participation in Cardano’s market activity is countering this, which is flashing a sell signal. This is particularly evident in the price daily active addresses (DAA) divergence, where the number of unique addresses involved in transactions is not aligned with the price movements. Such a divergence is often a precursor to further downward pressure or consolidation.

The price DAA divergence suggests that despite the recent price drop, there isn’t enough market engagement to support a quick recovery. This lack of active participation could mean that traders are hesitant to re-enter the market, possibly anticipating further declines or uncertain about the future price direction.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

This scenario usually leads to a period of consolidation as the market seeks stability.

ADA Price Prediction: Potential Six-Month Low if Support Fails

Cardano’s price recently faced a significant setback as it failed to break out of the symmetrical triangle pattern. Instead, it broke down and dropped to $0.40, indicating a bearish turn for the cryptocurrency.

This move has raised concerns among investors and analysts who were hoping for a bullish breakout. Thus, the likely outcome for ADA is now sideways movement between $0.43 and $0.40.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

However, if the altcoin does not bounce back from $0.40, it could break below it. This would result in Cardano’s price forming a six-month low, falling to $0.38, and invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.