The United States Securities and Exchange Commission listed Cardano (ADA) among the tokens identified as securities in a court filing on Monday. As expected, the markets reacted negatively, triggering a 10% price retracement. On-chain data reveals a slim chance of an imminent ADA price rebound.

Cardano (ADA) has been one of the worst-hit assets in the top 10 global crypto rankings this week. With unrealized losses rising to critical levels, will the beleaguered investors now stop selling and help Cardano price recover?

Cardano Holders Could Soon Stop Selling

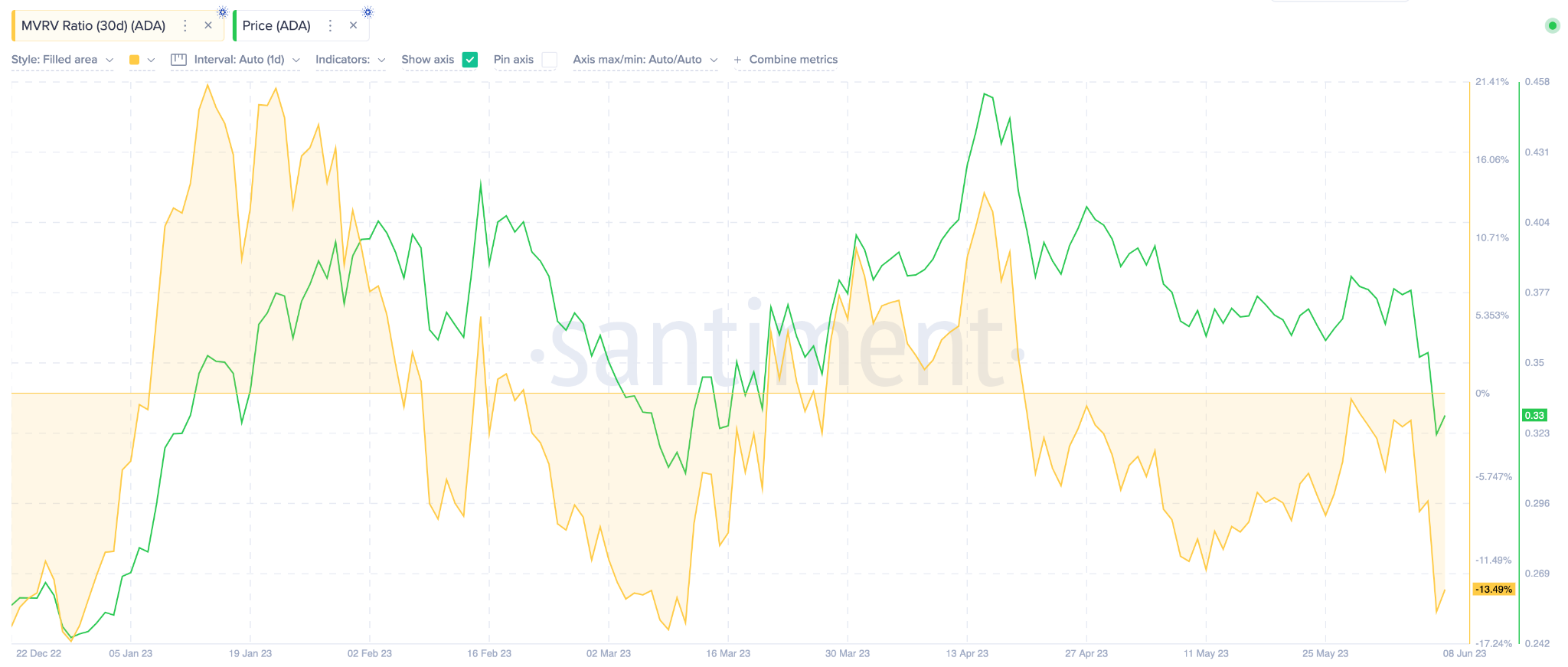

According to Santiment’s Market Value to Realized Value (MVRV 30d) data, most crypto investors that bought Cardano in the past month are now sitting on sizeable unrealized losses.

The MVRV ratio evaluates the net-financial position of investors by comparing their purchase prices to current market prices.

The chart below shows that, with prices sitting at $0.33, investors that bought ADA in the past month are holding nearly 13% unrealized losses.

With a net-loss position of 13%, strategic Cardano investors may grow unwilling to sell. Notably, over the last year, Cardano holders have only taken a hit of 15% on two occasions —the FTX crash in late-2022 and during the aftermath of the recent USDC de-peg in March 2023.

Hence, if they indeed stop selling as they desperately look to keep their losses below 15%, they could inadvertently trigger a rebound.

Long-Term Investors Now Look to HODL

Furthermore, the gradual drop in ADA Age Consumed suggests that long-term investors are cutting down on their sell action.

Age Consumed evaluates trading sentiment among long-term investors by tracking the number of coins recently transferred multiplied by the number of days since they were last moved.

According to the on-chain data, long-term investors move tokens en-masse on Monday. But once the price dropped below $0.35, they gradually slowed down the network activity.

The chart below shows how ADA Age Consumed dropped 77%. It went from 53.05 billion to 12.28 million between June 5 and June 8.

When Age Consumed drops considerably, as seen above, it signals that long-term holders are growing increasingly unwilling to sell. This reduced sell pressure could help ADA defend the $0.30 in the coming days.

ADA Price Prediction: Potential Rebound to $0.40

Considering the aforementioned factors, the probability that Cardano price recovers is important. It could even rebound toward $0.40 in the coming weeks.

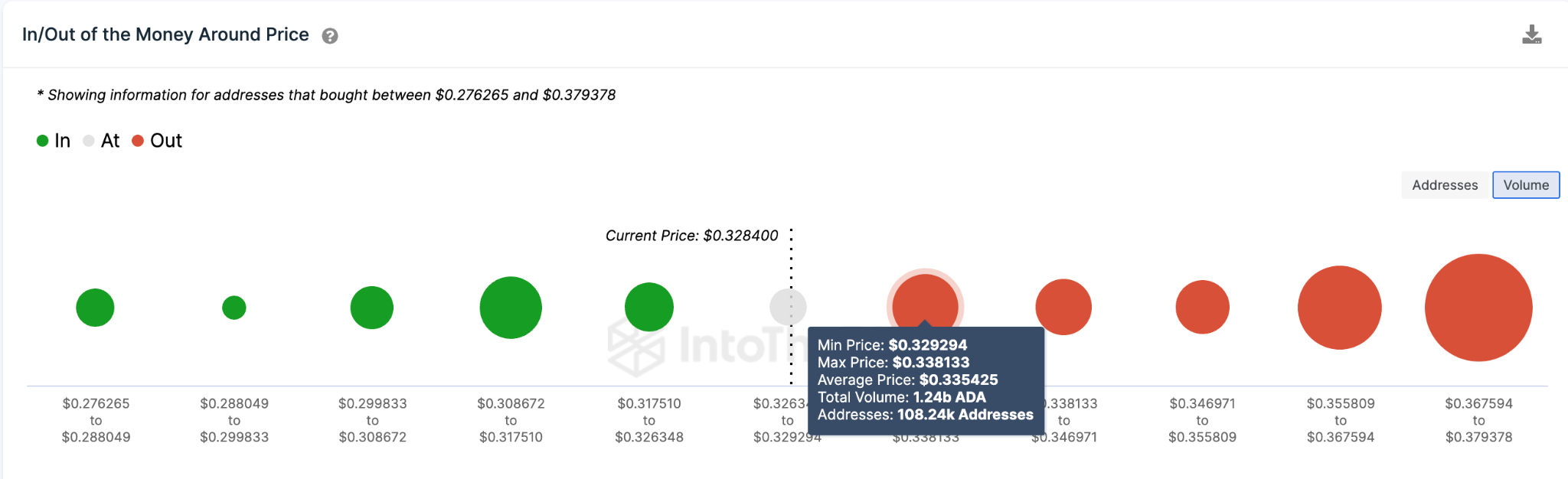

However, IntoTheBlock’s In/Out of The Money Around Price (IOMAP) data suggests that ADA will face its initial major resistance around the $0.34 mark.

As seen below, 96,000 investors that bought 760 million ADA at an average price of $0.34 could mount a sell-wall. However, if the bullish momentum prevails, as expected, the bulls could push further above $0.38.

On the other hand, the bears could invalidate the bullish Cardano price prediction if ADA unexpectedly drops below the critical $0.30 support zone. But, the 122,000 investors that purchased 1 billion ADA at a minimum price of $0.30 will likely prevent that.

Although unlikely, ADA could retrace further toward $0.27 if that support level is breached.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.