Nasdaq-listed Chinese mining equipment manufacturer Canaan reported increased revenues in Q2, but its bottom line remains underwater. Its topline increased from $55.2 million in Q1 to $73.9 million in Q2, while it sustained a $22.5 million higher loss than Q1 as miners stockpile machines ahead of the Bitcoin (BTC) halving.

Both topline and bottom line numbers are down on an annual basis. Revenues in Q2 2022 were $245.9 million, while, instead of sustaining loss, the company earned a gross profit of $138.3 million.

Canaan’s Own Bitcoin Mining Revenue Increases

In Q2 2023, Canaan sold equipment capable of a mining hashrate of six million terahashes per second (TH/s). Miners use special computers called ASICs to guess the correct hash of a Bitcoin block.

Canaan’s own operations suffered a reduction of two million TH/s after authorities in Kazakhstan imposed a new licensing regime for miners. But on the flip side, the company’s revenue from its own mining rose 43.3% from $11.1 million to $15.9 million.

The company predicts a tough Q3 as Bitcoin and other assets face a series of challenges, including macro uncertainty and the lack of regulatory clarity in the US. As a result, it has slashed its Q3 revenue forecast to $30 million.

Bitcoin Halving Expected to Increase Demand Miner Demand

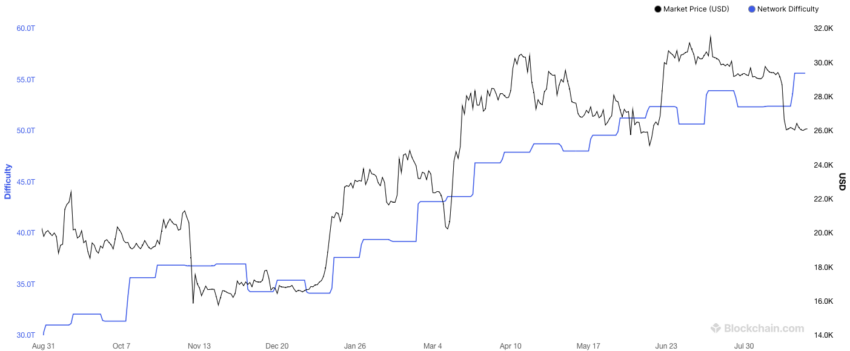

The decline in the Bitcoin price to around $26,000 in mid-August has wiped off around $3 billion from the market caps of five public miners.

Also weighing down on miners is the increase in mining difficulty. After next year’s halving, mining operations will earn half the 6.25 BTC reward for successfully guessing a block’s hash.

As a result, companies are buying more machines to increase their chances of earning Bitcoin. To prevent one entity from monopolizing mining power, the Bitcoin algorithm makes it more difficult to achieve the reward if more machines are connected to its network.

Interested in the latest and greatest mining gear. Read more here.

Earlier this month, mining infrastructure provider Blockstream said it was splashing out $5 million to buy mining equipment to sell ahead of the halving. The company anticipates an increase in Bitcoin’s price after the event.

Got something to say about the financial results of Bitcoin miner Canaan, the upcoming halving, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.