Polkadot price is witnessing the bullish impact of the positive interest it has received from institutional investors. The altcoin seems to be heading towards a previously failed high.

However, it might face multiple resistances in its path, which could subdue the bullishness noted presently.

Polkadot Outperforms Solana and Cardano

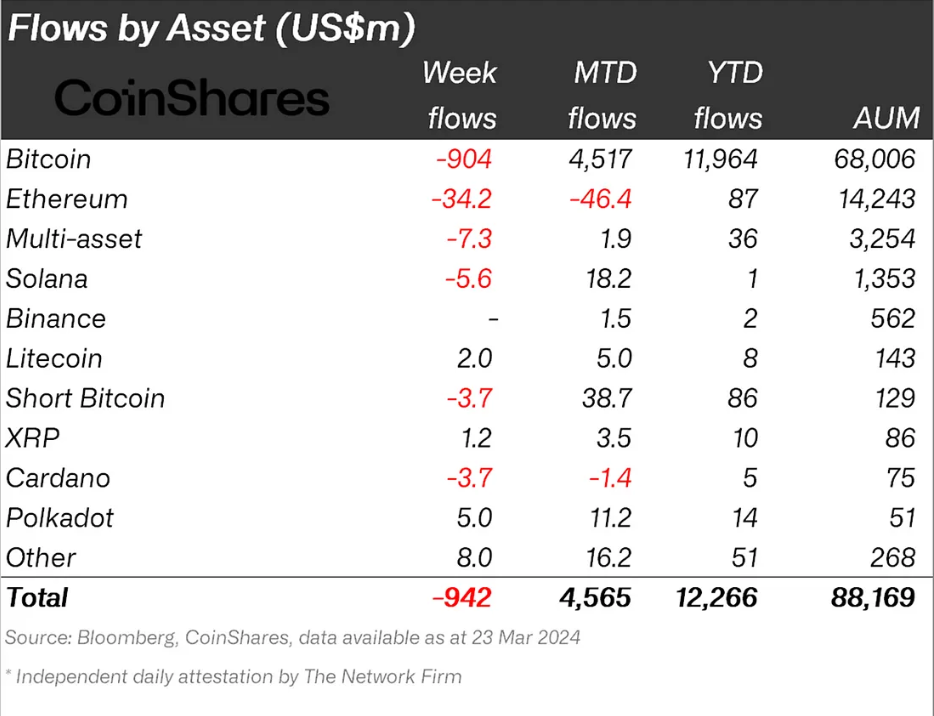

Polkadot price recovered by 12% this week and part of the credit for this goes to institutions along with retail investors. Their interest in DOT surged in the week ending March 23, so much so that they picked this altcoin over the likes of Solana and Cardano.

Polkadot recorded inflows worth $5 million, which, albeit not much, is still positive. On the other hand, SOL and ADA both observed outflows worth $5.6 million and $3.7 million, respectively. This shows that institutions opted for DOT this week, which also gave the price a boost.

Read More: Polkadot (DOT) Price Prediction 2024/2025/2030

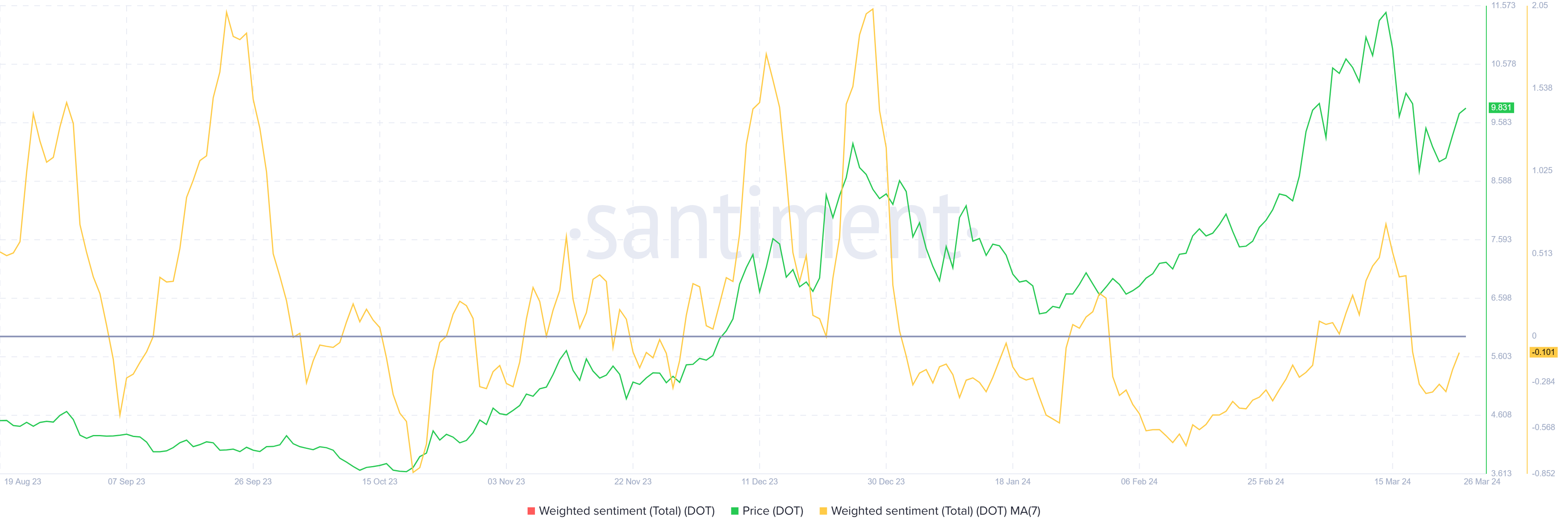

Similarly, retail investors are also exhibiting a comeback of the bullish sentiment following the recovery. This is crucial for Polkadot price as optimism would induce conviction which would keep the altcoin trending upwards.

DOT Price Prediction: Will Investors See $12 Again?

The bullish cues suggest that Polkadot price is certainly on the path of recovery and will continue rising. Over the past few weeks, the altcoin could be seen forming a rounding bottom pattern. This bullish reversal pattern suggested a potential rally of 31%, placing the target price at $12.

While DOT could not manage to fulfill this target during the previous bull run, it has a shot this time around, provided it can breach through the resistance levels marked at $10 and $11.

Read More: What Is Polkadot (DOT)?

This local barrier might act as a hindrance to Polkadot’s rise, and if it fails to breach these resistances, it could fall back down to the $9.2 support floor. Losing this level would invalidate the bullish thesis, causing a decline to $8.