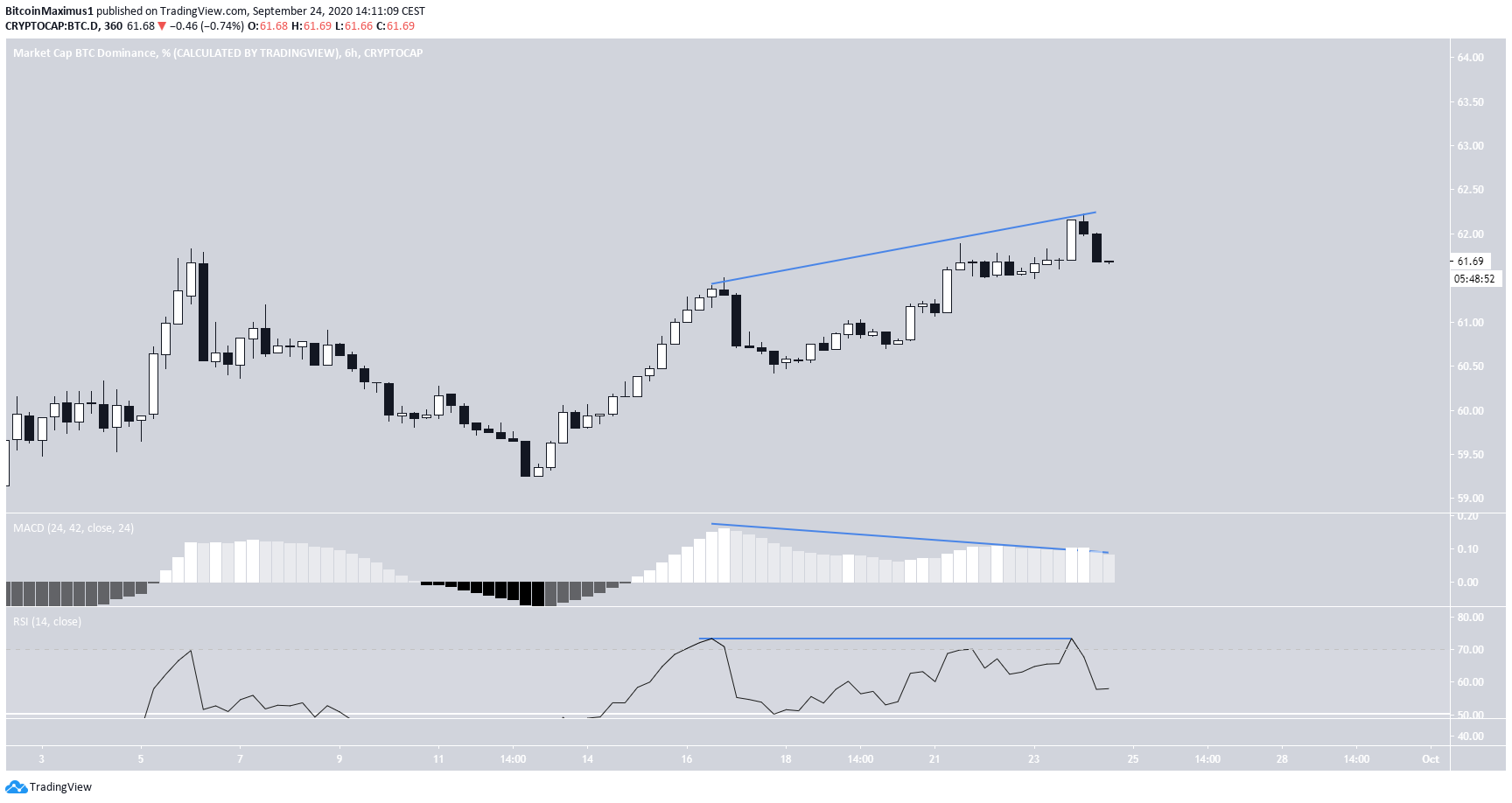

The Bitcoin Dominance Rate (BTCD) has reached a crucial resistance area, and a breakout above/below it will likely determine the direction of the future trend.

Long-Term Levels

The BTCD has been declining since September 2019, when it reached a high of 73.02%. The decrease has followed a descending resistance line. The 62% area previously acted as support in February 2020, initiating an upward move that reached the descending resistance line. However, the rate fell below this level in the beginning of August and is currently in the process of validating it as resistance or possibly reclaiming it. Technical indicators provide an ambiguous outlook. While the weekly RSI is deep into oversold territory and has generated bullish divergence, the Stochastic oscillator has just rejected a bearish cross. If the price fails to reclaim the 62% area, it could decrease all the way to 52%.

Possible Rejection

Cryptocurrency trader @anbessa100 outlined a Bitcoin Dominance Chart, stating that she expects a decrease, which would lead to an altcoin rally.

Wave Count

Beginning in January 2018, BTCD has likely completed a bullish impulse (in white below), and is in the process of completing a complex W-X-Y correction. The correction would be expected to end between the 0.5-0.618 Fib levels, between 49.5-54%, fitting with the support area outlined in the first section.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored