The Bitcoin (BTC) price trades inside two bearish patterns with the same support line. A breakdown from them can greatly accelerate the rate of decrease.

The Bitcoin price has created two bearish patterns, warning that a considerable decrease is forthcoming. Will the price confirm this bearish hypothesis by breaking down from the pattern, or will a bounce invalidate it?

BTC Price Deviates and Gets Rejected

The Bitcoin price fell significantly after creating a bearish engulfing candlestick two weeks ago. This is a type of bearish candlestick in which the entire gains from the previous period are negated in the next one.

Last week, the price attempted to move upwards but was rejected by the $29,800 resistance area.

So, in a span of two weeks, the BTC price deviated above an important resistance area (red circle). It then validated it as resistance (red icon). Both are considered bearish signs and often lead to downward movements.

Despite the rejection, the weekly Relative Strength Index (RSI) is still positive as it is above 50 and rising. Traders use the RSI to evaluate whether a market is overbought or oversold and to decide whether to buy or sell an asset.

If the RSI is above 50 and the trend is upward, the bulls remain in control, but if the RSI falls below 50, the opposite is true. It is worth mentioning that the number of average transactions reached a new all-time high last week.

Bitcoin Price Prediction: Does a Correction Await?

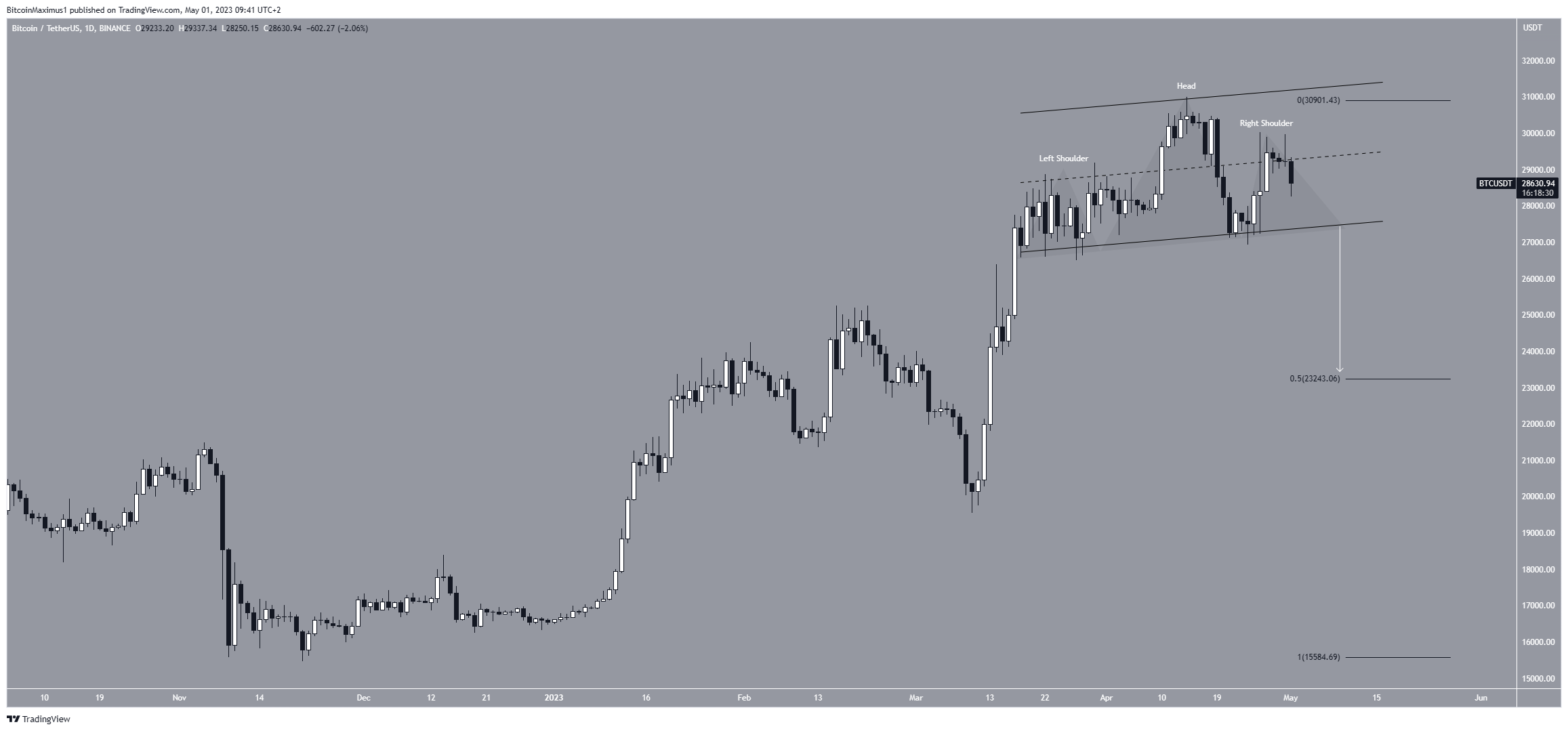

The technical analysis from the daily time frame gives a bearish Bitcoin price prediction for two reasons.

Firstly, the digital asset is trading inside an ascending parallel channel. The ascending parallel channel is classified as a corrective pattern where the price stays within parallel resistance and support lines before eventually breaking down.

As the channel is upward-sloping, it suggests that the overall trend is downward, making it a bearish pattern. The fact that the price was rejected by the channel’s midline numerous times (red icon) and is now trading in its lower portion solidifies the bearish outlook.

Next, the price has created a head and shoulders pattern, which is also considered bearish. The pattern consists of an absolute high between two lower highs. After the second lower high is complete, the price usually breaks down swiftly.

If this occurs, it will also cause a breakdown of the channel. A movement that travels the entire height of the pattern will take the BTC price to $23,400, also coinciding with the 0.5 Fib retracement support level (black).

Looking at all the above indicators, If the price breaks out toward an average price of $42,500, it is anticipated that the area will provide support once again, but as a result of the rejection, the area continues to function as resistance.

If the decline persists, the nearest support level will be at $25,000.

On the other hand, moving above the channel’s midline at $30,000 will invalidate this bearish Bitcoin price prediction. In that case, the price could increase to the channel’s resistance line at $31,300.

Since this would also mean that the BTC price breaks out from the long-term $29,800 resistance area, it could accelerate the rate of increase further.