A look at Bitcoin’s on-chain data, specifically funding rates and open interest, allows us to determine when the conditions in the future market are unreasonable, and a correction is expected.

While the funding rate is not yet at the same level as it was on March 13, open interest has already reached this level.

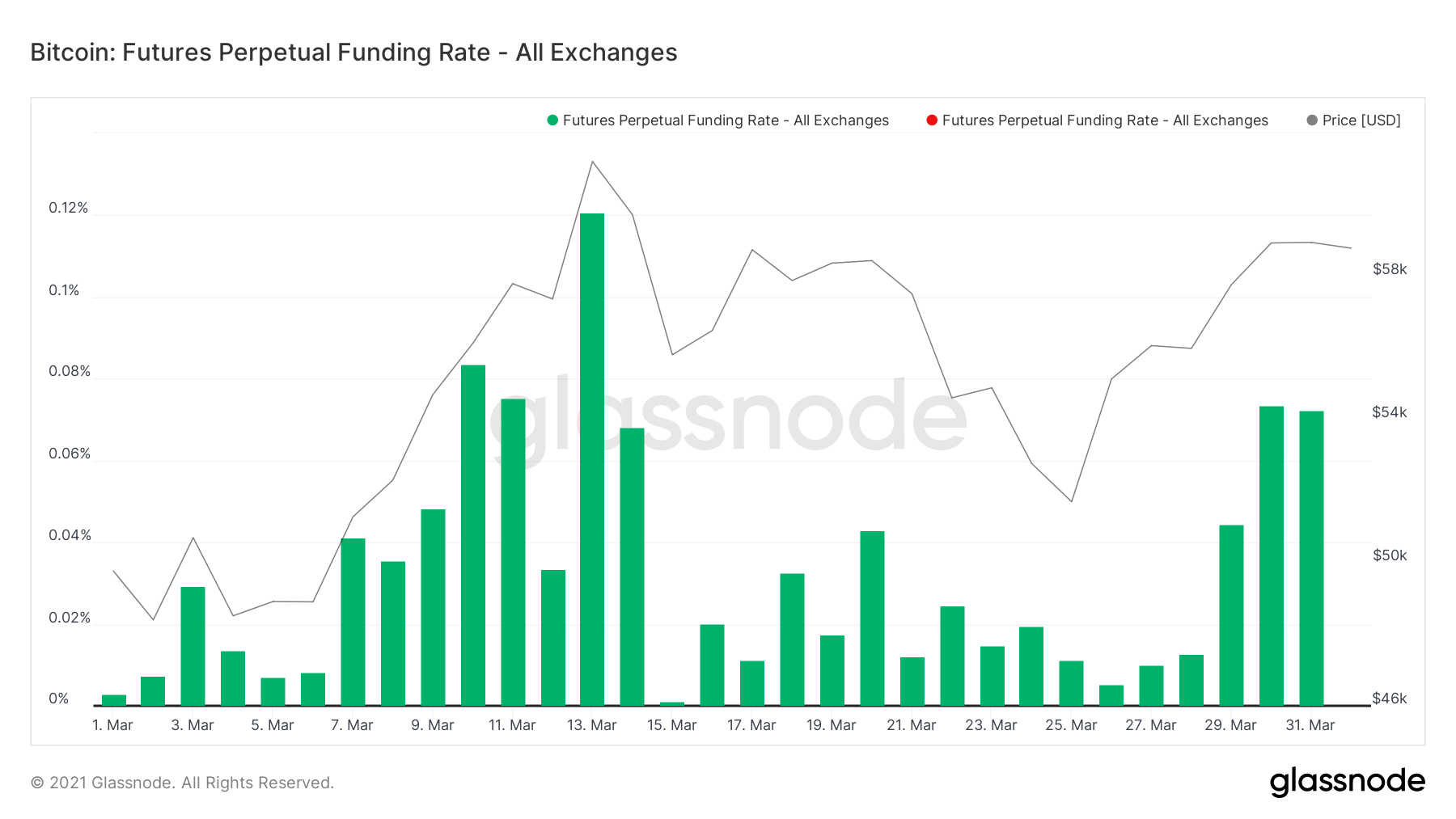

Funding Rate

Funding rates indicate the premium that futures traders have to pay (or receive) to keep a position open.

If the funding rate is positive, traders with an open long position have to pay a premium to keep the trade open. If the funding rate is negative, traders with a short position have to pay a premium to keep the trade open.

High positive funding rates have historically signaled tops (and vice versa for negative rates). This was visible on March 13, when the funding rate was at 0.121%. This means that long traders pay a premium of 0.121% to short traders for keeping their trades open.

The next two days, a significant correction followed, and the funding rate reset back to 0.

Currently, the funding rate is at 0.072%.

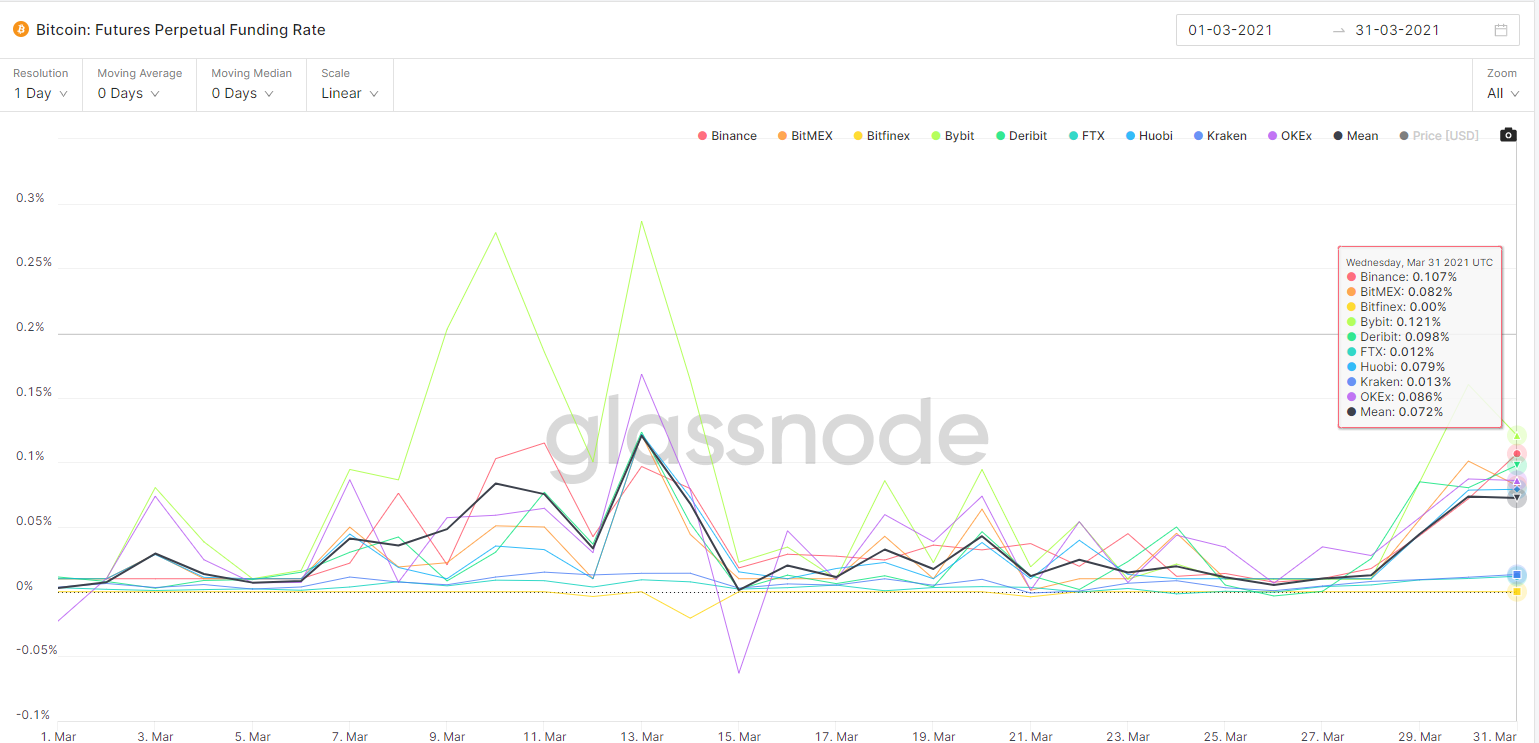

While they are similar, funding rates differ slightly between exchanges.

Bybit has the highest funding rates at 0.121%, followed by Binance at 0.107% and Deribit at 0.098%. Therefore, opening a short position would be the most lucrative in these three exchanges.

Conversely, the lowest funding rates are currently at Bitfinex – 0.00%, FTX – 0.012% and Kraken – 0.013%.

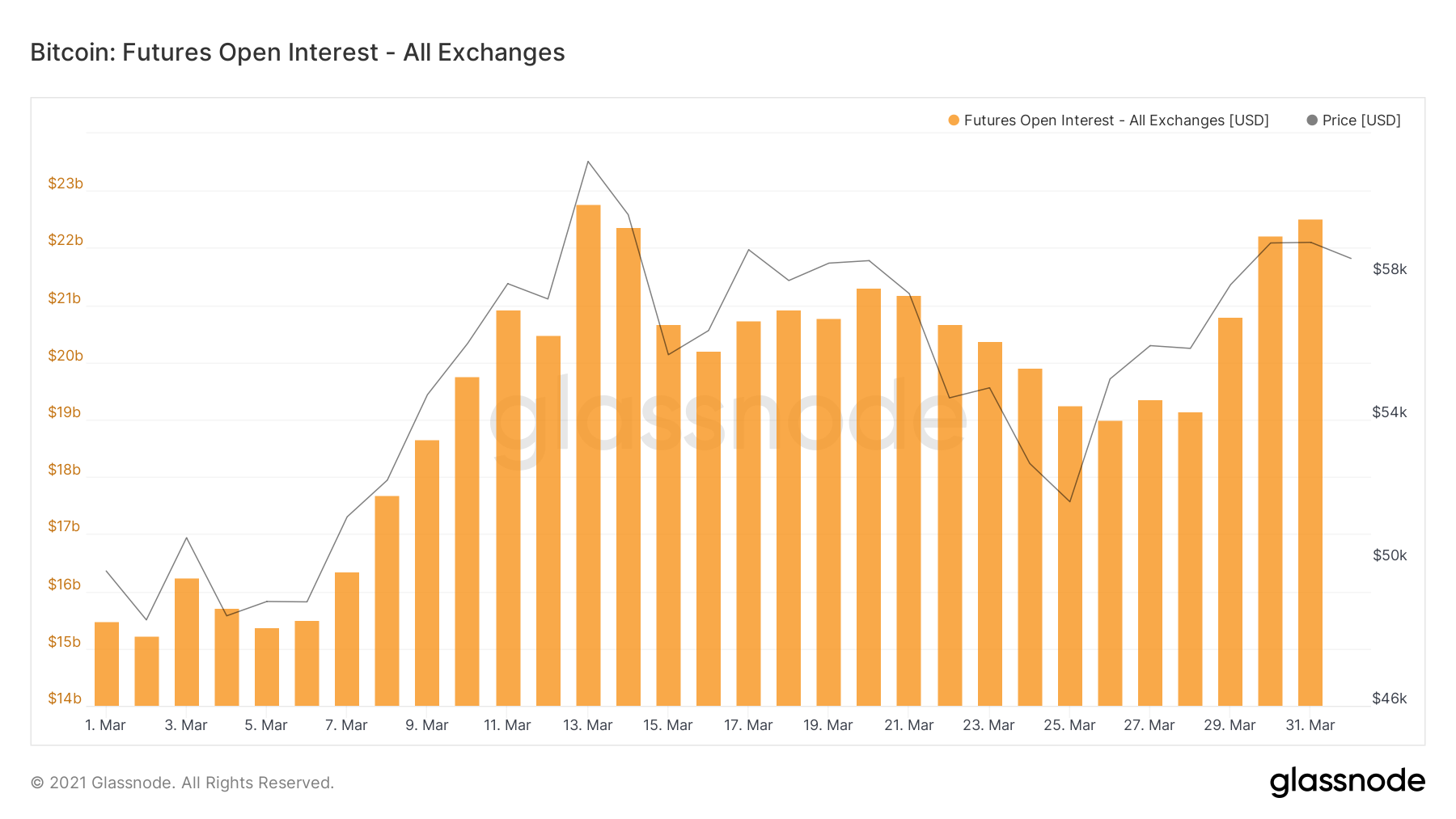

Open Interest

Open interest refers to the total amount of funds that are in open futures contracts. However, it does not show whether these funds are placed in long or short positions.

Similarly to the funding rate, open interest tends to peak near or at a local top. This makes sense instinctively since long-traders might get euphoric near a top, while short-traders could see it as a good shorting opportunity.

Therefore, since the open interest only measures the volume, not the direction, it makes sense that it would be the highest near a top.

The total open interest was $22.771 billion on March 13. Yesterday, it reached $22.521 billion.

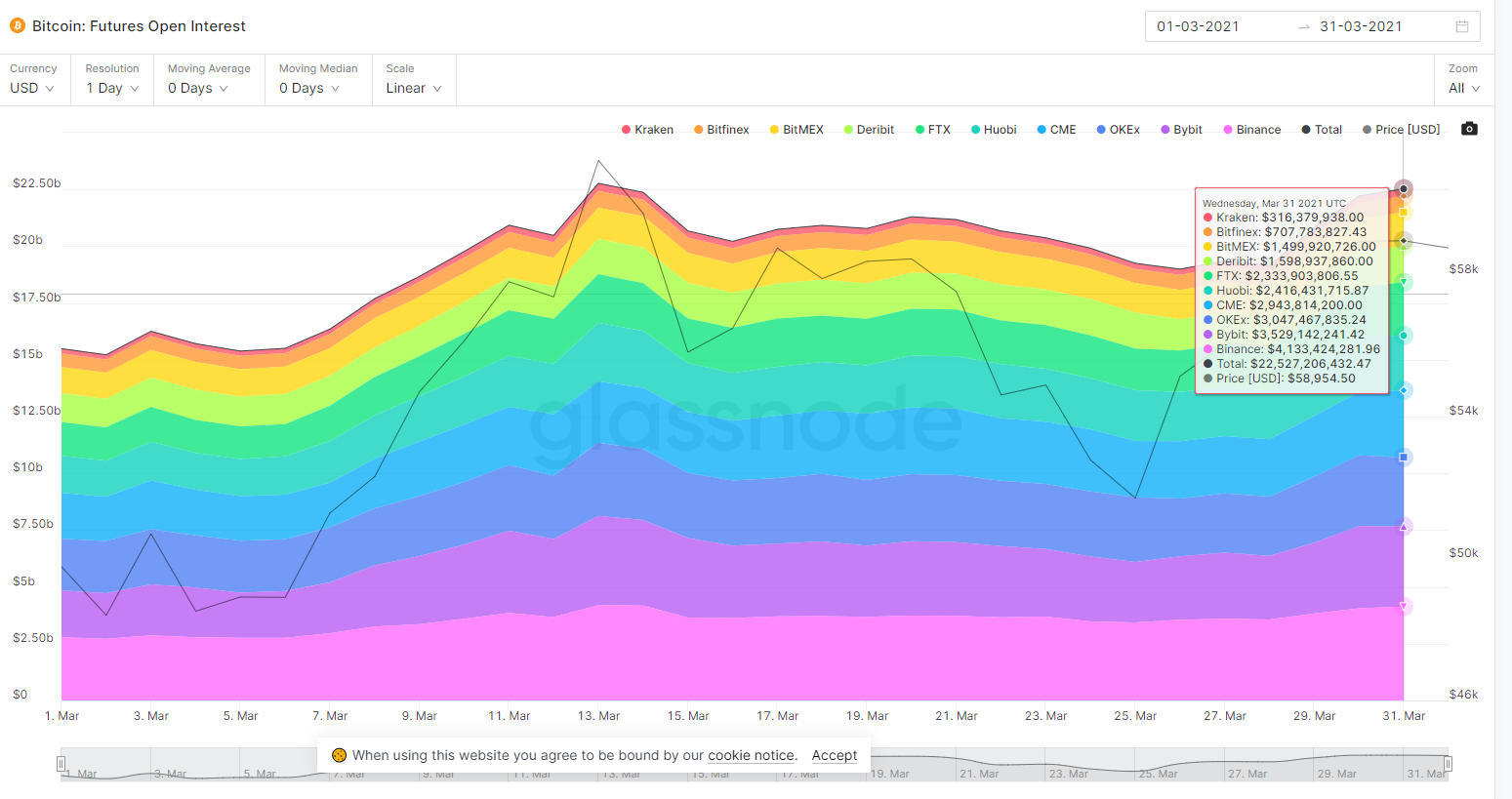

As for exchanges, Binance led with an open interest of slightly more than $4 billion, followed by ByBit with $3.5 billion and OKEx with $3 billion.

Conclusion

To conclude, both open interest and funding rates tend to peak at a local top. The former is currently at the same level as of March 13, while the latter is still lagging.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.