BONK is showing signs of a spirited ascent. The memecoin was recently listed on Robinhood, and its price soared by 19%. However, after reaching a peak price of $0.000045, the BONK token underwent a correction, with its price adjusting downwards to $0.000029, a 32.56% correction.

With unique traders and transactions surging, the digital asset market buzzes with anticipation. But can BONK reclaim the key levels to continue its bullish price surge?

Unique BONK Traders on the Rise Following Robinhood Listing

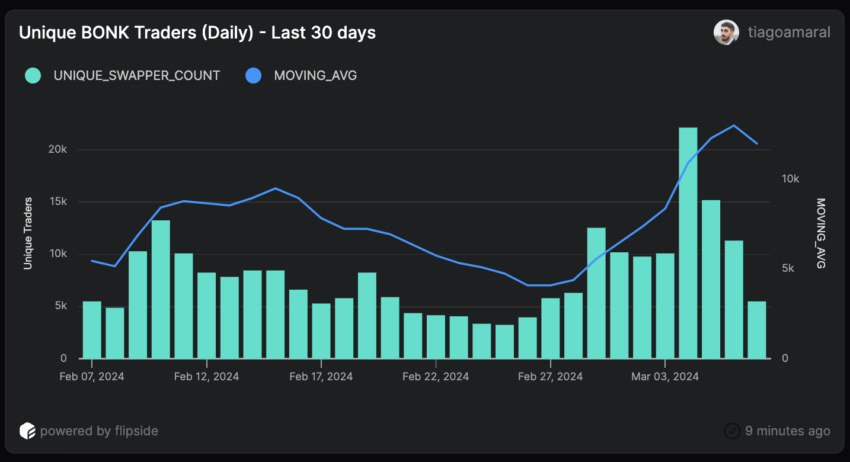

Robinhood listed BONK 2 days ago, and in the days before that, the number of unique traders buying and selling BONK grew from 9,770 to 22,100 in just 4 days, a 126.20% growth. During that exact period of growth, BONK reached a new ATH, moving its price to $0.00004547.

Following the peak, a notable decline in daily unique traders is captured by the individual bars and the moving average line in the chart below.

The moving average, which smooths out short-term fluctuations, illustrates a clear upward trend leading to the peak, followed by a gradual decrease. This could indicate a cooling off of trader interest or market activity after an initial phase of enthusiasm before the Robinhood listing.

BONK followed a similar path when listed in other exchanges, such as Coinbase, in December 2023. Price grew by almost 50% in the days before the listing and then corrected by 40% in the following days. Although this could mean a bearish sign for BONK, its size, compared with other memecoins, price support, and resistances, bring bullish signals.

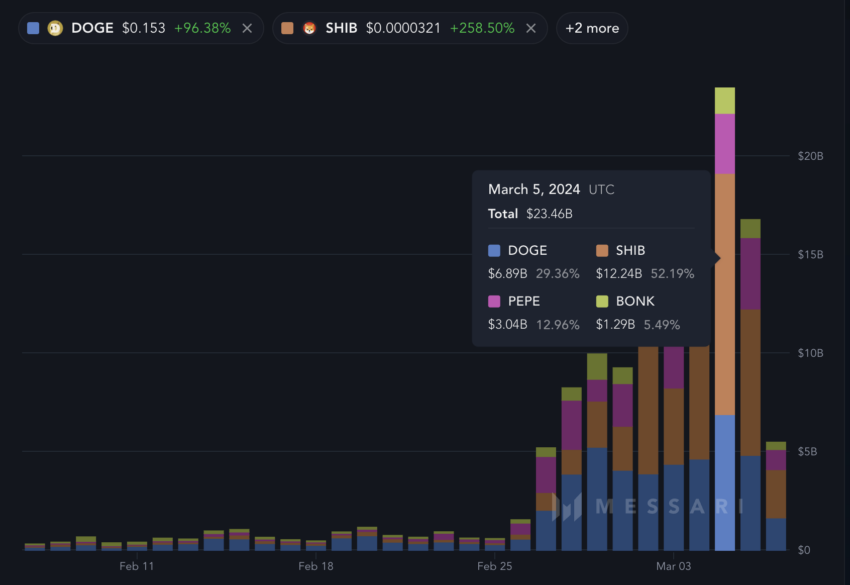

BONK Is Still Dwarfs Ethereum’s Biggest Memecoins

BONK is still a smaller contender when compared to the leading memecoins on the Ethereum network, like PEPE, DOGE, and SHIB, especially when we look at trading volumes. Taking a snapshot from March 5, the trading volume for BONK was a significant $1.29 billion. However, this figure was half the size of what PEPE recorded, a quarter of DOGE’s volume, and even more notably, just one-tenth of the massive trading volume seen with SHIB.

Comparing BONK with other Solana memecoins, its daily trading volume notably outpaces competitors, being five times greater than that of WIF and a remarkable 583 times more than CORGIAI, showcasing BONK’s dominance in the Solana space.

Historically, the largest and most traded memecoins have predominantly been part of the Ethereum network. However, the landscape seems to be shifting. With the increased activity and growing popularity of decentralized exchanges (DEX) on the Solana network, coupled with its advantages of speedy transactions and minimal fees, there’s a potential shift on the horizon.

Solana could very well become the new hub for memecoins. Within this emerging space, BONK positions itself as a likely leader, potentially becoming the most influential memecoin within the Solana ecosystem, capitalizing on the network’s strengths.

BONK Price Prediction: Climbing the Ladder Back to $0.000035?

Analyzing the price trajectory of the BONK token, we can pinpoint a critical juncture at exactly $0.000032, which currently constitutes the primary resistance level that the token is grappling with. Should the price manage to reclaim above this specific point, there’s a potential for a bullish trend to take hold, propelling the token toward the anticipated target of around $0.000035.

Historical chart analysis reinforces this sentiment, suggesting that if BONK can breach this threshold, it might set the stage for an even more substantial rally by cementing a new support level that could further fuel the token’s ascent.

Provided that the BONK price doesn’t dip below the crucial $0.000028 floor and the overall market conditions exhibit a bullish bias, there’s a conceivable chance that the token could escalate to meet or potentially exceed the $0.000035 benchmark in the near future.

Conversely, if the token’s valuation faltered and descended beneath the established support level, investors might witness a price contraction toward the $0.000023 area.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.