Binance Coin (BNB) has dropped below $500 again, despite multiple attempts to stay above this level. This decline has caused traders and the broader crypto market, which has been in a state of extreme fear, to become increasingly bearish on the coin.

As of this writing, BNB trades at $494. This analysis explains what the participants think of the cryptocurrency’s short-term potential and highlights the likely price trend.

Binance Coin Traders Have Changed Sides

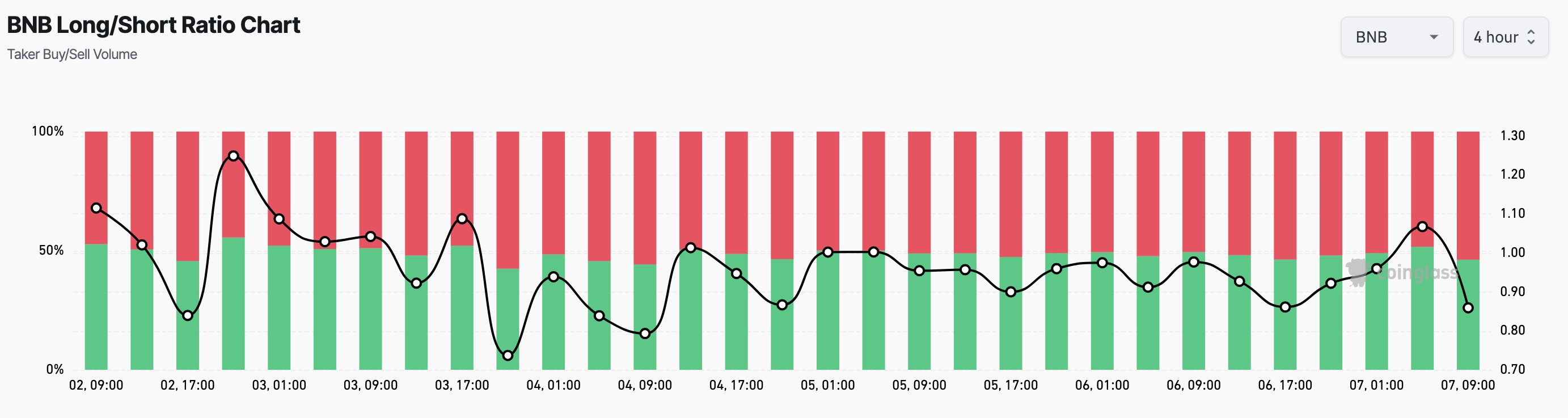

According to Coinglass, BNB’s Long/Short ratio initially rose in the early hours of September 7 but has since dropped to 0.85. This ratio, which measures investor sentiment, indicates that 53% of traders expect the price to decline.

On the other hand, 46% of BNB traders are betting on a price increase. A Long/Short ratio above 1 suggests that more traders are taking long positions, anticipating a price rise.

However, the current drop below 1 signals that many participants doubt BNB’s ability to sustain an uptrend. As a result, the negative sentiment could make it harder for the coin’s price to recover, potentially dampening demand.

Read more: 9 Best Crypto Desktop Wallets for 2024

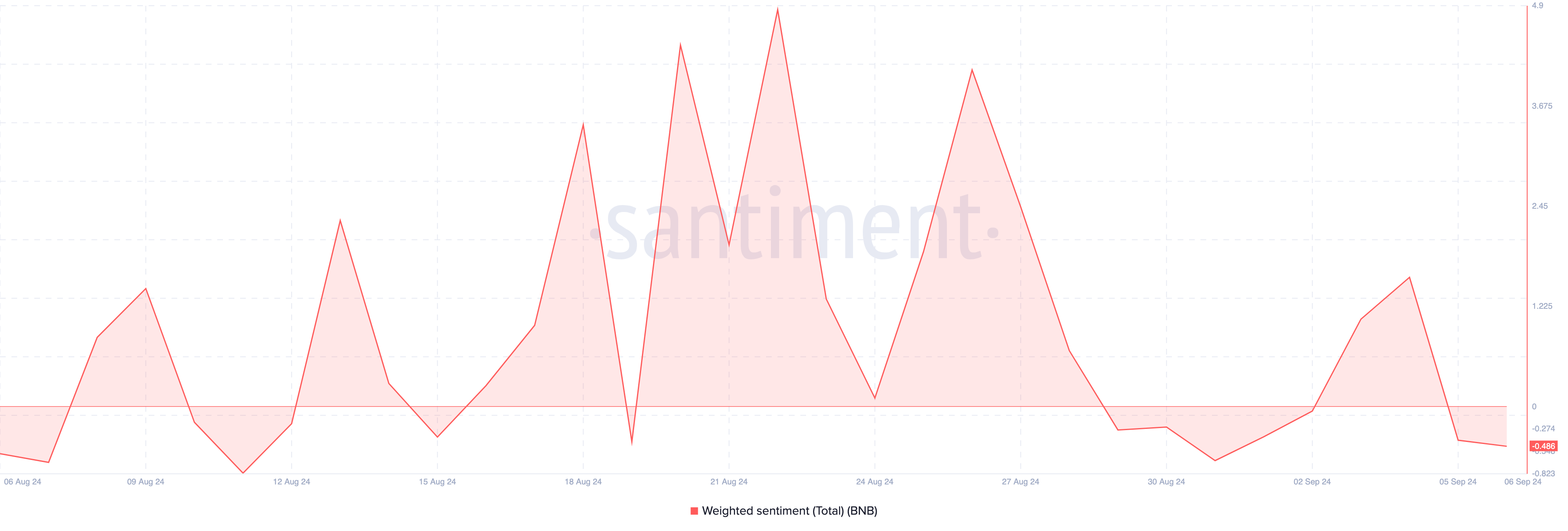

However, traders in the derivatives market are not the only ones with such a perception. According to Santiment, the Weighted Sentiment climbed to $1.57 on September 4. Today, the same metric is down to -0.46.

Weighted Sentiment reveals if the comments online around a cryptocurrency are mostly bearish or bullish. If the reading is positive, then most comments are bullish. However, in Binance Coin’s situation, most posts or messages around it tilt toward a negative sentiment, reinforcing the notion that many participants doubt a BNB price recovery.

BNB Price Prediction: Move to $464 Possible

On the daily BNB/USD timeframe, bulls had attempted to defend the support at $503, but bears eventually resisted it as the price broke down to $494. A look at the Exponential Moving Average (EMA) displayed the formation of a death cross.

A death cross is a bearish pattern that occurs when a shorter Exponential Moving Average (EMA) drops below a longer one. In this case, the 20-day EMA (blue) has crossed beneath the 50-day EMA (yellow), signaling that BNB’s price remains at risk of further decline.

If bulls fail to defend the price again, the coin price might decrease to $464. While recovery looks unlikely, buyers have to BNB would not drop below $487. Once this happens, the bearish thesis might be invalidated, and an upswing to $503 could come to pass.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

Regarding the possible invalidation, Brian Quinlivan, Lead Analyst at Santiment, suggests that once relief appears, the market could fully support the coin price.

“BNB has been relatively quiet over the past month, but there has been a steady, noticeable rise in social volume. The crowd will likely play a part in its next rise,” Quinlivan told BeInCrypto.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.