Binance Coin (BNB) futures traders are locked in a fierce battle, with long and short positions vying for dominance.

With the market witnessing a higher demand for long positions, a potential decline in BNB’s value puts these long traders at risk of liquidation.

Binance Coin Long Traders Shoot Their Shot

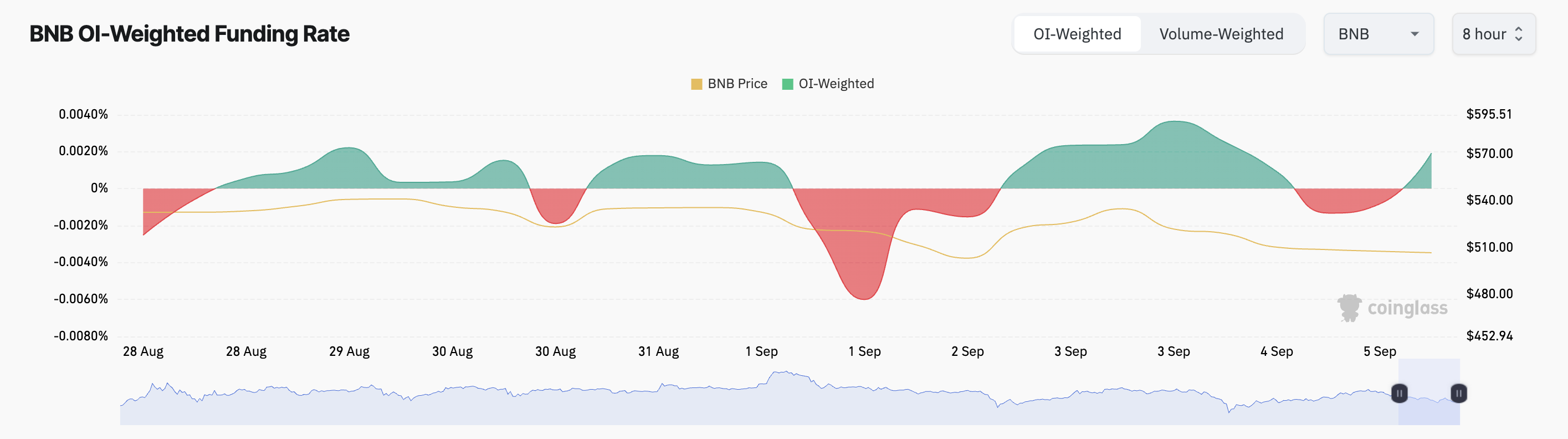

BNB’s recent price fluctuations have created an imbalance in the demand for long and short positions in its futures market. This is evident from the alternating positive and negative funding rates recorded since August 28.

Funding rates in perpetual futures contracts help align an asset’s contract price with its spot price. Positive funding rates indicate higher demand for long positions, while negative rates suggest an increased appetite for short positions.

In BNB’s case, the predominance of positive funding rates over the past few days shows that traders are favoring long positions, even as the coin continues its attempt to extend its current downtrend.

As of press time, BNB is trading at $504.63, having dropped 7% over the past week. The altcoin has remained below a descending trend line, indicating negative market sentiment and the potential for further declines.

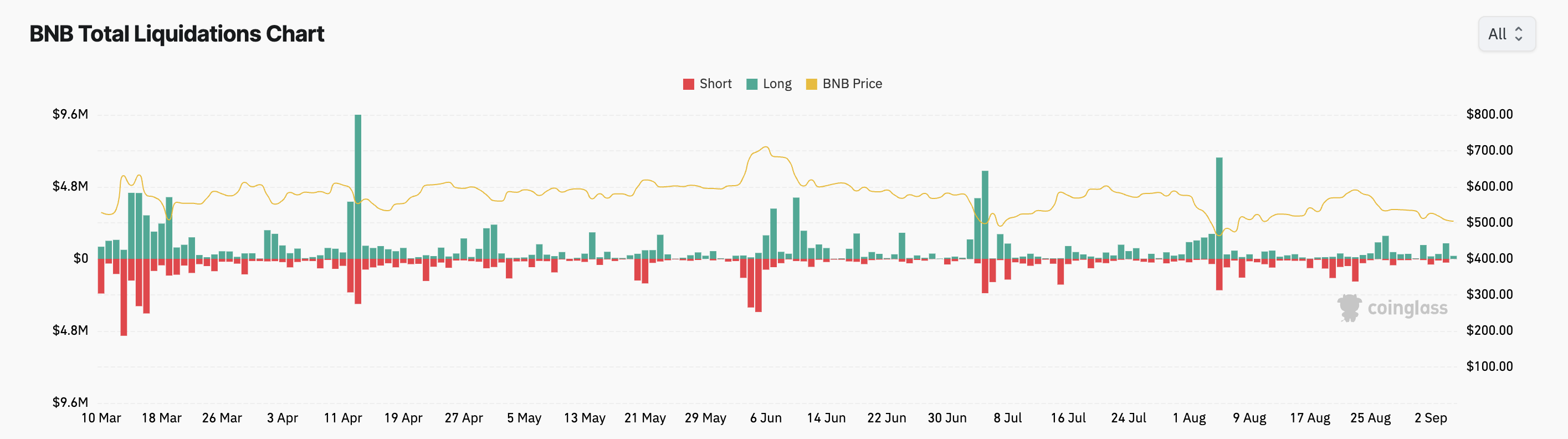

If BNB’s downtrend continues, long positions could face a greater risk of liquidation. This trend has already begun, with long liquidations outpacing short ones in recent days. On Wednesday alone, long liquidations reached $1.04 million, while short liquidations were much lower, totaling less than $250,000.

Read more: Best BNB Wallets to Consider in 2024

BNB Price Prediction: The Bears Have It

There is no gain saying in denying that BNB is poised for more downturn. Its falling Relative Strength Index (RSI) indicates strengthening selling pressure in the market. As of this writing, this key momentum indicator is in a downtrend at 38.33, suggesting that market participants have preferred to sell their coins rather than buy new ones.

Additionally, a measure of BNB’s bull-bear power reveals that the sellers control the market. The coin’s Elder-Ray Index, which measures the relationship between the strength of buyers and sellers in the market, has been negative since the coin began trading under the descending trend line on August 27. When its value is negative, bear power is dominant.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

If bearish pressure mounts, BNB’s price will fall under $500 to trade at $475.90. However, if the market trend shifts to bullish, its value may climb to $522.90.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.