BinanceCoin (BNB) price grazed the $340 milestone before retracing on May 1. The recent turmoil in the broader crypto market has seen BNB drop by 3% in the last 7 days. However, critical on-chain indicators currently give bullish investors a premise to make positive BNB price predictions.

BNB is the native coin of the BNB Chain blockchain network created by the prominent cryptocurrency exchange Binance.

Recently, there has been an unusual spike in Bitcoin mempool and transaction fees as fresh Ordinals and memecoin rave spread to the pioneer blockchain. Coincidently, BNB appears to be gaining significant traction in the past week as crypto traders seek more efficient alternatives to make transactions.

BNB failed to break the $340 resistance in May, but some on-chain indicators suggest that the bull rally is far from over.

Here’s how the spike in trading activity and accumulation by crypto whales could validate the bullish BNB price predictions.

Despite Price Drop, BNB Chain is Attracting Fresh Trading Activity

Critical on-chain indicators show that the BNB chain has recently gained significant market share. Specifically, the number of Daily Active Users (DAU) on the BNB chain network has increased considerably in the last seven trading days.

Between May 2, and May 9, even as the price dropped 3%, BNB active users increased 27% from 4,068 to 5,148, according to the on-chain data illustrated below.

The positive divergence between BNB price and Daily Active Users (DAU) is a bullish signal. DAU measures the number of unique wallet addresses interacting on a blockchain network.

When DAU begins to increase during an industry-wide price retracement, it signals that the underlying project is gaining market share from its competitors.

If crypto investors continue to look to deploy their transactions on BNB, it is only a matter of time before it triggers a price rebound.

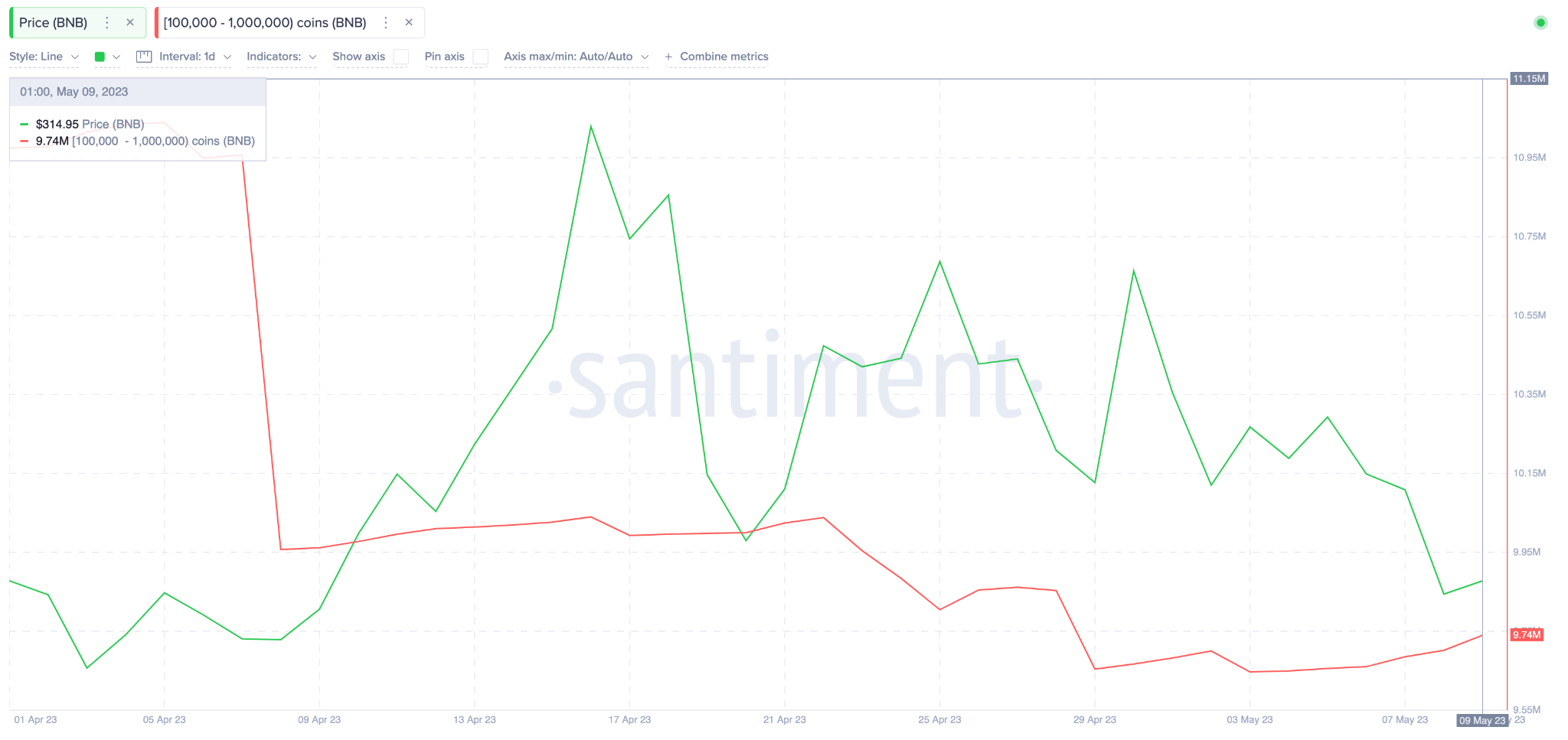

Whale Investors Have Stopped Selling

A fresh accumulation trend among large institutional BNB investors is another critical factor that points toward an imminent price rebound.

After booking a ton of profits in April, the chart below shows how a cohort of whales with balances of 100,000 to one million BNB have recently stopped selling. Between May 3 and May 9, the whales added 90,000 BNB coins into their wallet balances.

At current market value, this fresh investment by the whales is worth $28 million. This accumulation trend suggests that the whales are regaining confidence about the price prospects of the BNB coin.

Considering how this whale cohort has successfully timed previous bull rallies, their current accumulation wave could help validate the positive BNB price prediction.

BNB Price Prediction: Slight Decline is Expected Before a Bullish Reversal to $350

The historical trading patterns and evaluation of the current financial position of most BNB coin holders suggest that the next bull rally could reach $350.

Despite the recent price drop, most crypto investors that bought BinanceCoin within the past month are still sitting on unrealized profits of 2%. Historical data suggests they are likely to sell some more until they break even when prices decline toward $308.

However, if the bullish scenario plays out, BNB will rebound 5% toward $325 before facing an initial resistance. And if that resistance is breached, it could rally by another 10% toward the $355 zone before the bears begin to regroup.

Conversely, the bears could negate the narrative if the BNB price drops below the $308 target. Nevertheless, investors will likely offer bullish support at this level as they look to avoid entering a net-loss position.

Otherwise, the bullish BNB price prediction could be effectively negated, and the bears could push for the next significant support level at $300.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.