The crypto venture capital (VC) company Blockchain Capital has raised $580 million for its two new venture funds.

Some believe that crypto assets are going through the longest-ever bear market as Bitcoin hovers between $25,200 to $30,000. However, with the anticipation of a new bull market post the Bitcoin halving, additional capital is entering the market.

Blockchain Capital Plans to Focus on Six Crypto Sectors

According to TechCrunch, BlockChain Capital secured $580 million for its sixth early stage fund and first “opportunity fund.” The VC firm will allocate two-thirds of the total capital for the former and the remaining amount for the latter.

The company would invest in the seed round and Series A round of crypto startups through its early-stage fund. However, the opportunity fund will focus on the companies raising funds at a later stage if Blockchain Capital missed participating in the initial rounds.

With the latest funding, Blockchain Capital will focus on six sectors:

- Decentralized Finance

- Centralized Finance

- Decentralized Infrastructure

- Centralized Infrastructure

- Gaming

- Consumer/Social

Click here to learn how to monetize your social media influence on Friend.tech

While more details about the funding are not available, it is worth noting that companies like PayPal and Visa are some of the largest investors in Blockchain Capital. They were the main investors in Blockchain Capital’s $300 million Fund V.

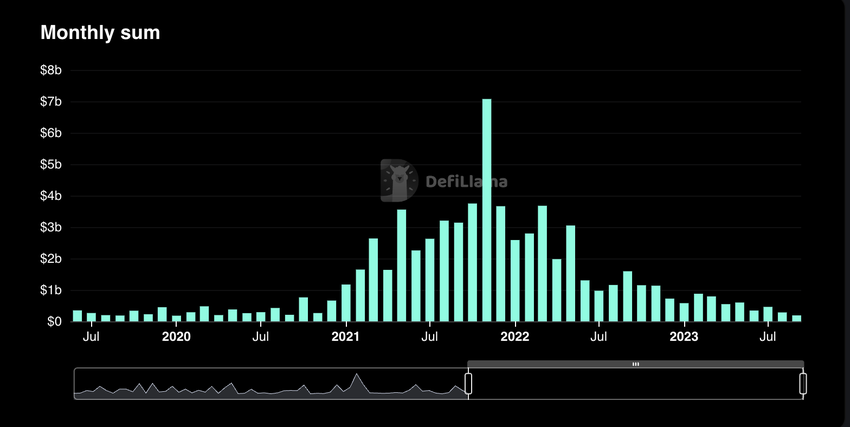

With this fundraising, some community members believe the crypto bulls are back in the game. The development comes as crypto monthly fund raises are down to 2020 levels.

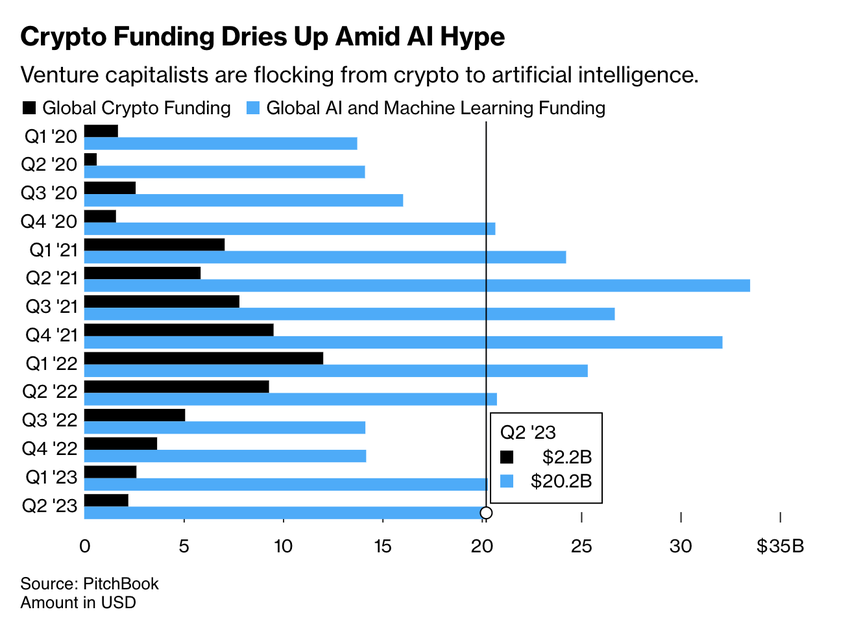

Investors Favor AI Over Crypto

As VCs become more focused on artificial intelligence (AI), crypto investment has started to dry up. The screenshot below shows a declining trend in crypto investments, whereas AI investments have increased simultaneously.

BeInCrypto reported that the VC giant SoftBank has shifted focus on AI investments, drifting away from crypto. Other big investment houses are also betting big on AI. Last week, Australia’s largest pension fund invested $1.6 billion in Vantage Data Centers, which supports AI infrastructure.

Click here to learn more about the best artificial intelligence companies for 2023.

However, Blockchain Capital has a long-term vision for crypto startups. Its general partner Spencer Bogart told TechCrunch:

“There’s always been temptation across VCs to experiment in new sectors, but we have no intent to expand and become an AI fund or hedge fund and trade tokens.”

Do you have anything to say about Blockchain Capital or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.