Bitcoin’s classification in the financial ecosystem is highly debatable. Some analysts see it as a stable haven and others as a risky asset.

However, Robbie Mitchnick, the head of digital assets at BlackRock Inc., argues that Bitcoin is fundamentally a risk-off asset.

BlackRock Executive Talks About Fundamentals of Bitcoin

Risk-off assets like gold and government bonds are favored in uncertain times, providing a safe harbor when the economic forecast looks grim. In contrast, risk-on assets, such as stocks, thrive when investor confidence is high. Despite occasional correlations with the stock market, Mitchnick asserts that Bitcoin ultimately behaves differently in the long run.

“There’s been periods where Bitcoin’s correlation with equities has spiked and there’ve been periods where it’s gone negative. Actually gold shows a lot of the same patterns where you have these temporary periods where it spikes, but long term, close to zero,” Mitchnick said.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Mitchnick further explores Bitcoin’s unique attributes as a global, decentralized, non-sovereign asset. He believes that Bitcoin is not tied to any single country’s economic health or policies. It’s a scarce asset, immune to the usual risks of currency debasement and political turmoil.

According to Mitchnick, due to these reasons, Bitcoin becomes an attractive option when traditional currencies falter.

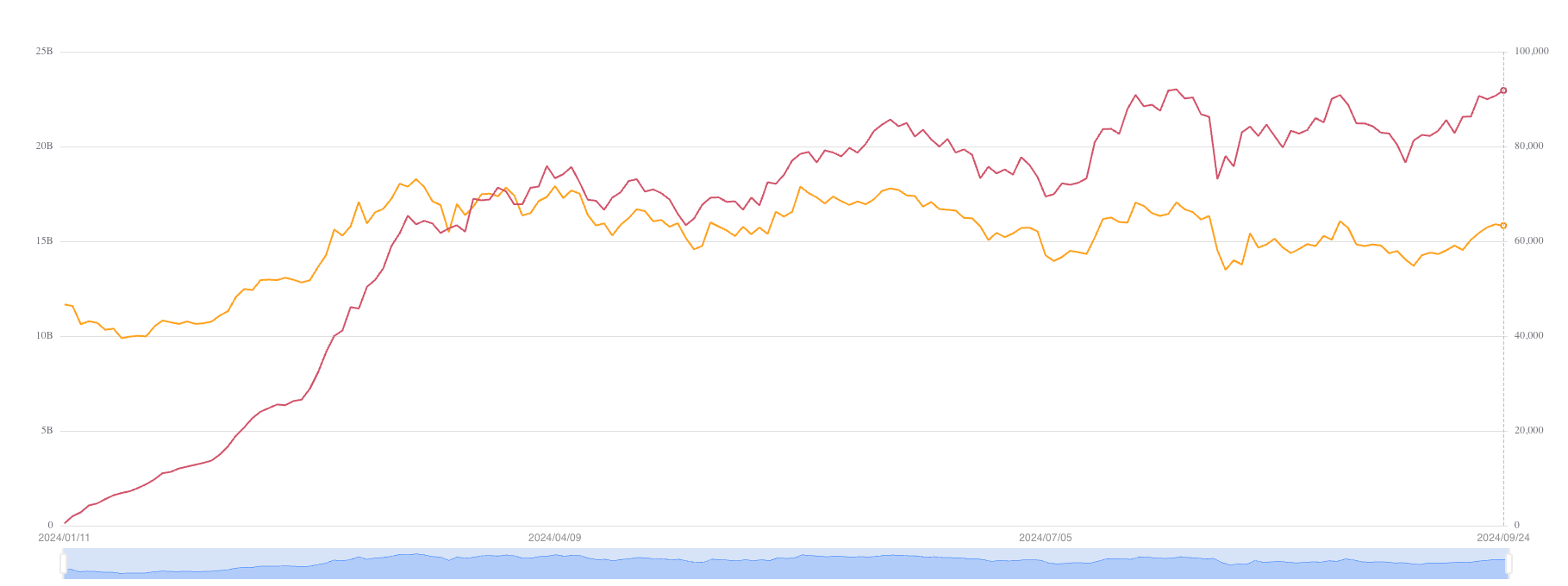

BlackRock’s engagement with Bitcoin highlights its risk-off potential. The firm’s iShares Bitcoin Trust (IBIT) now holds nearly $23 billion in assets. This significant management suggests a strong institutional and retail belief in Bitcoin’s stability in tumultuous times.

This shifting perspective is evident beyond BlackRock. At the recent Barron’s Advisor 100 Summit, a clear change was noted among top financial advisors in the US.

Read more: Who Owns the Most Bitcoin in 2024?

Matt Hougan, Chief Investment Officer at Bitwise, emphasized this trend, stating that about 70% of summit attendees now personally own cryptocurrencies—significantly up from just a few years ago. This marked increase mirrors a broader industry trend in which advisors’ personal investments precede their recommendations to clients.

As these barriers erode, incorporating Bitcoin into diverse portfolios might become more standard, reinforcing its role as a risk-off asset.

Moreover, Alvin Kan, the COO of Bitget Wallet, believes that the shift in investors’ sentiment is a key milestone for Bitcoin.

“Bitcoin’s evolving reputation as a ‘risk-off’ asset, comparable to gold, highlights its growing role as a stable store of value in uncertain times. Institutional investors, especially those focused on long-term growth, may find Bitcoin increasingly appealing during periods of volatility. This shift is a key milestone in Bitcoin’s maturation as more investors recognize its value in diversified portfolios,” Kan told BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.