Larry Fink, CEO of BlackRock, discussed the potential for Bitcoin (BTC) to reach values of $500,000, $600,000, or even $700,000 per coin.

He explained how institutional adoption could significantly impact Bitcoin’s price, suggesting that it could propel the cryptocurrency to such high levels if investors allocated even a small portion of their portfolios to Bitcoin.

BlackRock CEO’s Bitcoin Prediction

In an interview with Bloomberg at the World Economic Forum in Davos, Fink discussed one of the most bullish cases for Bitcoin. He noted a recent conversation with a sovereign wealth fund where the topic of Bitcoin allocation was raised.

“I was with a sovereign wealth fund during this week and that was the conversation: ‘Should we have a 2% allocation, should we have a 5% allocation? If everyone adopted that conversation, it would be $500,000, $600,000, $700,000 per Bitcoin,” said Fink.

However, Fink quickly clarified that he was not directly promoting Bitcoin.

“I’m not promoting it by the way. That is not my promotion,” he added.

Fink’s optimistic view on Bitcoin aligns with comments made by Coinbase CEO Brian Armstrong. He recently predicted that Bitcoin could eventually reach multi-million dollar prices.

The BlackRock CEO elaborated on crypto’s role in the global economy, describing it as a “currency of fear.” He explained that Bitcoin serves as an alternative for those concerned about the debasement of their local currency or their country’s political and economic instability.

“An internationally based instrument called Bitcoin that will overcome those local fears,” he remarked.

BlackRock’s Bitcoin Strategy

Notably, BlackRock has been actively increasing its exposure to the largest cryptocurrency. In 2024, the firm became the first to receive approval from the US Securities and Exchange Commission (SEC) for a Bitcoin exchange-traded fund (ETF).

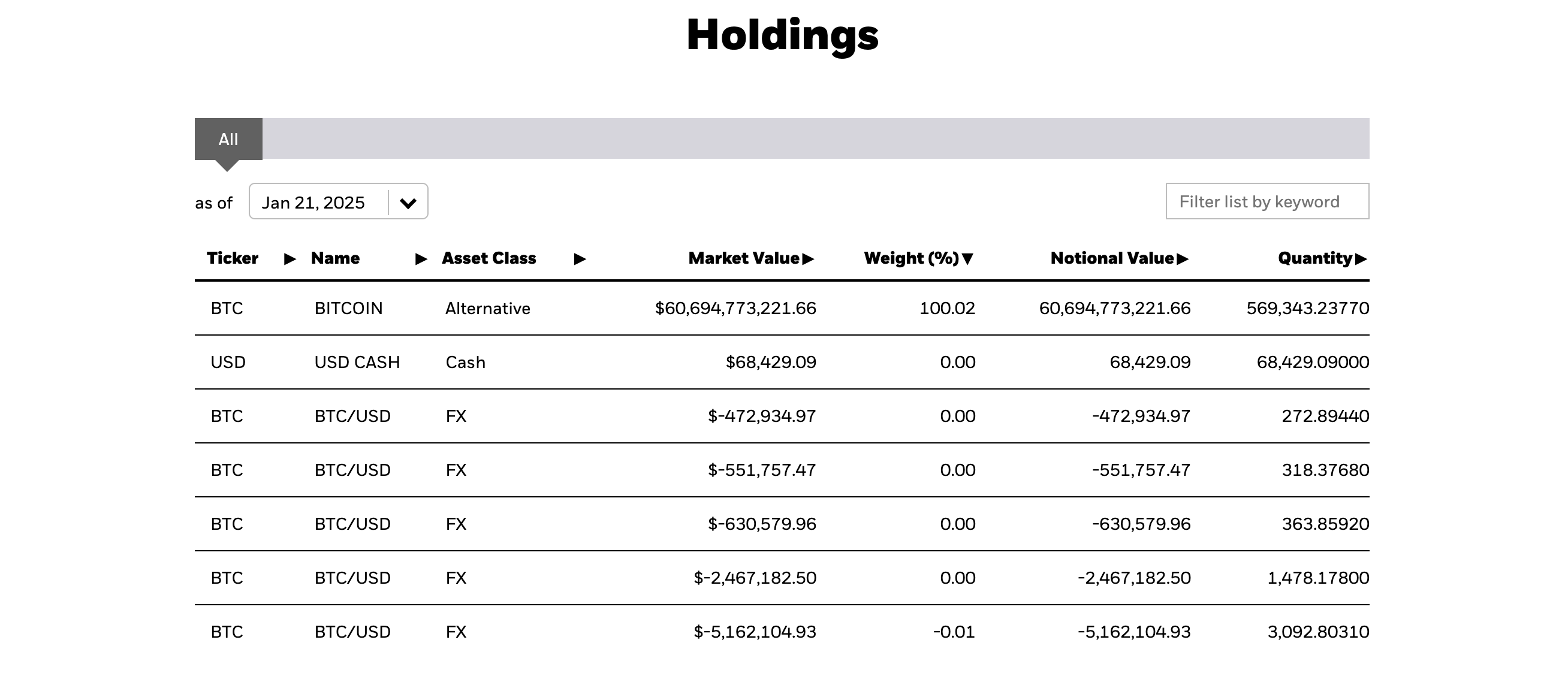

As part of its ETF strategy, BlackRock has been accumulating Bitcoin and is now one of the largest cryptocurrency holders. According to the latest data, BlackRock’s Bitcoin holdings stand at an impressive 569,343.23770 BTC. These holdings are valued at over $60 billion at current prices.

In fact, according to intelligence platform Arkham Intelligence, BlackRock made its largest Bitcoin purchase of the year, acquiring $600 million worth of Bitcoin.

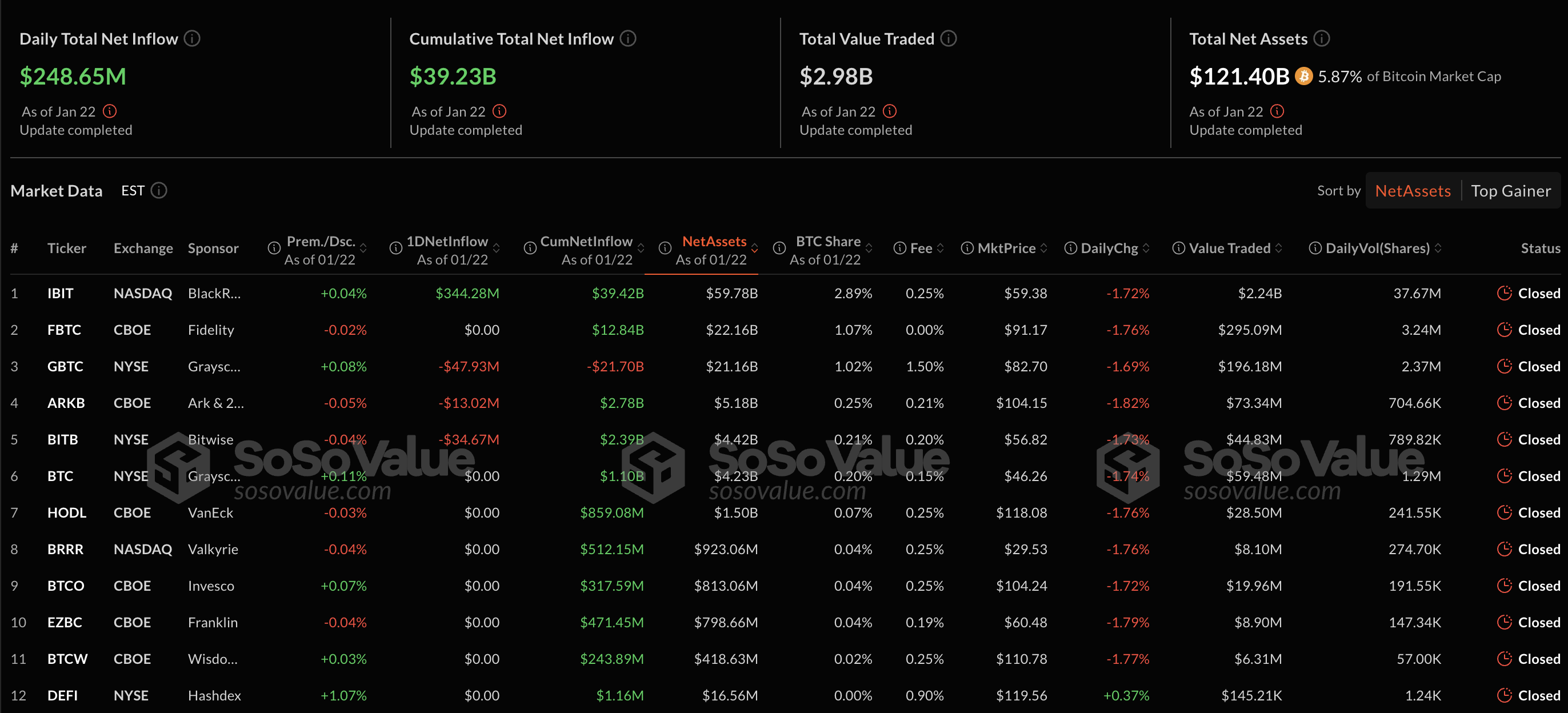

That’s not all. BlackRock’s iShares Bitcoin Trust ETF (IBIT) is the largest Bitcoin ETF in the US market. According to data from SoSo Value, it controls 2.89% of the total Bitcoin market capitalization.

Furthermore, on January 22, the IBIT ETF saw inflows of $344.28 million. Meanwhile, other Bitcoin ETFs experienced either no inflows or negative flows.

In addition to its US offerings, BlackRock launched the iShares Bitcoin ETF in Canada on January 13, trading under the ticker “IBIT” on Cboe Canada, expanding its Bitcoin investment strategy internationally.