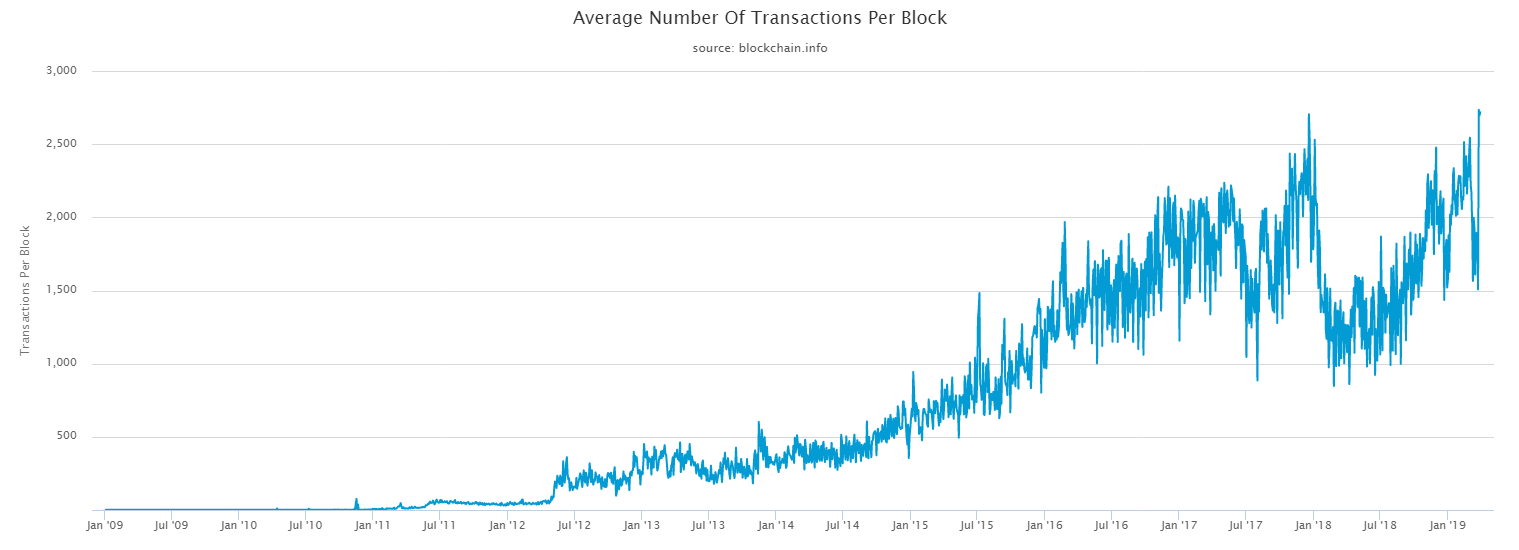

In spite of the cryptocurrency market’s relatively-lackluster performance throughout 2018 and 2019, the average number of Bitcoin transactions per block has reached a new all-time high.

The new peak set on March 30, 2019, beat the previous record that was achieved during the crypto bull run of 2017.

Many in the Bitcoin (BTC) community have pointed out that the number of transactions could be even higher than indicated as current forms of measurement often fail to include off-chain transactions.

Bitcoin Transactions Per Block At All-Time High

On March 30, 2019, the average number of transactions per block on the Bitcoin network rose to 2718. A gradual rising pattern in the data can be observed since the beginning of March 2019. This trend finally peaked on March 30, thereby breaking the previous highest average number 2704 recorded on December 12, 2017. Notably, this count only includes transactions that took place on the Bitcoin (BTC) blockchain. It does not include all of the transactions that were completed using second-layer payment solutions such as the Lightning Network, which is built to function somewhat independently of the Bitcoin blockchain. As a consequence of this, the actual number of transactions completed in recent times may be higher than what is recorded.

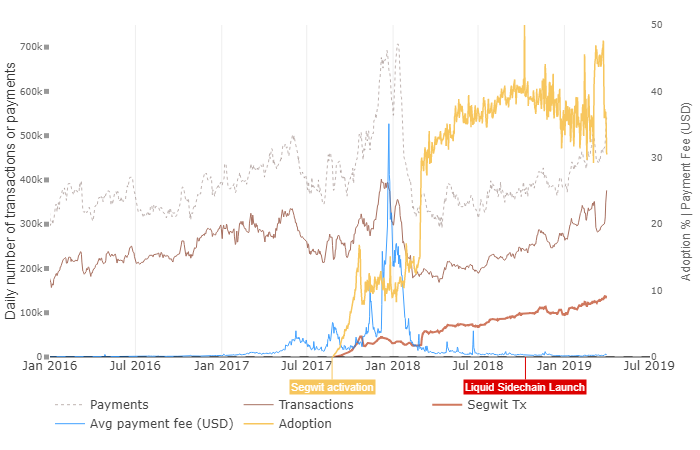

Role of SegWit and Exchanges in the Rise

The notion of Segregated Witness was first introduced by Bitcoin Core developer Pieter Wuille in 2015. On August 23, 2017, the SegWit protocol upgrade was activated on the Bitcoin blockchain. Since the size of each Bitcoin block is fixed at 1MB, there are only so many transactions that can be added to one block. The SegWit upgrade allows for removal of signature data from blocks thereby freeing up more space for transaction data. Even though the SegWit protocol was one of the preliminary solutions to Bitcoin’s scalability problem, it played a key role in increasing the average number of transactions per block. After the activation of the feature, more transactions could be added to singular blocks than ever before. A few months later, cryptocurrency exchanges also started to batch transactions before broadcasting them, which further improved efficiency. All of this has resulted in the optimum utilization of memory in each newly mined block. Do you think the future of Bitcoin development will focus around improving efficiency? Let us know in the comments below.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored