Bitcoin (BTC) price recently surged to a new all-time high (ATH) at $123,218 but faced a slight dip, trading at $117,500 today. The decline is likely owing to the anticipation surrounding the upcoming inflation data, as US CPI is expected to rise 2.7% Year-on-Year (YOY) in June.

Nevertheless, current investor behavior reflects ongoing optimism, but market conditions exhibit concern about a potential pullback.

Bitcoin Is Observing Support From the Spot Market

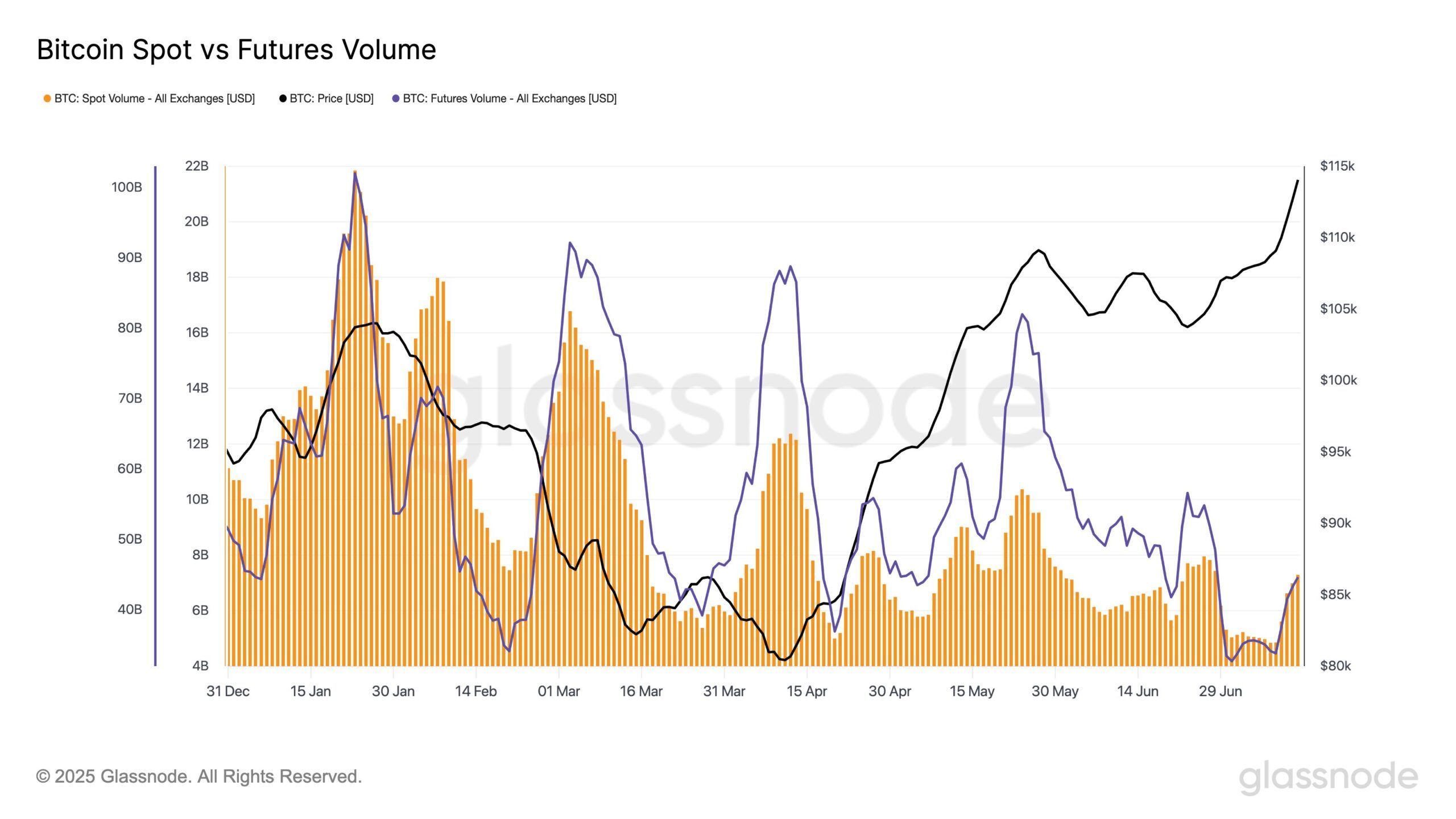

The spot volume has surged by 50% since July 9, indicating a strong interest in Bitcoin purchases. This increase is a sign that the rally isn’t solely driven by derivatives, as futures volume rose by 31.9%. These numbers point to a growing interest from spot investors, although both volumes remain below the 2025 year-to-date (YTD) averages.

The spot volume stands 23.4% under the YTD average, while futures are 21.9% under, showing that market participation is improving but remains relatively cautious compared to earlier this year.

Despite the positive uptick, investors are still hesitant. The slower volume growth, particularly in futures, shows a degree of caution from institutional and retail traders alike.

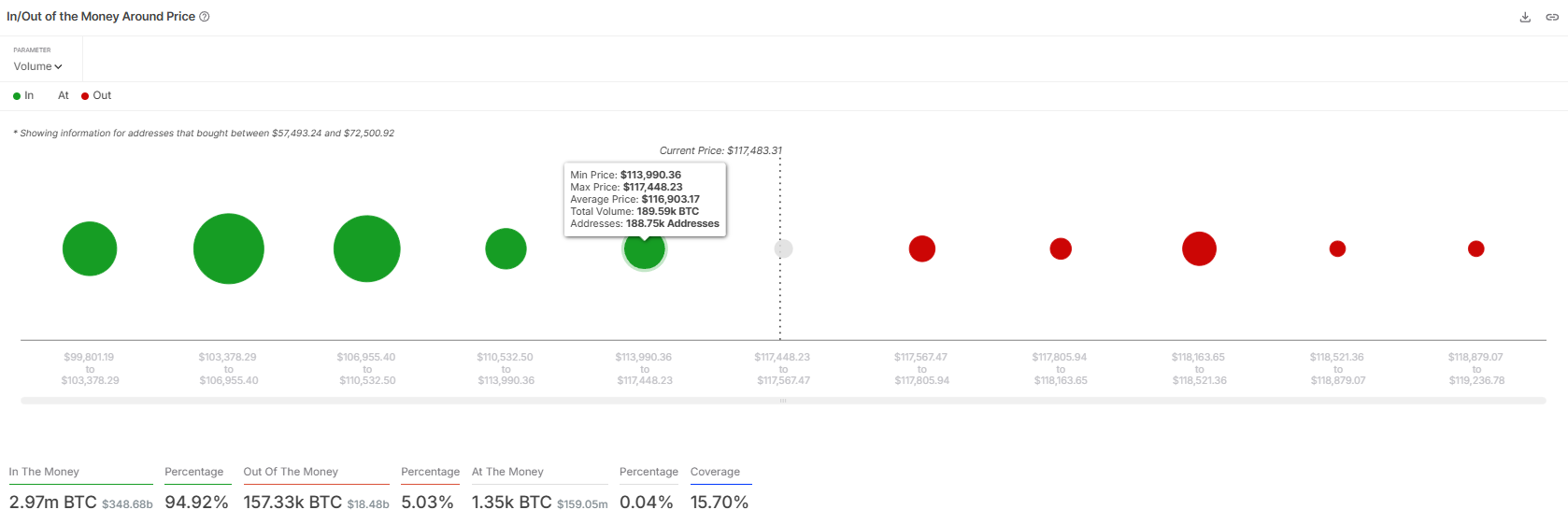

Looking at the macro momentum of Bitcoin, the IOMAP (In/Out of the Money Around Price) data reveals an important demand zone between $114,000 and $117,500. In this range, more than 189,590 BTC were bought, equating to over $22.3 billion.

This accumulation means that many holders bought at these levels and are unlikely to sell at a loss. This demand zone is crucial as it creates a cushion for Bitcoin’s price, making it less likely for the cryptocurrency to dip below this range. If the price approaches this level, it could trigger buying activity, reinforcing Bitcoin’s upward momentum and providing confidence to traders.

Can BTC Price Bounce Back?

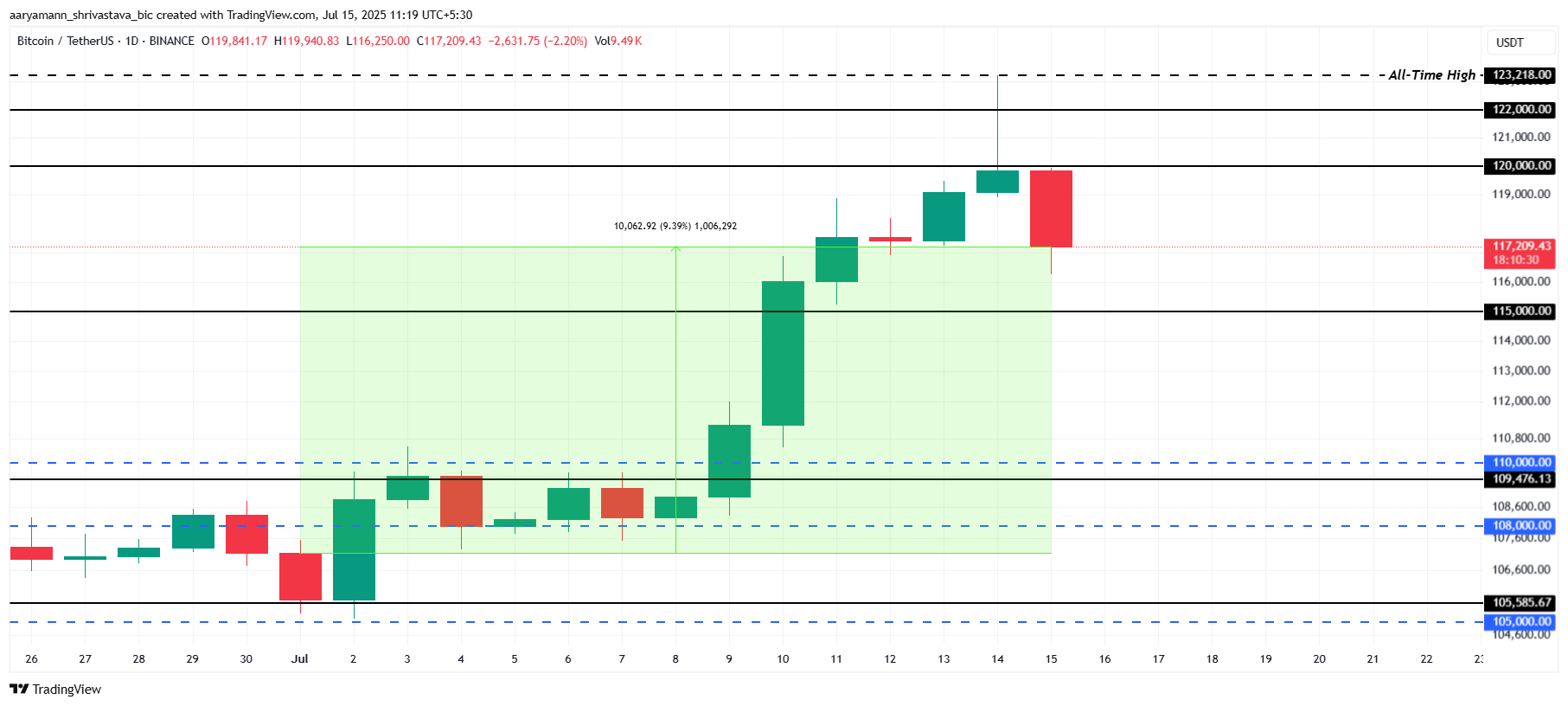

Bitcoin is currently trading at $117,209, down from its recent all-time high of $123,218. Despite this, the cryptocurrency has risen by about 9% since the start of the month.

The above-mentioned factors suggest that Bitcoin could rebound in the coming days. However, it may first drop to $115,000 before bouncing off this support level and pushing toward the $120,000 mark. This movement will likely follow the established market patterns.

However, market concerns are growing ahead of the upcoming U.S. inflation report, with expectations that the Consumer Price Index (CPI) will rise to 2.7% YoY in June, up from 2.4% YoY in May. This potential inflation increase could trigger monetary tightening, which may negatively impact risk assets like cryptocurrencies, leading to a possible dip.

As a result, Bitcoin could drop below $115,000 and even fall to $110,000. Such a decline would invalidate the current bullish thesis, suggesting a deeper market correction.