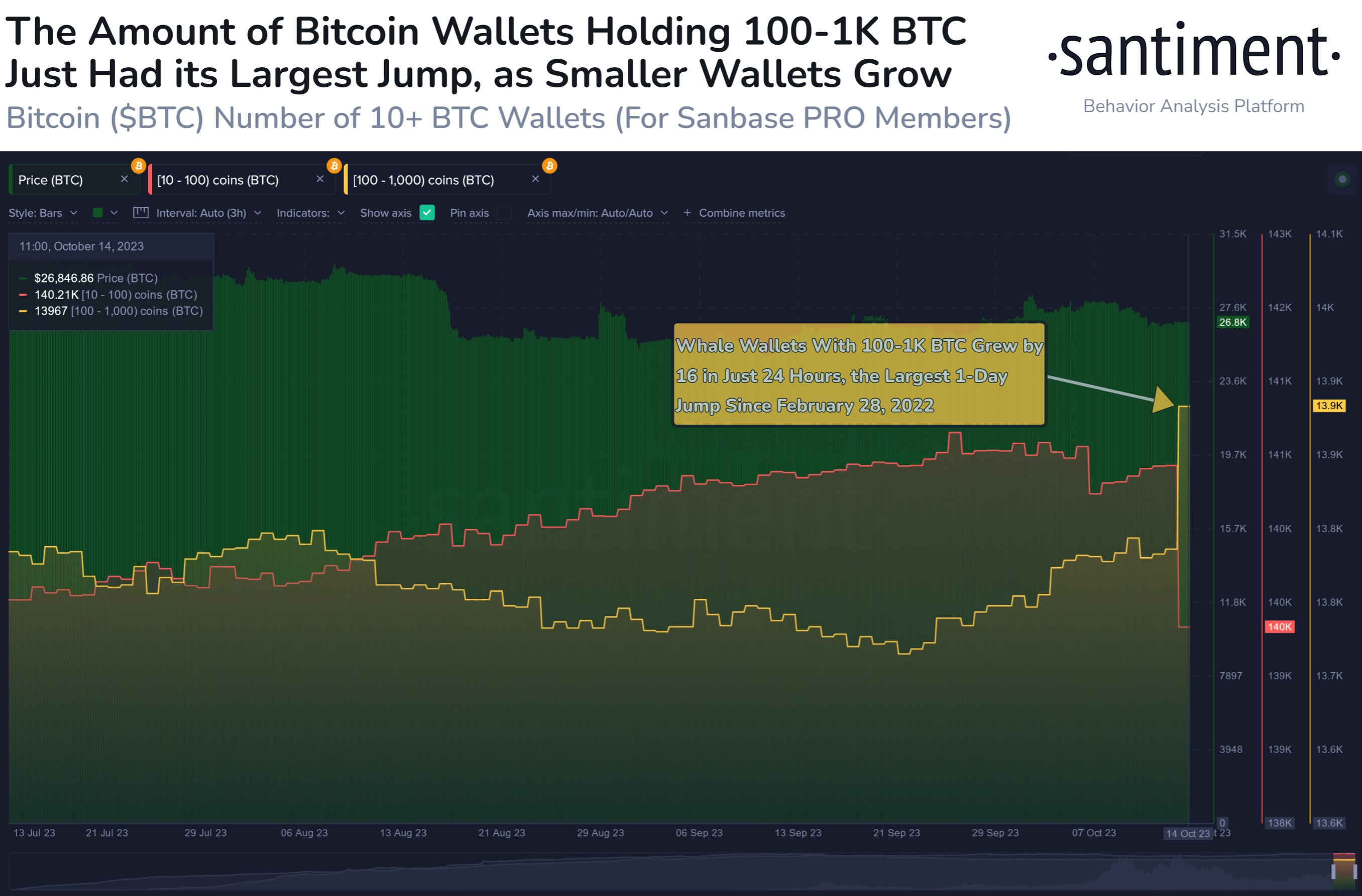

In a significant development, Bitcoin’s whale addresses have marked a notable surge, with 16 new addresses added within a 24-hour, as Santiment reported.

This surge coincides with Bitcoin’s ongoing attempt to break the crucial $27,000 resistance level.

Bitcoin Whales Number Increase

Santiment’s data highlights that this surge in whale addresses, specifically those holding between 100 to 1,000 BTC, represents the most substantial one-day increase since February 28, 2022.

With these new additions, this cohort’s total count of addresses now stands at 13,967.

However, it’s worth noting that this growth is partially due to smaller wallets progressing into the next tier. Presently, 140,210 addresses hold between 10 and 100 BTC.

Earlier, Santiment disclosed that wallets containing at least 10 BTC had witnessed a historic rise since February 2022. Since March 2022, there have been 11,806 new addresses for holdings of 10+ BTC, indicating an 8.12% growth in these retail-oriented addresses.

Concurrently, the recent uptick in Bitcoin whale addresses coincides with the long-term holders’ continued acquisition of the top digital asset. Blockchain analytical firm IntoTheBlock revealed that investors holding BTC for over one year own 69% of the asset’s supply.

BTC Price Action

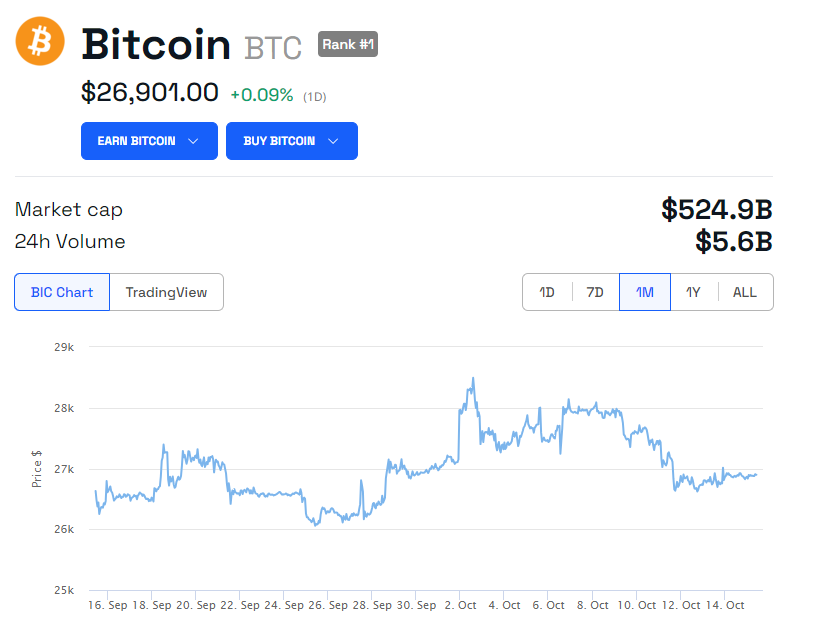

In October, Bitcoin’s price faced major challenges that pushed its value down to $26,900 from more than $28,000 recorded earlier in the month.

BeInCrypto warned that BTC risks falling to $25,000, citing the escalating tensions in the Middle East and conflicting derivatives market data. The warning was further augmented by IntoTheBlock, which reported that the market could see more selling pressure due to BTC miners’ action.

According to the firm, BTC miners sold over 20,000 BTC this week, the largest amount since April. It added:

“This suggests that miners are capitalizing on higher Bitcoin prices to offset their operational costs. While not uncommon, it can add significant sell pressure to the market.”

Despite these issues, market observers point out that BTC’s fortune would drastically improve if the U.S. Securities and Exchange Commission approved a spot exchange-traded fund (ETF).

Additionally, they note that the upcoming Bitcoin halving is bullish for the industry, citing the asset’s historical performance.

Read More: Best Crypto Sign-Up Bonuses in 2023