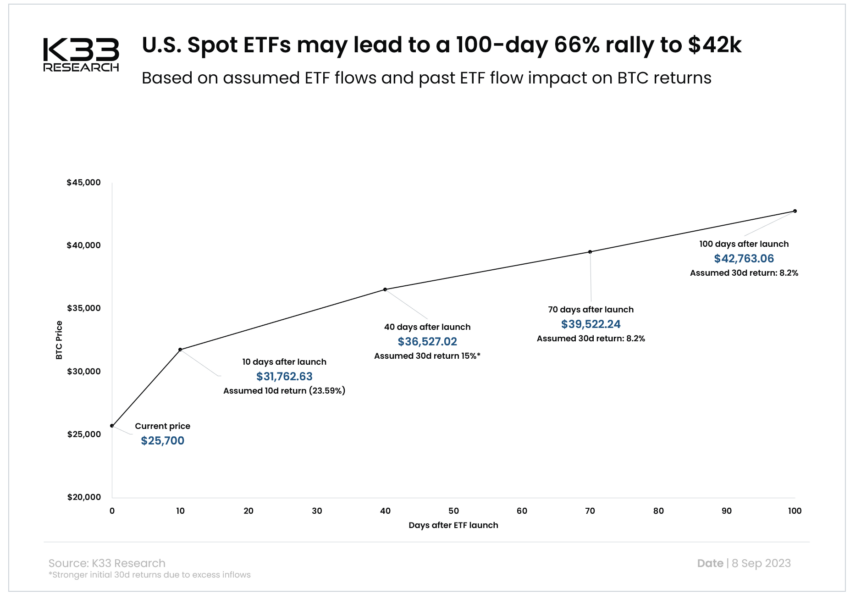

K33 Research anticipates that spot Bitcoin exchange-traded funds (ETFs) will draw over 30,000 BTC within their first 10 trading days, worth nearly $1 billion. This capital influx could elevate the price of Bitcoin beyond $42,000 within 100 days post-approval.

The prediction springs from an analysis by Vetle Lunde, a seasoned analyst at K33 Research. Lunde based his forecast on the inflow patterns observed for the ProShares Bitcoin Futures ETF (BITO) and Purpose BTC ETF (BTCC) after their debuts.

A Potential 66% Uptick in Bitcoin Price

According to K33 Research, a green light for a spot Bitcoin ETF could catalyze a 66% bull rally. Consequently, potentially propelling the price of Bitcoin toward $42,000 in the first 100 days of its sanction.

The report from K33 Research underscores the possible underestimation by the market of the profound influence a spot Bitcoin ETF approval in the US could have on the cryptocurrency market. Historical data highlights a robust link between hefty inflows and amplified upward momentum.

Read more: How to Buy Bitcoin Safely

Commenting on this, Lunde remarked:

“The market is wrong – and dramatically underestimates the impact of US BTC ETFs (and ETH futures-based ETFs)… Odds for US spot ETF approval have never been better… I expect stronger inflows than both BITO and Purpose managed in their first trading days… The past four years have seen a strong relationship between strong BTC investment vehicle inflows and appreciating BTC prices.”

It is worth noting these projections do not factor in other events that could sway Bitcoin and the crypto market.

Surge in BTC Inflows on the Horizon

Lunde opines that a nod from the US Securities and Exchange Commission (SEC) for spot Bitcoin ETFs will set the stage for a remarkable capital infusion. He foresees a combined inflow of up to 100,000 BTC into Bitcoin investment avenues both domestically and internationally within a span of four months.

Highlighting the Canadian scenario, Lunde noted that Canada’s Purpose Bitcoin ETF alone attracted an impressive 11,141 BTC. Together with other Canadian ETFs, the tally reached 58,000 BTC in the first four months post-launch.

Read more: How To Trade Bitcoin Futures and Options Like a Pro

The analyst emphasized that with its broader market scope compared to Canada, the US would witness an even more pronounced impact from the approval of spot Bitcoin ETFs.

“BITO saw inflows of 19,425 BTC in their first ten trading days. BITO launched without serious competition, securing a considerable first-mover advantage. Further, US futures-based ETFs are inferior to direct spot-based exposure due to rolling costs. This leads me to expect heightened spot ETF inflows in the US compared to BITO,” Lunde added.

Where Bitcoin Price Currently Stands

Presently, Bitcoin stands at $25,867, marking a 12.3% price dip over the past month, as per BeInCrypto data. The pioneer crypto has largely been red since the SEC postponed its verdict on seven Bitcoin ETF proposals.

Read more: 9 Best Bitcoin Exchanges and Platforms in 2023

At this rate, Bitcoin hovers around levels seen before BlackRock’s announcement and has forfeited gains spurred by Ripple’s partial triumph against the SEC and Grayscale’s favorable judgment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.