The Bitcoin market correction continues and could dip a fair bit lower, according to data from on-chain analysis firm Glassnode.

In its ‘Week on Chain’ report released on May 1, Glassnode revealed the extent that the market correction could go if it continues.

Bitcoin On-Chain Metrics

Bitcoin has already corrected 10% from its 2023 high of just below $31,000 in mid-April. However, markets could drop much further from current prices of around $28,000.

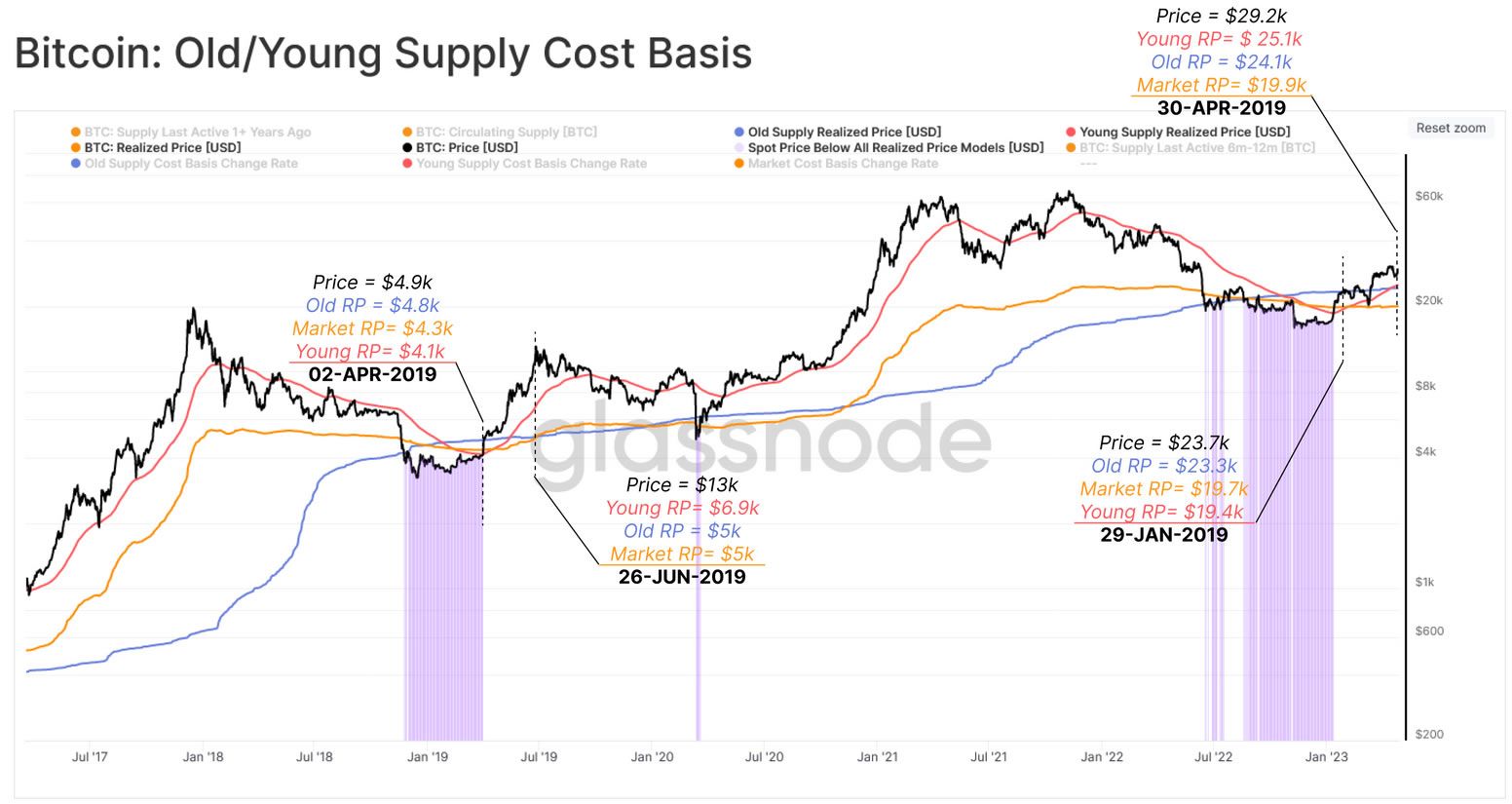

The blockchain analytics firm looked into the concept of ‘Old/Young’ wealth redistribution through up-cycles. It used these metrics to gauge demand in the market.

The report concluded that new investors influence the market, largely driven by their unrealized and realized profit performance. Furthermore, sell pressure by new investors was a “key driving force that established resistance at $30,000,” it said before adding.

“Should this present correction resume, the cost basis of the young supply holders at $24.4k may well be a psychological level to monitor in the weeks ahead.”

Correction Deepens

Glassnode classifies ‘Young supply’ as coins held for less than six months and ‘Old supply’ as those held for longer.

The monthly net position change of young supply indicated that selling pressure had reached a stable rate of 250,000 BTC per month.

It said the patterns looked similar to the 2019 uptrend, which had a long ‘equilibrium period’ before the 2021 bull market. This suggests that markets could trend sideways for much of the rest of this year following their correction.

Furthermore, the transfer of USD-denominated wealth into the Young supply region has increased. However, it remains ‘remarkably low’ and hasn’t reached previous bull market thresholds.

“This suggests that new demand inflows remain relatively soft, but the supply remains predominantly held by longer-term, higher conviction holders.”

The Young supply and new investors are primary forces in a bull market uptrend. Nevertheless, the current on-chain situation suggests that their appetite is waning.

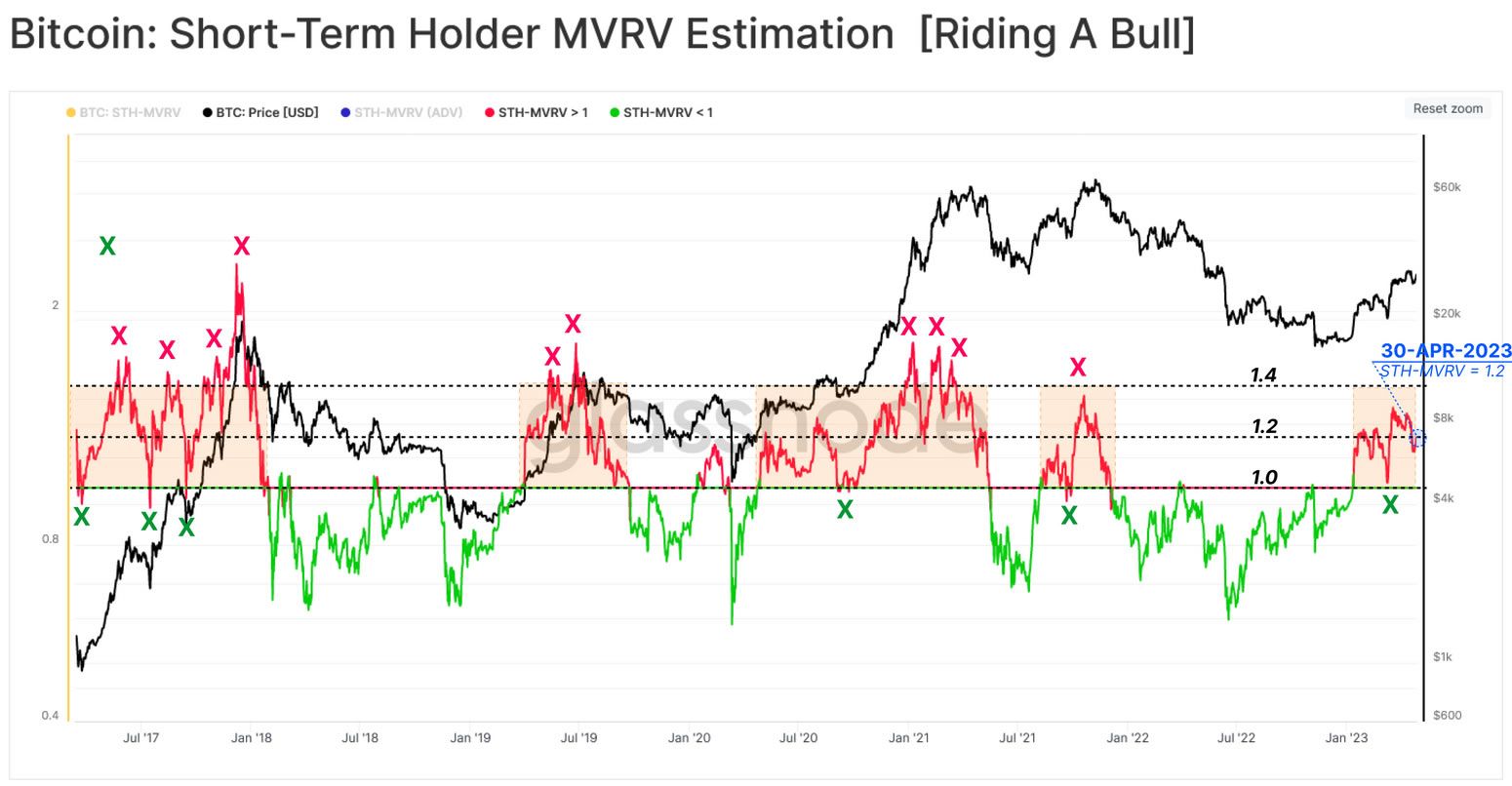

Glassnode also analyzed the MVRV (market-value-to-realized-value) ratio, which measures market capitalization versus realized capitalization. In other words, the ratio between the spot price and the on-chain cost basis.

The metric was also signaling that the $30,000 level resistance had an MVRV ratio of 1.33. A return to the break-even value of 1 would see a correction to $24,400, which serves as support.

BTC Price Outlook

Bitcoin price has retreated 2% on the day to just below $28,000 at the time of writing. BTC hit an intraday and weekly low of $27,722 during the morning Asian trading session.

The next immediate level of support is around $27,400 should current levels break down. On-chain metrics suggest that this correction is not over yet.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.