America’s oldest bank, BNY Mellon, published a report on bitcoin earlier this week. The report discusses bitcoin’s role as digital gold, among other things.

BNY Mellon, America’s oldest bank, published a report earlier this week, offering some commentary on the price of bitcoin as well as its long-term prospects.

While it stopped short of offering an exact prediction, it did provide some optimistic analysis of Bitcoin’s place in the global market.

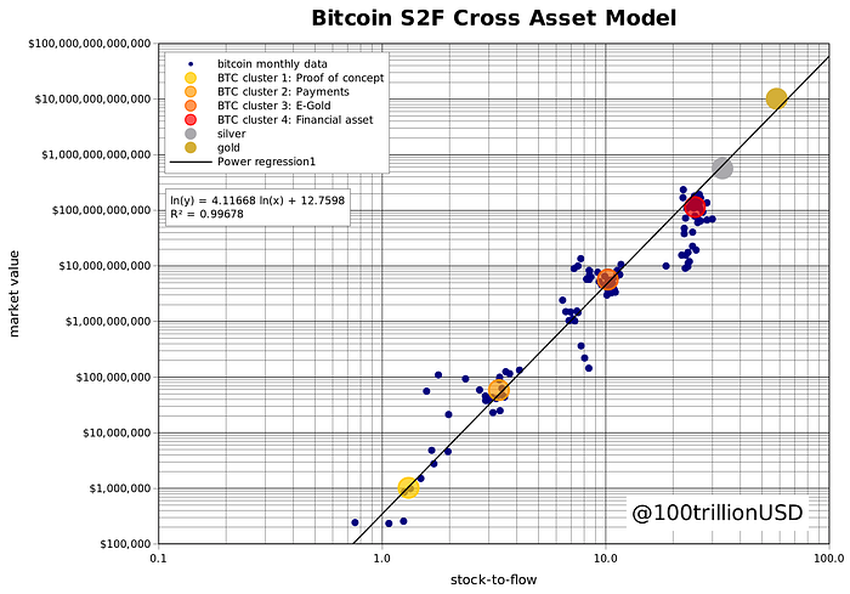

The bank’s analysis refers to the popular stock-to-flow model cross-asset model (S2FX), which predicts that Bitcoin will reach $100,000 by the end of 2021.

Bitcoin’s current all-time high is approximately $62,000. It’s current price of $58,000 is still impressive, marking a near 100% hike in value since the start of 2021.

Additionally, the report compared Bitcoin to gold, which is another popular narrative that seems to be holding its ground. Multiple companies and firms have turned to Bitcoin as they fear that cash and gold would be bad assets to hold reserves in. Microstrategy was among the first to get into the market for this reason. Since then, many others have joined in.

Various research papers have made good cases that Bitcoin does have an intrinsic value and models were formalized using pricing based on its marginal cost of production.

It also notes that the public is questioning the “intrinsic value” of fiat currencies, which has led to the consideration of alternatives like bitcoin. It goes on to say that “bitcoin valuation will likely be a combination of several models and be constantly evolving.”

Despite no price prediction, it’s still quite a positive endorsement of the asset. The bank also states that valuation is “more art than science” and that every model has its pros and cons.

BNY Mellon Joins Others in Considering Bitcoin

BNY Mellon isn’t the first bank to discuss bitcoin. Others, like JPMorgan Chase and Citibank, have gone much further and even offered price targets above $100,000.

Bitcoin was once the target of mockery from banks, but this has changed in the past two or so years. Many banks that once called bitcoin worthless have now offered related services or have called it digital gold. This, if anything, is a sign that the asset is hitting the mainstream.

The arrival of institutional investors and services also lends legitimacy to bitcoin’s role as a distinct asset. This is setting the scene for cryptocurrency’s broader role, as countries work out the kinks of regulation.