On Nov 19, the activity on the Bitcoin (BTC) blockchain intensified as the cryptocurrency markets dip, causing a significant backlog of transactions to appear.

The first and most popular cryptocurrency is once again appears to be facing a similar scaling issue to that which it encountered last year — though not yet as extreme.

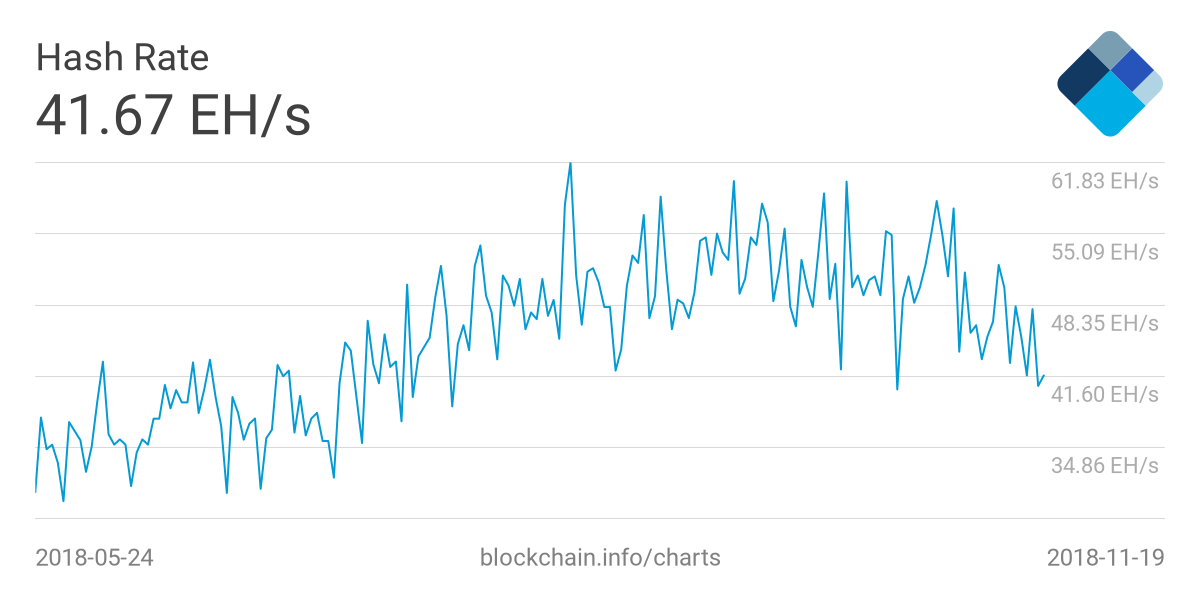

Alongside the increase of transactions, Bitcoin’s total hash-rate is lowered as well. The combination has caused a temporarily stalled block production time. While difficult to confirm, it may be possible that BTC miners have switched over to Bitcoin Cash (BCH) in an effort to leverage the fork as much as possible.

Bitcoin’s blockchain has internal systems to regulate lowered hash rate, but it will take some time for network difficulty to stabilize. In the meantime, you can expect that confirmations on your transactions will take longer than average.

Users on Twitter trying to transact in this period have voiced their frustrations with the overwhelming amount of time they have had to wait in order to get their transactions through.

Bitcoin’s blockchain has internal systems to regulate lowered hash rate, but it will take some time for network difficulty to stabilize. In the meantime, you can expect that confirmations on your transactions will take longer than average.

Users on Twitter trying to transact in this period have voiced their frustrations with the overwhelming amount of time they have had to wait in order to get their transactions through.

https://twitter.com/rippleXRPmoon/status/1064586963494277120So much for 'fast' and 'cheap' transactions through #Bitcoin $BTC. I've been waiting for 3 hours and still 0 confirmations. #crypto

— Michael Kenneth (@hattrick_mk) November 19, 2018

The Return of the Transaction Fee ‘Marketplace’

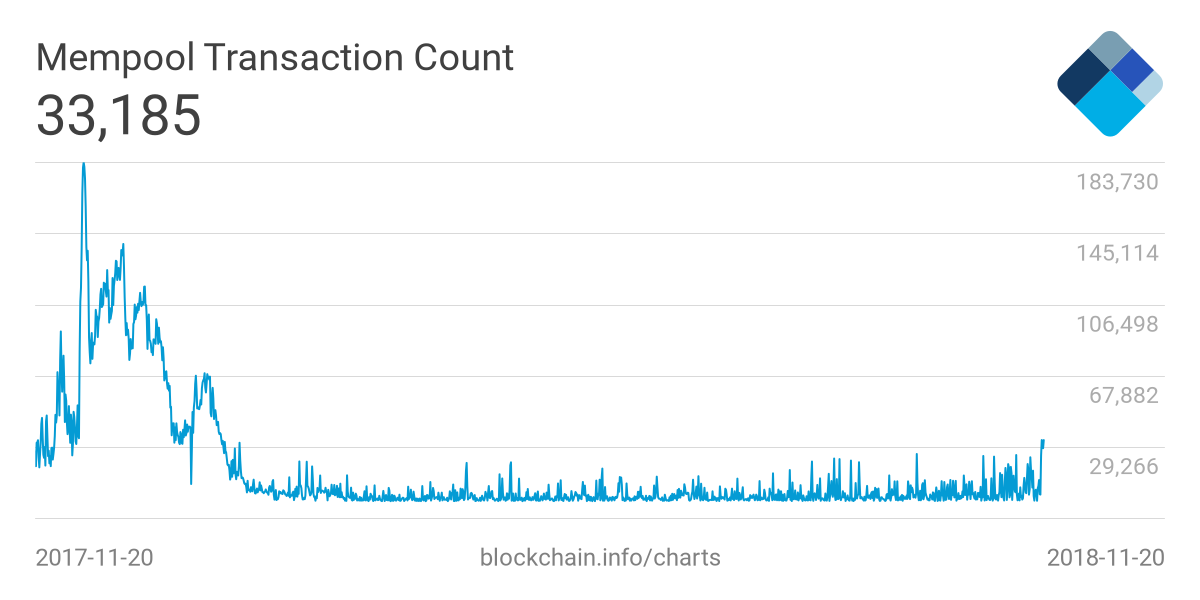

[bctt tweet=”There is something that you can do to make sure that your transaction is among the first in a new block.” username=”beincrypto”] Simply increase the transaction fee that you pay when making the transaction. As long as no competitors make higher ‘bids,’ your transaction will be in the next block. This phenomenon is at the heart of the Bitcoin scalability issue, where miners are able to generate tremendous amounts of income through transaction fees alone. Last year’s crypto rally meant that a lot of transactions took place. The transaction backlog caused the fee to rise up to $40 for a normal transaction. This can happen again, especially considering that the transaction volume is picking up at a similar time when compared to last year. Have a look at the graph below: On the left side, you can see the massive amount of transactions in the memory pool — which is where the network keeps the transactions before confirmation). On the right side, we can barely see the onset of what is potentially a new wave.

Does this mean another rally is in store for Bitcoin? Do you think an increase in transaction volume can be considered a signal for a price rally? Do you think that BCH would be better equipped to deal with this situation? What will the price of BTC be on New Year’s Eve? Speculate away in the comment section below!

On the left side, you can see the massive amount of transactions in the memory pool — which is where the network keeps the transactions before confirmation). On the right side, we can barely see the onset of what is potentially a new wave.

Does this mean another rally is in store for Bitcoin? Do you think an increase in transaction volume can be considered a signal for a price rally? Do you think that BCH would be better equipped to deal with this situation? What will the price of BTC be on New Year’s Eve? Speculate away in the comment section below!

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Zoran Spirkovski

Zoran Spirkovski is a freelance journalist, brand strategist, and author published by CryptoBriefing, BeInCrypto, CryptoNewsNet, and NewsBlockchain. He writes about blockchain technology, cryptocurrency, branding, marketing, and productivity, and other stories that brew up in his mind.

He writes a daily blog about the same topics at zoransp.medium.com and he regularly contributes to freelance discussion groups.

Zoran Spirkovski is a freelance journalist, brand strategist, and author published by CryptoBriefing, BeInCrypto, CryptoNewsNet, and NewsBlockchain. He writes about blockchain technology, cryptocurrency, branding, marketing, and productivity, and other stories that brew up in his mind.

He writes a daily blog about the same topics at zoransp.medium.com and he regularly contributes to freelance discussion groups.

READ FULL BIO

Sponsored

Sponsored