In recent trading, Bitcoin short sales have neared an all-time high, leading to substantial speculation of a potential for either greater losses or a short squeeze, depending on market movements.

A short sale is a bet that the value of any given asset or commodity will reduce in the near term. Short sellers borrow an asset from a broker and sell that asset on margin, hoping to rebuy the asset at a lower price — returning it to the broker and pocketing the difference in lost funds.

However, should the price of the asset increase during the time that the asset is loaned, the trader is forced to rebuy the asset at an increased value, ‘squeezing’ his margin account and forcing him to sell other positions in order to cover those losses.

This process compounds as the price continues to rise with the increased buying, leading to what traders call a ‘short squeeze’. Short sellers are forced to purchase greater numbers of an asset to simply cover their loss positions from previous asset loans.

Low prices, market pops, and shorts — oh my!

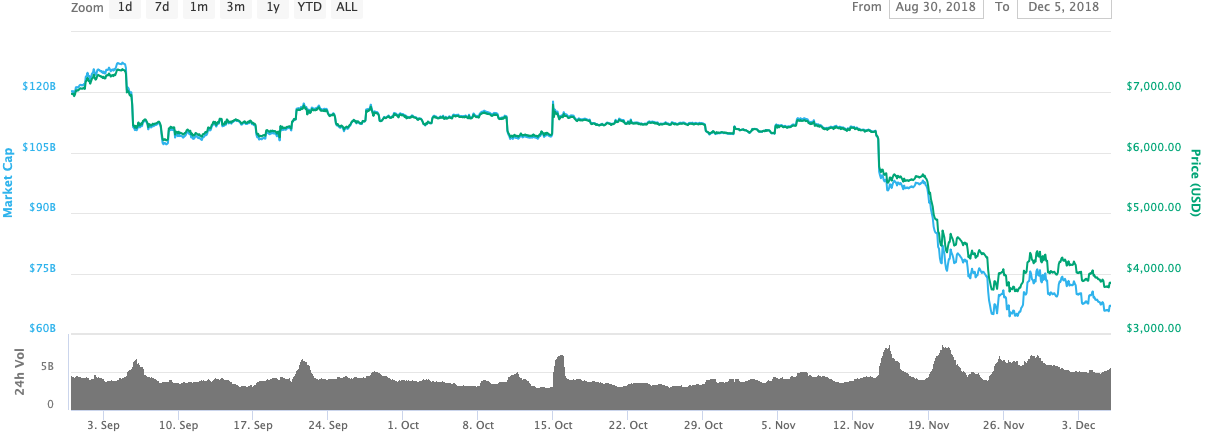

In the Bitcoin world, this activity allows short sellers to move bitcoins in and out of the market, pocketing the difference on the sales as the market has reduced, particularly over the past year’s bear market. The highest levels of short sellers have been in April, August, and September of this year. However, in recent trading, the market has begun to move heavily toward short sellers again. While this could be a harbinger of greater levels of loss, it could also spell a potential short squeeze, should the market rebound from the current 12-month lows.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored