Investors in traditional markets, such as the Nasdaq, will often reason that the digital asset and cryptocurrency market is too risky because of its high levels of volatility.

While statistically in the past this has been often true, the market environment lately has been a bit different.

Flip-Flopped

Skeptics of cryptocurrency love to use examples of the previously high levels of volatility in the market as reasons to keep away or to gloat that the cryptocurrency bubble has finally burst.

In fact, quite the opposite has been true as of late.

Looking at the Nasdaq Composite Index can help us get a better idea of the price movement in more than 3,000 companies, most of which deal in the technology sector.

Technology stocks in the Nasdaq Index have been on a near ten-year bull run, beginning in the aftermath of the 2008 housing crisis that brought the Index down to the 1,200 point level, up until the end of August this year, when it reached a new all-time high of 7,600.

Between the beginning of September and the time of writing, the Index has corrected 11 percent back to the 6,800 point level.

The Good Guys

All signs are pointing to a bubble burst and impending correction in the technology markets, and it has been interesting to see Bitcoin and the majority of the cryptocurrency market holding steady.

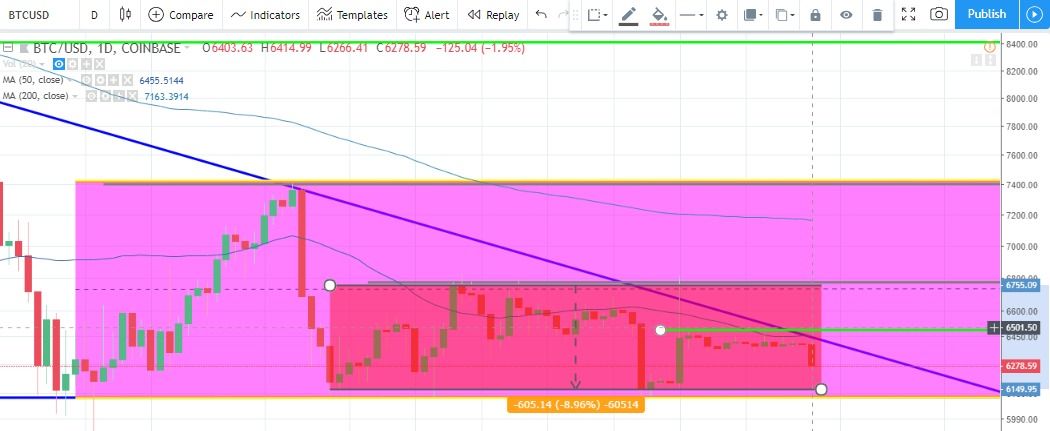

Bitcoin has been especially stable recently, trading in a $600 range since the first week of September, and trading in an even tighter range of $370 throughout October.

The total market cap of the cryptocurrency market has also remained fairly even, totaling between $220 billion and $196 billion so far in October.

This could potentially be the beginning of a shift in which many investors in the traditional technology markets move a portion of their funds away from faltering tech stocks and into the digital asset space.

Do you think the stock market will continue its pullback in Q4 2018? Will Bitcoin continue on a stable path moving into 2019? Let us know your thoughts in the comments below!