Bitcoin is currently at a pivotal juncture, raising questions about its true state in the financial system. Recent data reveals a complex picture, characterized by increased selling activity and shifting ownership patterns.

This analysis delves into why, despite some bullish signals, Bitcoin has yet to fully embrace a genuine bull market phase.

The Real ‘Bitcoin Bull Market’ Hasn’t Begun

According to blockchain analytics firm IntoTheBlock, Bitcoin has seen a sixth consecutive week of inflows into centralized exchanges (CEXs). Nearly $2 billion in net deposits have been recorded since December. This trend is commonly interpreted as a signal of increased BTC selling activity.

Delving deeper, it appears that Bitcoin ownership is shifting. Indeed, the average holding time of transacted Bitcoin coins hit a record high recently. This trend suggests that long-standing holders are beginning to move their assets, decreasing Bitcoin holdings.

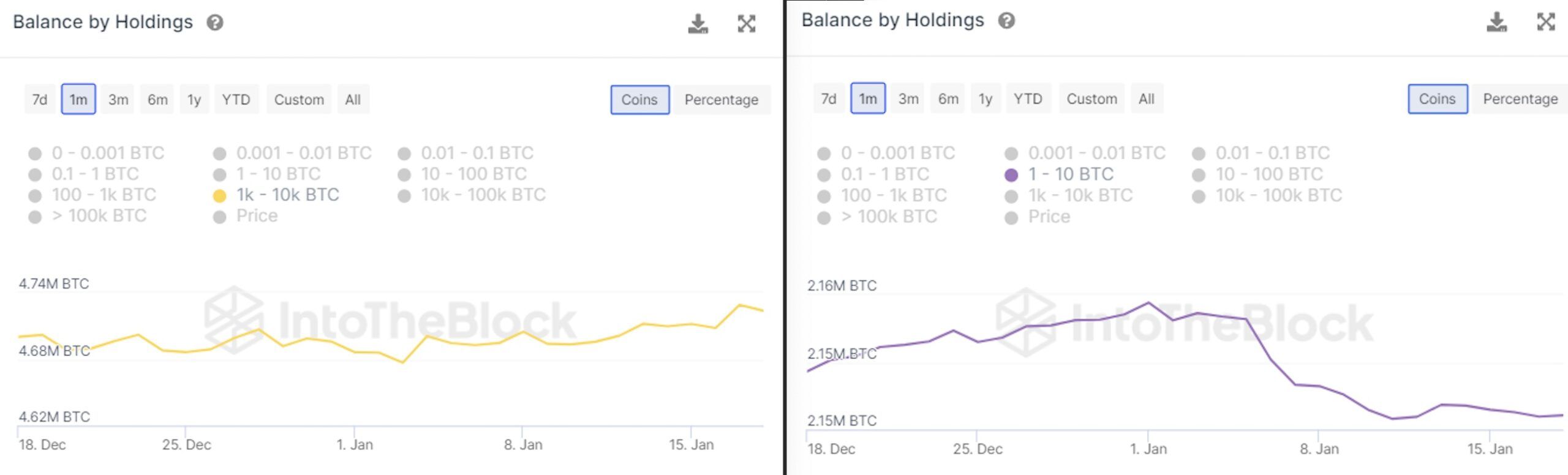

Interestingly, addresses holding over 1,000 BTC have increased their holdings, while those with fewer than 1,000 BTC have decreased theirs in January. On the other hand, the balance held by short-term holders has been on the rise since October 2023, a trend typically associated with bull markets.

Still, the current market scenario does not mirror the typical characteristics of previous tops, according to IntoTheBlock.

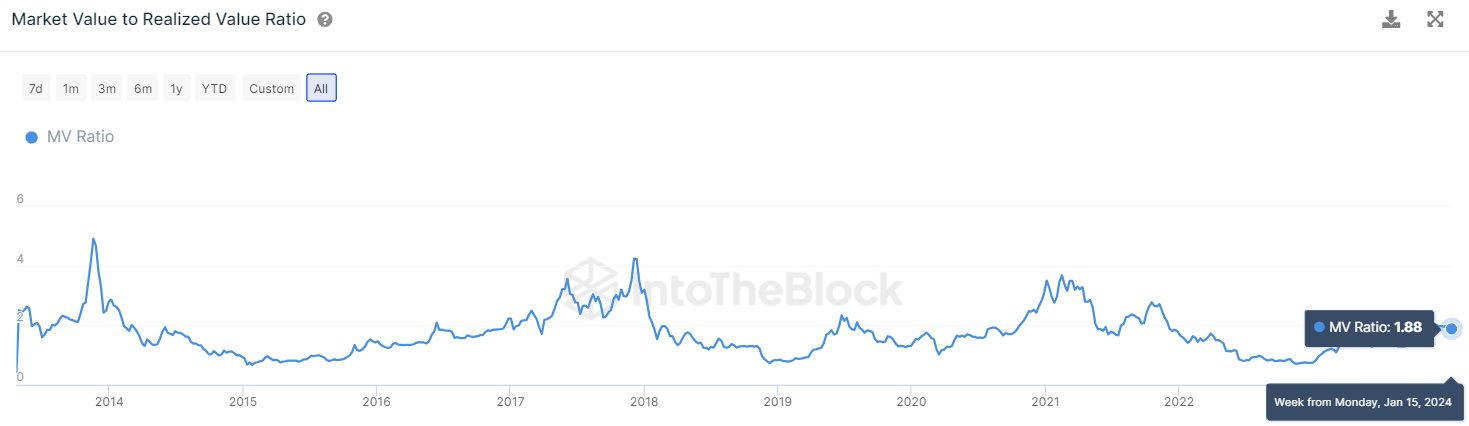

“A lack of volume compared to previous bull markets, a limited decrease in long-term holders’ balance, and a very modest MVRV ratio of 1.88, imply that Bitcoin is most likely suffering a temporary setback and is yet to enter the real bull-market territory,” analyst at IntoTheBlock said.

Read more: Who Owns the Most Bitcoin in 2024?

Juan Pellicer, senior researcher at IntoTheBlock, told BeInCrypto about the need for caution in interpreting these trends. He pointed out that Bitcoin has not undergone a significant pullback in six months.

Such a trend may indicate that the recent downward movement could be a natural market correction.

“Until we’ve seen things like the consistent distribution of assets from long-term holders to short-term holders, MVRV ratios of more than 2.5, and a significant spike in transactions and volume, it is too early to call the end of the bull market,” Pellicer said.

This nuanced understanding of the current market dynamics underlines the importance of thorough analysis in the cryptocurrency market.