The Bitcoin price pumped hard on Wednesday, reaching a local high of more than $9,400 on some exchanges. The price move is among Bitcoin’s largest ever single-day upswings by dollar value.

There have been a total of 14 days before now that saw the Bitcoin price gain more than $1,000 in just 24 hours. However, a look into history shows that such moves might not be as bullish as one may presume.

BTC at the Races: Historic Price Moves Lead into Month of Bitcoin Halving

Bitcoin is no stranger to volatility. In its 11-year history, the leading cryptocurrency has seen many price swings, both up and down, that make all but the most extreme moves on Wall Street look tame. Wednesday was one such day. At around 08:00 GMT, BTC traded close to $7,900. Just 24 hours later, it set a local top of more than $9,400. Typically, as BeInCrypto reported, the volatility coincided with a major cryptocurrency exchange dropping services — much to the chagrin of traders. Leading into the month of the third Bitcoin halving, such price moves might seem bullish at first glance. However, history suggests that Bitcoin’s more violent upswings tend to precede losses.What Goes Up…

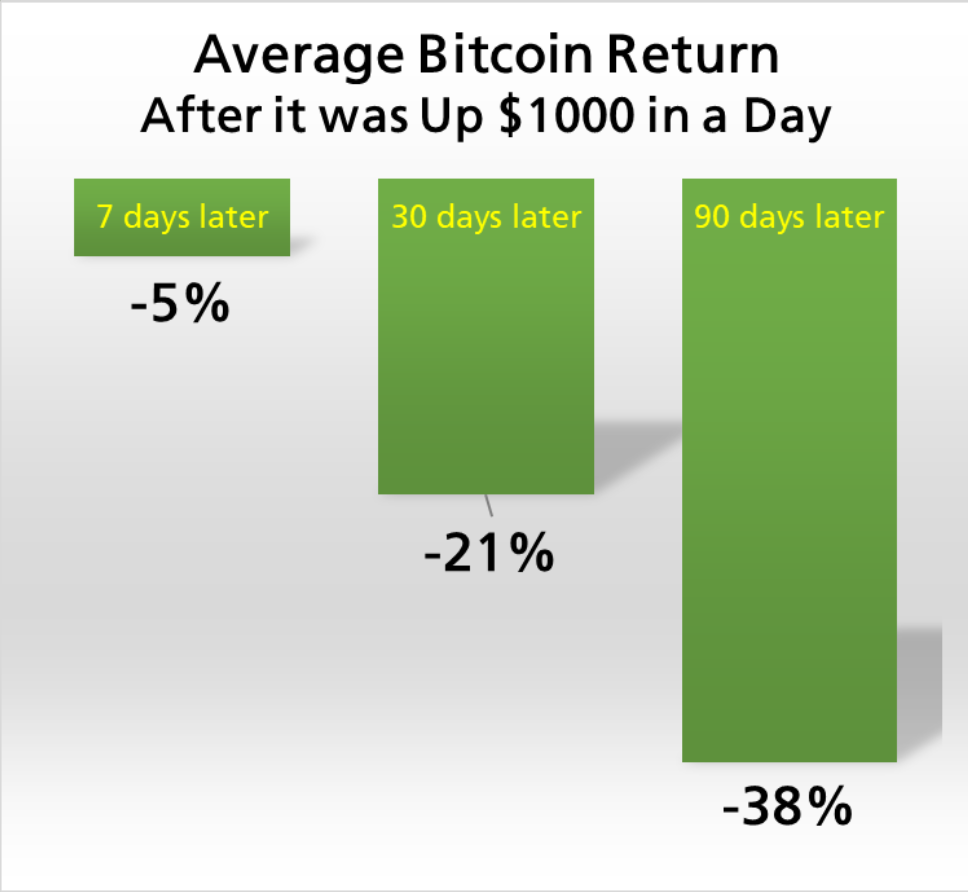

As Timothy Peterson, CFA at Cane Island Alternative Advisors, pointed out via Twitter, there have only been 13 other occasions that saw the BTC price gain by more than $1,000 in a single 24-hour session. On average, substantial losses have occurred in the weeks and months that follow. A graphic posted alongside Peterson’s tweet shows the average one-week, one-month, and three-month returns after Bitcoin’s four-figure, single-day increases. The seven days, 30 days, and 90 days following one of these bumper days of gains sees losses of 5, 21, and 38 percent, respectively.

However, in the days and weeks to follow, the price would shed most of its gains, arriving at its yearly low of around $6,600, exactly two years after Bitcoin reached its all-time high, that December.

Although such major price moves have more often than not preceded losses, some responding to Peterson disagree that the $1,000 day is the right way to go about categorizing Bitcoin’s largest ever gains. After all, a $1,000 move between $6,000 and $7,000 is far more significant than one between $16,000 and $17,000.

Many observers argued that percentage gains are the only real way to identify Bitcoin’s largest price moves. The trend described by Peterson is less pronounced using this alternative data.

However, in the days and weeks to follow, the price would shed most of its gains, arriving at its yearly low of around $6,600, exactly two years after Bitcoin reached its all-time high, that December.

Although such major price moves have more often than not preceded losses, some responding to Peterson disagree that the $1,000 day is the right way to go about categorizing Bitcoin’s largest ever gains. After all, a $1,000 move between $6,000 and $7,000 is far more significant than one between $16,000 and $17,000.

Many observers argued that percentage gains are the only real way to identify Bitcoin’s largest price moves. The trend described by Peterson is less pronounced using this alternative data.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rick D.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

A former professional gambler, Rick first found Bitcoin in 2013 whilst researching alternative payment methods to use at online casinos. After transitioning to writing full-time in 2016, he put a growing passion for Bitcoin to work for him. He has since written for a number of digital asset publications.

READ FULL BIO

Sponsored

Sponsored