Are weaker Bitcoin mining hands capitulating post-halving?

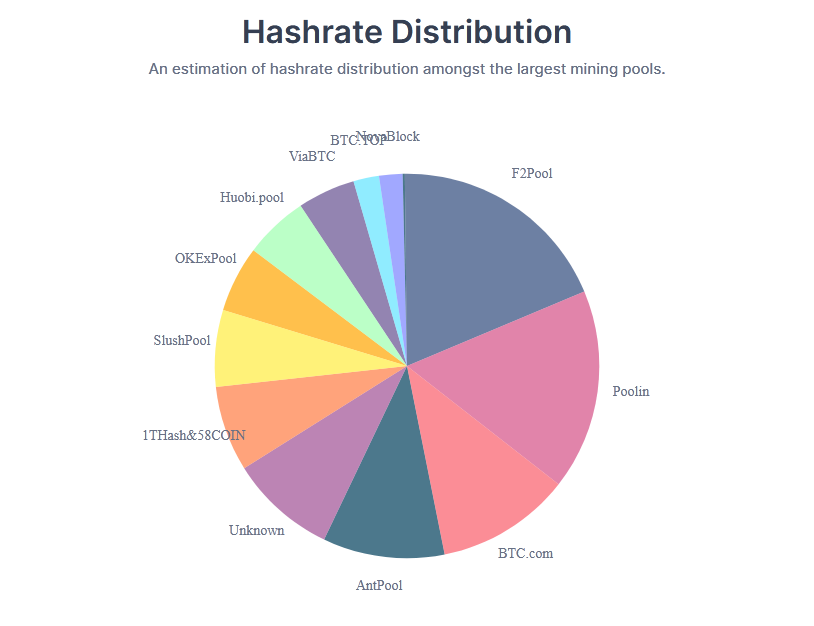

Recent sharp declines in the Bitcoin (BTC) price appear to coincide with massive ‘coin’ dumping from unknown mining pools. If anything, the May 2020 halving may quite literally be emptying the wallets of unprofitable Bitcoin miners worldwide.

Tweeting on Tuesday, Ki Young Ju, CEO of on-chain crypto analytics platform CryptoQuant, revealed the apparent relationship between the BTC spot price and mining pool wallet outflows:

According to data from CryptoQuant, the major Bitcoin price declines on May 20 and June 2 correspond with significant outflows from unknown miners. On May 20, Bitcoin fell by over $700, posting a 7% loss in a little over 24 hours. As previously reported here on BeInCrypto, the flagship cryptocurrency plunged below $10,000 on Tuesday, shedding more than $1,000 in the process. Reports indicate that inefficient miners are offloading their BTC hoard following the block reward halving. Last week, miners sold 673 more Bitcoin than they generated. It’s a likely sign that a shakeout of weaker mining hands is already underway.Significant outflows from the unknown miner before the dip. They're CAPITULATING.https://t.co/WVdBy1t17E pic.twitter.com/1LQeLYpY6X

— Ki Young Ju 주기영 (@ki_young_ju) June 2, 2020

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored