Chinese Bitcoin miners are experiencing difficulties in paying their electricity bills as law enforcement engages in major card freezing operations.

From supply chain disruptions caused by the coronavirus lockdowns to excessive flooding during the Sichuan monsoon season, Bitcoin (BTC) miners in China are enduring a challenging 2020.

74% of Chinese Bitcoin Miners Struggling with Electricity Payments

According to the Chinese crypto news source, @WuBlockchain, about 74% of Bitcoin miners in a recent survey reported difficulties in paying for electricity. Tweeting on Nov. 16, Wu Blockchain revealed that card freezing measures are severely limiting bill payment options for miners. Since the start of 2020, China’s government has gone on the offensive against money laundering with law enforcement specifically targeting the telecoms and crypto industry. As previously reported by BeInCrypto, Chinese police detained Star Xu (Xu Mingxing), co-founder of OKEx as part of a broader financial crime clampdown. The government’s action has resulted in a widespread freeze on card payments. According to reports on the Chinese social media platform WeChat, banks are freezing cards associated with crypto transactions. Thus, Chinese miners are facing difficulties in liquidating their mined BTC and other cryptos for local currency. With limited access to the yuan, Bitcoin miners in China are increasingly becoming unable to pay for electricity. The card freezes and subsequent logistical headaches may cause miners to migrate to other countries. With the block reward halved back in May, operational efficiency is driving the hash rate war now more than ever.Challenging China’s Hash Rate Dominance

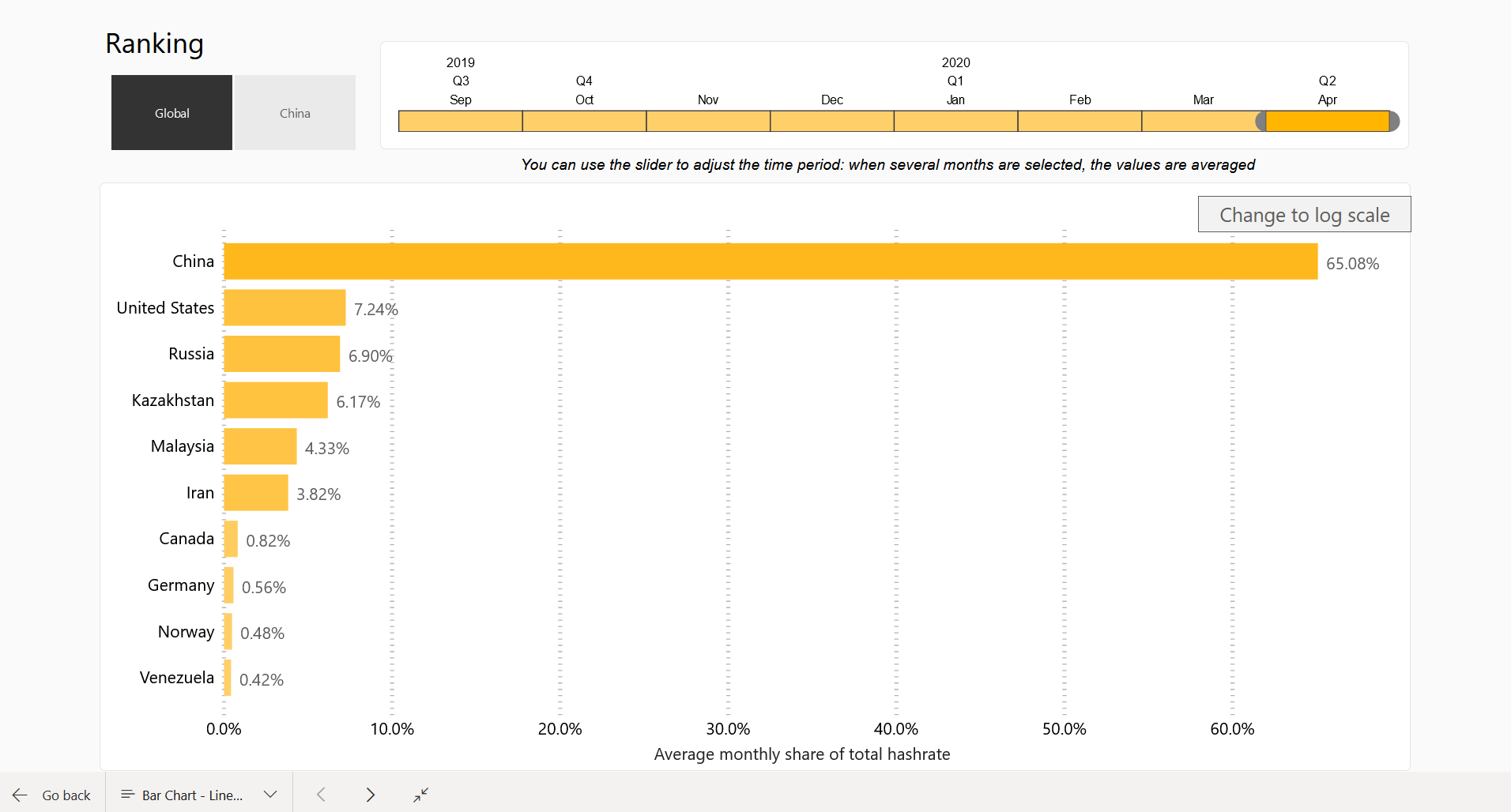

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), China accounts for about 65% of the total global hash rate distribution. A significant miner migration from China could see the US, Russia, and Kazakhstan control a greater share of the worldwide Bitcoin mining hash rate map.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Osato Avan-Nomayo

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

Osato is a reporter at BeInCrypto and Bitcoin believer based in Lagos, Nigeria. When not immersed in the daily happenings in the crypto scene, he can be found watching historical documentaries or trying to beat his Scrabble high score.

READ FULL BIO

Sponsored

Sponsored