Despite experiencing a significant drop from its all-time highs, major Bitcoin mining company Marathon Digital has undergone a substantial uptrend in its stock price over the past twelve months.

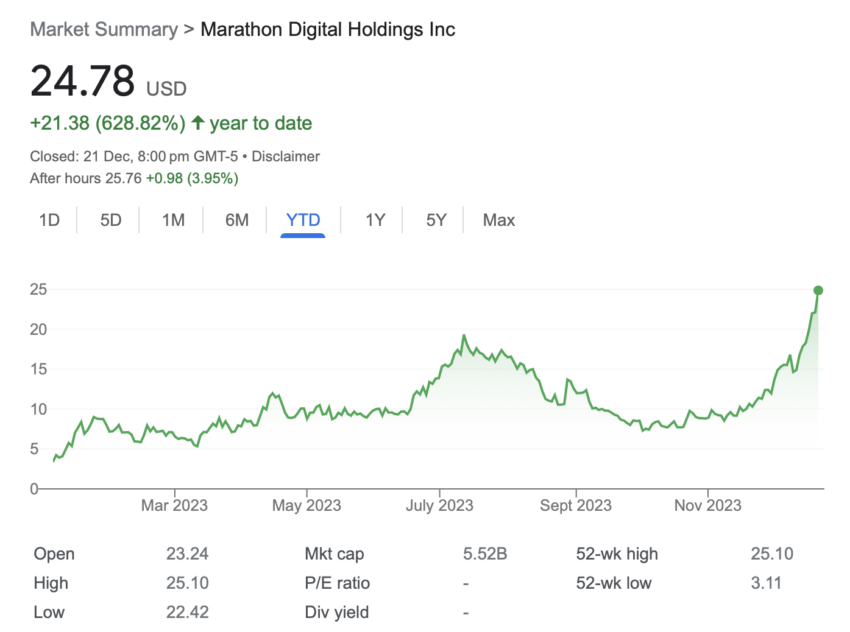

The current price of Marathon Digital Holdings (MARA) sits at $24.78, marking a decrease of approximately 6.69 times from its all-time high of $166.40.

Bitcoin Mining Company Marathon Digital Records Significant Growth

Marathon Digital’s stock has surged by 628.82% since January 1. Its current price stands at $24.78 as of the time of publication.

However, it reached an all-time high of around $166.40.

The rise coincides with two significant events fueling speculation about Bitcoin’s future price.

Numerous ETF analysts anticipate potential approval of the spot Bitcoin ETF by the US Securities and Exchange Commission (SEC) by January 10. This approval could lead to a substantial influx of capital. Additionally, especially if major players like BlackRock and Grayscale are granted permission to offer it to their customers.

On the other hand, the Bitcoin halving, which occurs approximately every four years. This has historically triggered price surges as the rate of new Bitcoin issuances decreases by 50%.

Read more: How To Earn Free Bitcoin Mining Income Without Investment

Marathon Digital Expands in Recent Times

This comes after recent reports that Marathon Digital has recently announced a significant move towards increasing its operational capacity.

Marathon entered into a purchase agreement to acquire two operational Bitcoin mining sites, amounting to 390 megawatts of capacity. BeInCrypto reported that the deal, valued at $178.6 million, marks Marathon’s transition from an asset-light organization to one managing a diversified portfolio of Bitcoin mining operations.

However, earlier reports documented the impact of record hot temperatures on Marathon’s output.

On September 6, BeInCrypto reported that Marathon attributed the decline in Bitcoin mining productivity in August to severe weather conditions.

“The decrease in bitcoin production from July was largely due to increased curtailment activity in Texas due to record high temperatures,” the statement noted.

Read more: How To Mine Cryptocurrency: A Step-by-Step Guid

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.