Bitcoin hits a new record high price of $66,000 as the first U.S. bitcoin futures-based exchange-traded fund (ETF) launched on Tuesday in New York.

This would make it more valuable than Facebook, the 5th largest US-listed company, in terms of market cap. The launch has been taken as a sign that cryptocurrencies have entered the mainstream financial market on Wall Street. Now investors can easily invest in Bitcoin indirectly through their existing stock accounts.

Also, as the ETF received US financial regulatory approval, this signals to investors that the government will not crack down on cryptocurrencies. This could be just the start of a long-awaited bull run for the King of cryptocurrencies.

Looking back, BTC has been associated with price volatility because of its very technical nature, few understood the digital asset, and wall street remained critical. In 2014, a cryptocurrency Tether (USDT) was launched which was pegged to the US dollar and claimed to be backed 1:1.

Today, stablecoins account for more than 70% of the total daily trading volume but with only 0.5% of the total market cap. Why did the world start using stablecoins as the primary trading currency on global exchanges and why not local currencies?

Convenience: 1) stablecoins like USDT are popular for their calculation simplicity when trading on exchanges (divide the price by 1 as opposed to divide by 0.0013); and 2) it is much easier to hold USDT than to withdraw and deposit fiat money from bank accounts to exchange.

But, stablecoins are pegged to fiat money and therefore subject to inflation. In some cases have no confirmed U.S. dollar backing, they are centralized and not transparent organizations without governance policies. Recent news on the leading stablecoin USDT would suggest that it is a fraud and just a matter of time before the $1 price collapses and rekts all the holders of USDT:

The basic principles of Bitcoin laid out in its original whitepaper were revolutionary because of the decentralization and transparency that Bitcoin introduced to the world. Bitcoin is safer than any other form of investment asset or currency because of this decentralized and transparent architecture.

There were many attempts at creating digital currencies and networks prior to Bitcoin, however, where Bitcoin innovated was with the creation of the blockchain and an incentive mechanism designed to reward miners. And so BTC manifests as the first “cryptocurrency” as a result of the technology and as such garners the loyalty of the cryptocurrency community. Now, with Wall Street and institutional investors beginning to hoard BTC and with the first ETF launch in New York…BTC moves to yet another ATH.

But then why are there thousands of other cryptocurrencies and many more coming to market daily? Maybe BTC and stablecoins are still not the perfect solutions.

This is the exact problem that Brinc finance was created to solve: combine all of the strengths of BTC’s transparency, decentralization, incentivization with stablecoin’s backing and price stability?

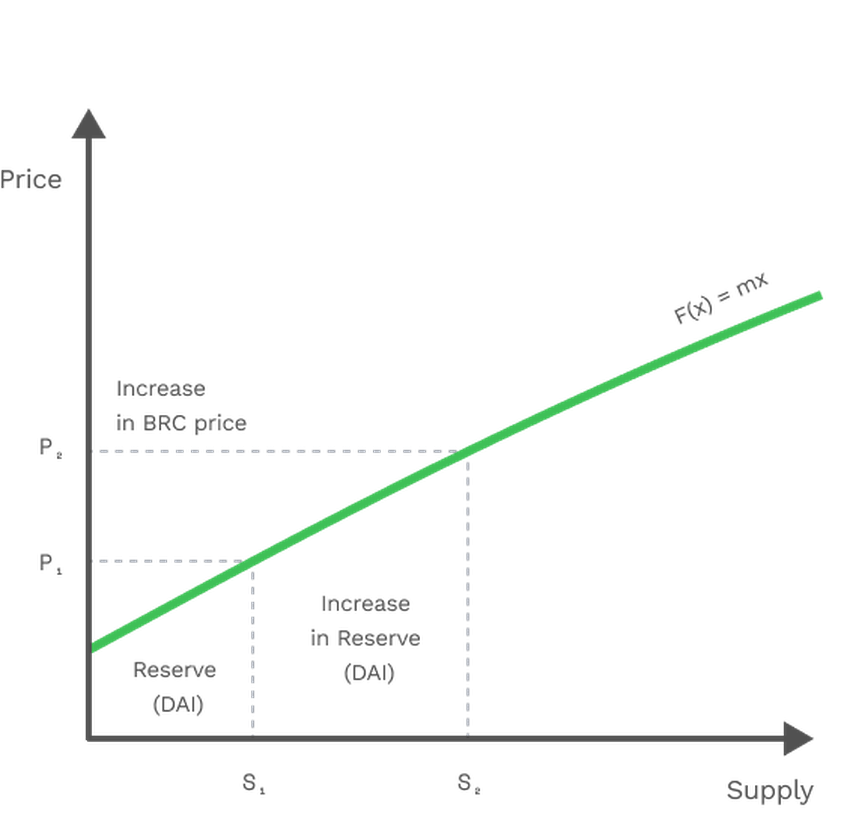

$BRC is a digital asset that can only be bought by depositing funds into a reserve i.e. a public Ethereum wallet address; one hundred percent of $BRC tokens in circulation are backed by these reserve funds. This means that every $BRC token is backed by the funds that were used to purchase them as opposed to the majority of cryptocurrencies which do not have any form of reserves or backing.

The minting, burning, and control of all $BRC tokens are completely done by smart contracts so that the token supply of $BRC is always decentralized and free from manipulation or arbitrary actions of the team behind the project.

No one, not even the founders, team, or community receives a single token without paying i.e. depositing to reserves. And there are no investors who benefit from buying in earlier than everyone else just because of their track record and brand power. $BRC is the first decentralized cryptocurrency asset that is fully backed with an increasing price curve powered by math and code.

For more information, click here.