The British multinational bank Standard Chartered believes that Bitcoin (BTC) will hit the milestone of $100,000 in 2024. But what will propel the growth?

During the late 2022s, many mainstream financial experts believed that Bitcoin and the broader crypto market were set to be doomed. However, a lot has changed in the past 12 months, with Bitcoin rallying almost 150%.

Crypto Spring Has Sprung: Standard Chartered

According to Business Insider, Standard Chartered said in a note that Bitcoin will hit $100,000 by the end of 2024. Geoff Kendrick, the Head of Crypto Research at Standard Chartered believes that the following are the key drivers that will push the Bitcoin to $100,000:

- Bitcoin miners’ accumulation of BTC

- Bitcoin halving

- Approval of a spot Bitcoin exchange-traded fund (ETF)

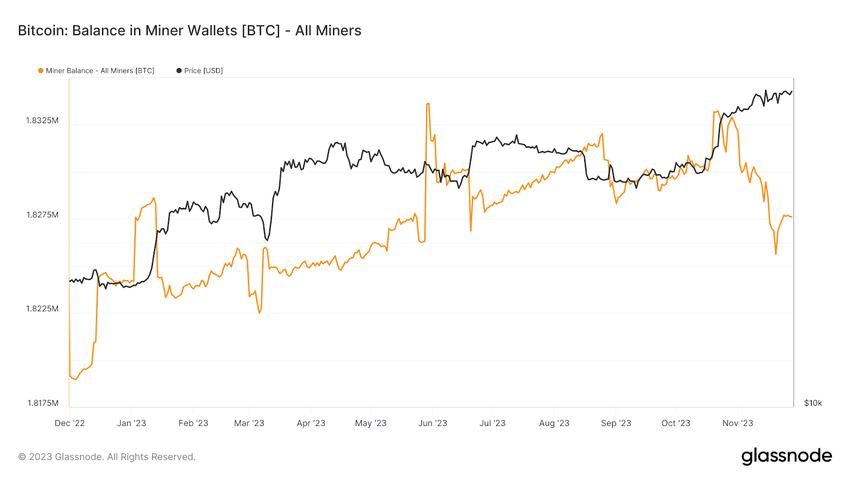

Indeed, the screenshot below shows that the Bitcoin miners’ BTC balance has continued to increase from December 2022. But, it is worth noting that there has been a heavy decrease in miners’ balance since late October 2023.

Indeed, Bitcoin halving introduces a supply shock in the circulation of BTC. On every halving, the block rewards given to miners get divided in half. Specifically, the 2024 Bitcoin halving will reduce the block reward allocation from 6.25 BTC to 3.75 BTC.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Standard Chartered Sees Spike in Bitcoin (BTC) Demand

However in 2024, Standard Chartered believes that along with supply shock, there will be a demand spike with the approval of a spot Bitcoin ETF. Kendrick wrote:

“We now expect more price upside to materialize before the halving than we previously did, specifically via the earlier-than-expected introduction of US spot ETFs. This suggests a risk that the $100,000 level could be reached before end-2024.”

In July, BeInCrypto reported that Standard Chartered predicted Bitcoin to hit $50,000 by the end of 2023.

However, at the end of November 2023, BTC is hovering around $38,000. The question is can the flagship crypto asset manage a more than 30% gain in the last month of the year?

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Do you have anything to say about Standard Chartered Bitcoin prediction or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.