Bitcoin faces a severe liquidity crisis as demand for the digital currency soars to unprecedented levels.

According to analysts at CryptoQuant, monthly demand has rocketed from 40,000 BTC at the outset of the year to a staggering 213,000 BTC presently. This surge is attributed to the growing total balance of accumulation addresses, indicating heightened investor interest in securing Bitcoin.

Bitcoin Liquidity Crisis Strikes Crypto Market

Bitcoin exchange-traded funds (ETFs) in the US significantly contribute to the surge in demand for BTC. These ETFs, excluding GBTC, have seen their BTC balances swell dramatically. Indeed, from February 25 to March 17, their balances grew from 117,000 to 185,000 BTC.

This trend reflects the crucial role that institutional investments through spot ETFs are playing in amplifying Bitcoin demand.

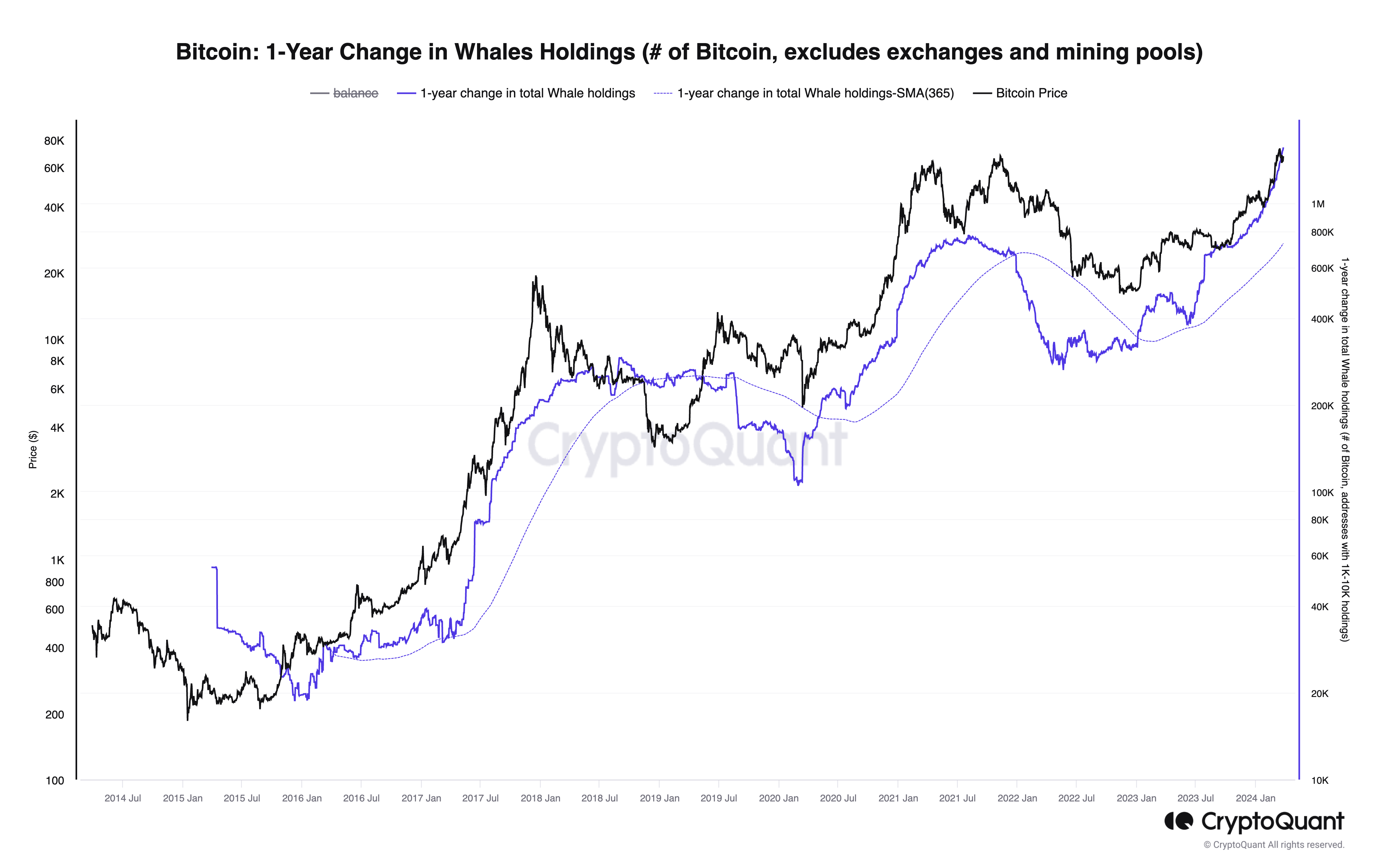

Moreover, the appetite for Bitcoin among large holders, or “whales,” is also witnessing a parabolic increase. The year-on-year growth in the total balance of Bitcoin whales — those holding between 1,000 to 10,000 BTC — has reached an all-time high of 1.57 million BTC, marking a significant acceleration from 874,000 BTC at the beginning of 2024.

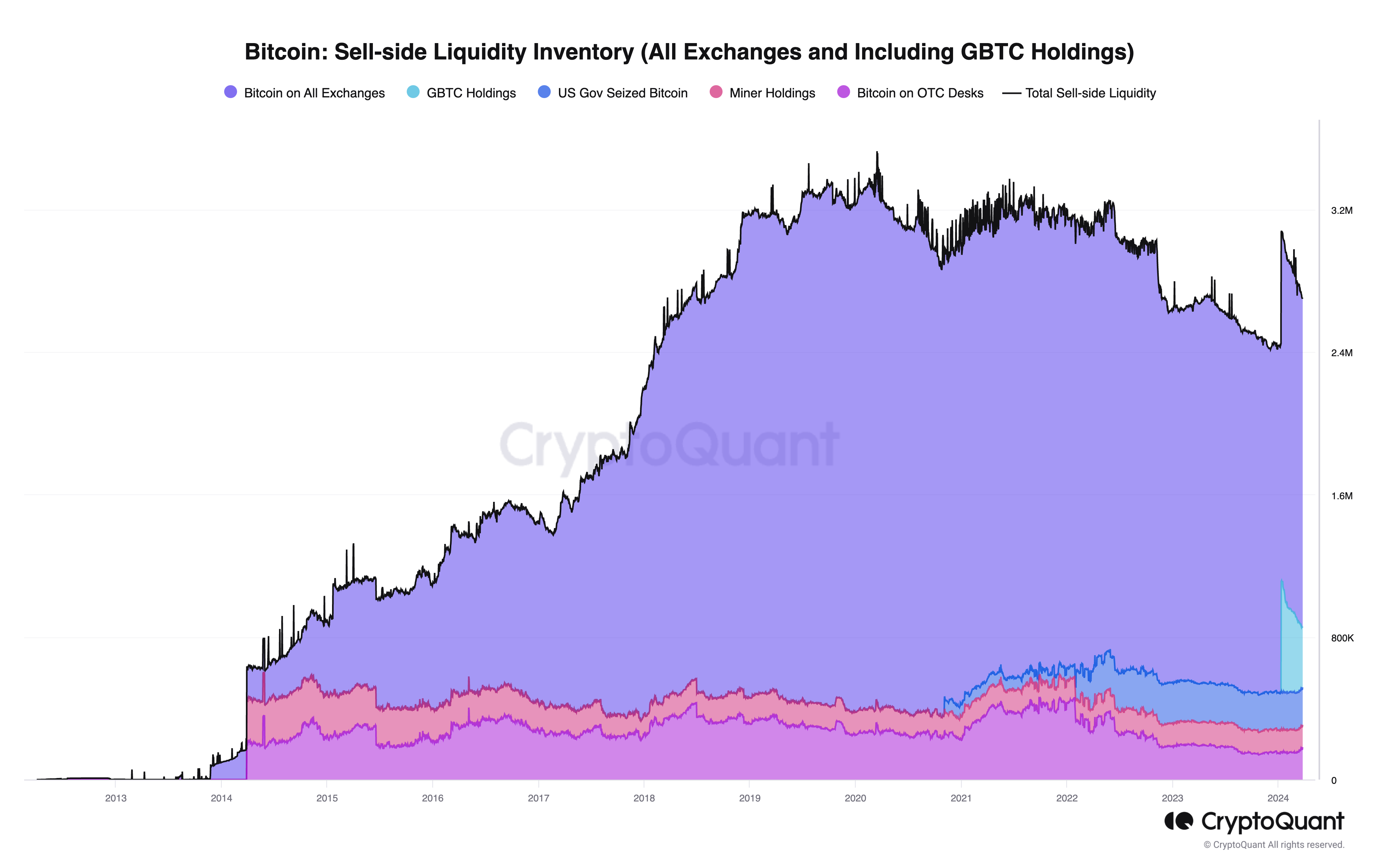

Concurrently, the sell-side liquidity of Bitcoin is experiencing a downward trend. The total visible amount of Bitcoin at key entities has dwindled to 2.7 million BTC. This is a sharp decrease from the all-time high of 3.5 million BTC in March 2020.

This imbalance between record-high demand and decreasing sell-side liquidity led to a historic low in the liquid inventory of Bitcoin. Estimates suggest that the current sell-side liquidity can only satisfy the surging demand for the next twelve months, assuming demand from accumulating addresses alone.

This situation becomes even more critical when considering the exclusion of Bitcoin on exchanges outside the US, with the liquid inventory dropping to just six months of demand. This exclusion is based on the premise that US spot Bitcoin ETFs primarily source Bitcoin from within the country.

“Record Bitcoin demand paired with declining sell-side liquidity has resulted in the liquid inventory of Bitcoin plunging to the lowest ever in terms of months of demand… A declining liquid inventory would support higher prices,” analysts at CryptoQuant wrote.

Read more: Bitcoin Price Prediction 2024/2025/2030

The convergence of these factors signal a bullish future of the price of Bitcoin. Indeed, CryptoQuant CEO Ki Young Ju added that under these conditions price corrections “entail a max drawdown of around 30% in bull markets, with a max pain of $51,000.”