Bitcoin, Ethereum, and XRP all shared the same bearish narrative with prices plunging by double digits on the weekly window.

A larger market downfall, following the FTX-Binance drama, led to market-wide panic selling that brought down Bitcoin and altcoin prices. Bitcoin price oscillated at $17,564 at press time, dropping by over 20% in the last three days.

Ethereum and XRP followed BTC’s suit as their price fell below key support zones. While Bitcoin, Ether, and XRP all presented a slight uptick in price, on the hourly time frame, price action was still massively bearish.

How deep can Bitcoin losses extend?

The FTX disaster triggered heavy market losses as Bitcoin price tested the record low price of $15,580. The $15,500 level was last seen by BTC in November 2021 after which Bitcoin price regained momentum as a bull rally began.

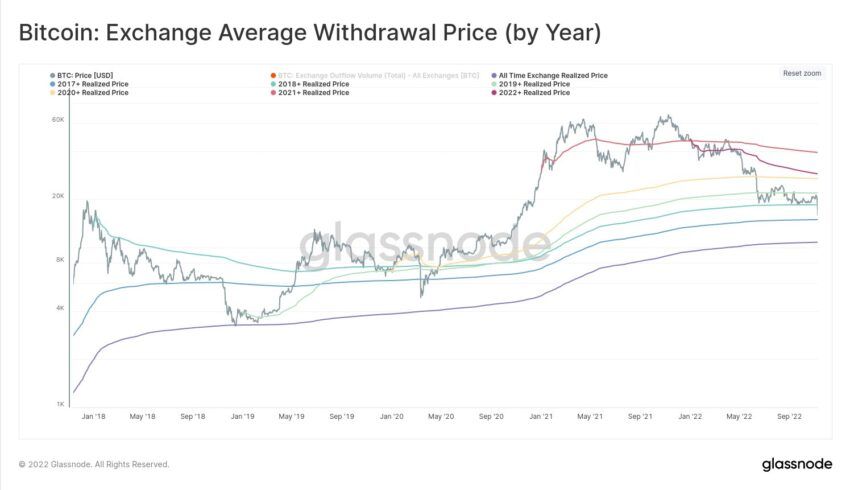

Data from Glassnode highlighted that near the $15,700 level, only investors from the class of 2017 and earlier were in profit. The average exchange withdrawal price since January 1, each year, suggested that the class of 2018 support at the $18,500 mark was lost.

Bitcoin’s supply in loss this year was also at par with the 2020 black swan event and the final peak of 2018.

The amount of supply in a loss in November this year stood around 10,499,799, while it was at 10,492,135 in 2020. Investors’ losses were so grave that it was tough to assess how long the market will take to recover.

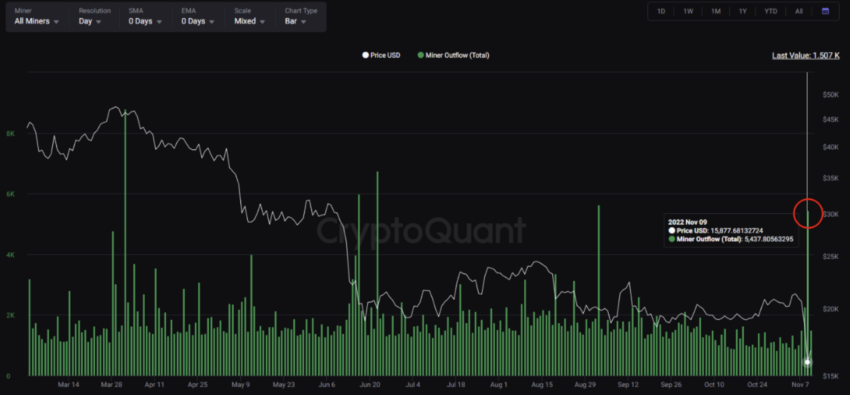

Even though BTC price was up by over 5.11% on the hourly chart, Bitcoin miner metrics suggested there was still immense pain. Notably, the Hash Ribbons Index was at an all-time high.

However, the Bitcoin mining volume was gradually decreasing which could severely affect miners.

On Nov. 9, around 5,437 BTC was withdrawn from the Miner Outflow Index. This can be interpreted as miners increased market selling pressure.

Bitcoin whales redistribute

Going forward, if the miner withdrawal table shows that the miner withdrawal rises, the BTC price could fall further.

Bitcoin whales were also more cautious this time. BTC whales holding 1,000 to 10,000 BTC were seen selling or redistributing. This whale cohort redistributed around 140,000 BTC in the last two weeks, worth roughly $2.25 billion.

Thus, with whale and miner behavior looking increasingly suspicious it can’t be said that a bottom is in.

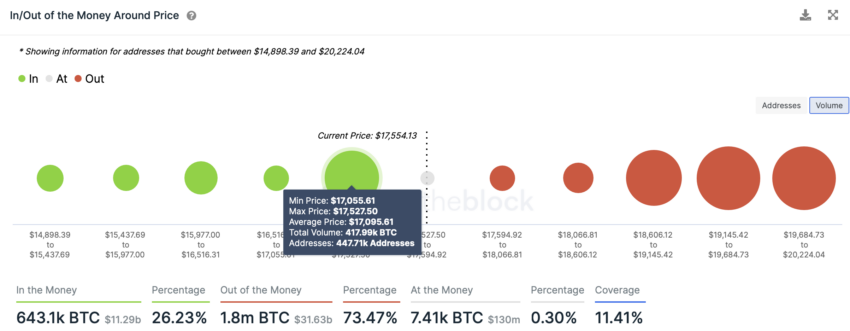

Going forward, with short-term price momentum improving, IntoTheBlock’s In/Out Of Money Around Price Indicator suggested a strong support for Bitcoin price at the $17,095 mark where 447,000 addresses hold 417,000 BTC.

However, if the Bitcoin price fell below the $17,000 mark there seems to be no major support till the $15,000 range.

Ethereum attempts recovery

Both Ether and XRP recorded one of the most notable price pullbacks below key support levels. However, at press time, Ethereum price gained 7.19% while XRP’s price appreciated by 2.11% on the daily window.

The losses weren’t as grave for ETH as they were for Bitcoin and some other altcoins this time. In fact, the ETH price maintained above the $1000 psychological support level.

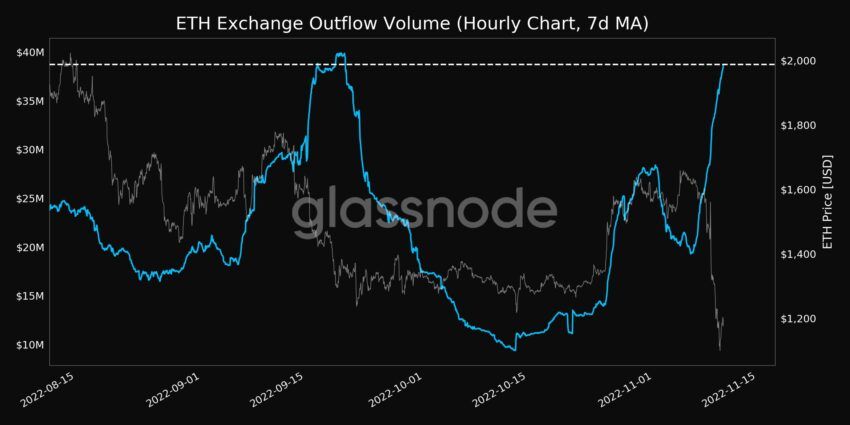

Despite bears taking over, ETH Exchange Outflow Volume reached a 4-month high of 26,377.735 ETH. Outflow volume spiking was largely indicative of Ether leaving the exchange.

Two of the biggest ETH whale cohorts holding 100,000 – 1 million coins and 1 million to 10 million coins redistributed or sold. Data from Santiment highlighted that, these cohorts reduced their holding by almost 1.3 million ETH amounting to over $1.3 billion at press time price.

Going forward, if ETH price can establish above $1350 resistance alongside a return of whales to the scene some relief can be expected.

XRP network growth spikes

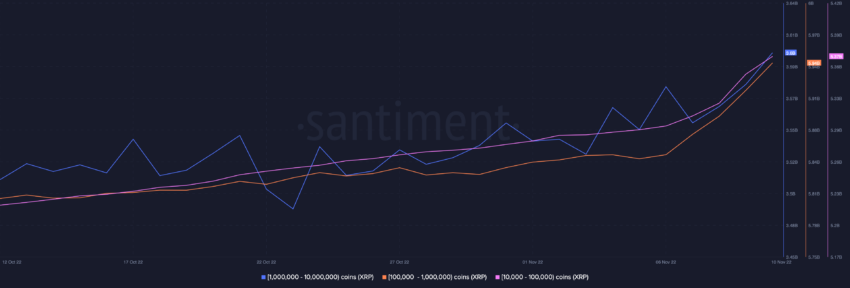

XRP price was still down 14.63% on the weekly chart but presented some gains on the short-term chart. As seen below, XRP whales weren’t deterred by the recent market crash, in fact, two of the biggest XRP whale cohorts stacked up some XRP.

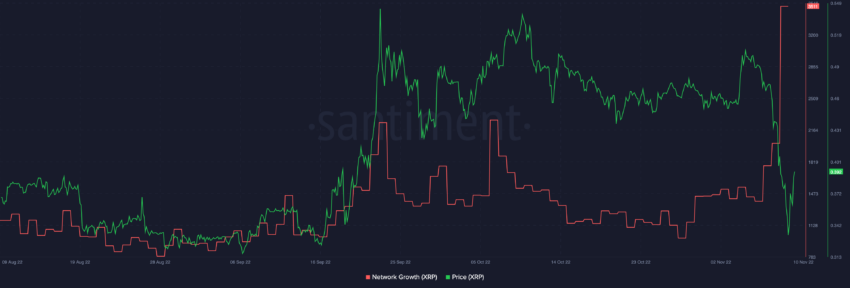

XRP’s network growth saw one of the most notable spikes making a new all-time high.

However, the price still had a long way to go, with the XRP price in a long-drawn downtrend owing to the ongoing regulatory battle.

For the XRP price, the next major resistance would be at the $0.40 mark while the $0.30 mark still acts as strong support.

Nonetheless, with the larger market still looking volatile a lot would depend on the macro market conditions.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.