The crypto market will witness $1.62 billion in Bitcoin and Ethereum options contracts expire today. This volume of options expiring could cause short-term price volatility, potentially affecting traders’ profitability.

Specifically, the Bitcoin (BTC) options due for expiry are valued at $1.25 billion, while those of Ethereum (ETH) are worth $367 million.

Bitcoin and Ethereum Holders Brace For Volatility

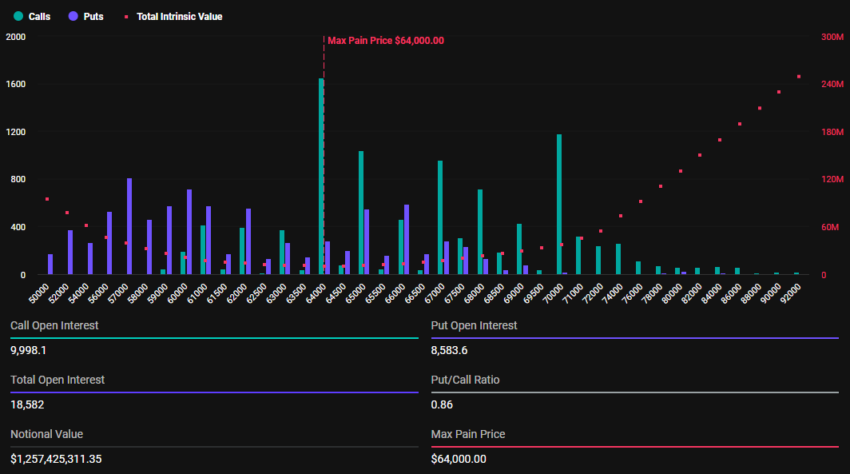

According to data on Deribit, 18,583 Bitcoin options will expire today, slightly higher than the 18,271 contracts that went bust last week. The options contracts due for expiry today have a put-to-call ratio of 0.86 and a maximum pain point of $64,000.

Read more: An Introduction to Crypto Options Trading.

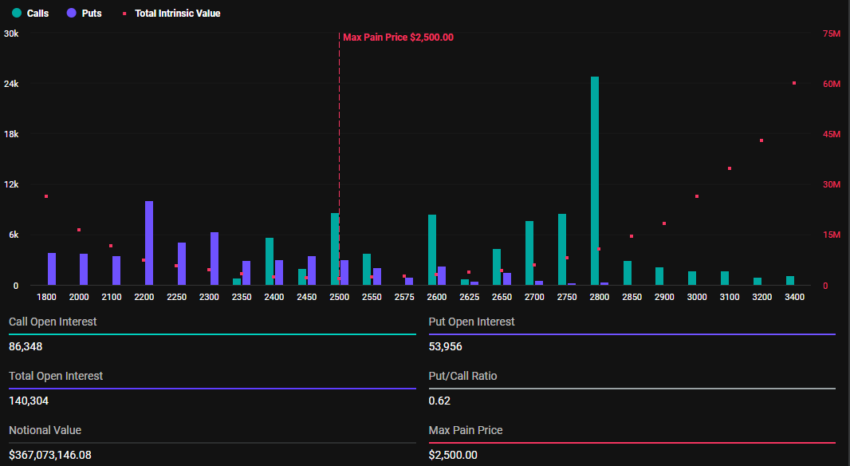

On the other hand, 140,320 Ethereum options contracts will expire today, significantly lower than the previous week. They will expire with a put-to-call ratio of 0.62 and a maximum pain point of $2,500.

These data suggest a generally bearish sentiment for both contracts. Bitcoin, currently trading for $67,661, is above its maximum pain point. Similarly, Ethereum is exchanging hands for $2,617 as of writing, well above its strike price.

As the options contracts near expiration, Bitcoin and Ethereum prices are expected to approach their respective maximum pain points. This means BTC and ETH values might drop as smart money is incentivized to push the price toward the “max pain” level. This is based on the Max Pain theory, which predicts that options prices will converge around the strike prices where the largest number of contracts — calls and puts alike — expire worthless.

The strategy causes option buyers to lose the most value, hence the implied bearish sentiment. Nevertheless, the pressure on BTC and ETH prices could reduce after 08:00 UTC on Friday, when Deribit settles the contracts.

Read more: 9 Best Crypto Options Trading Platforms.

Meanwhile, analysts say Bitcoin and the broader market are looking for a strong push that could see the pioneer cryptocurrency reclaim its all-time high above $73,777. From a macroeconomic perspective, tailwinds are not anywhere near sight. However, CoinShares researchers say the US elections remain the key driver for current market sentiment.

“…investor decisions have likely been more influenced by the upcoming US elections than by monetary policy outlooks. This trend is evident in the fact that stronger-than-expected economic data had little impact on stemming outflows, whereas the recent US vice presidential debate and a subsequent shift in polling towards the Republicans, perceived as more supportive of digital assets, led to an immediate boost in inflows and prices,” a paragraph from the recent report stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.