Friday is Bitcoin options expiry day, and there has been an increase in derivatives trading in recent weeks as spot BTC ETF hype grows. Crypto markets have also been steadily gaining but can this expiry event add to the momentum?

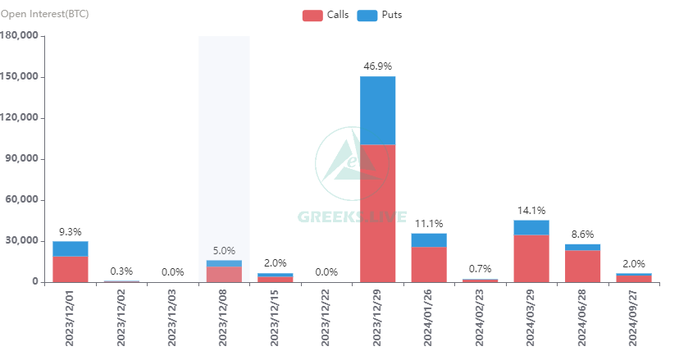

Around 29,000 Bitcoin options contracts are set to expire today. The tranche is less than a third of last week’s mammoth expiry event, which was also the end of the month.

Bitcoin Options Expiry

The notional value for today’s expiring contracts is a little over $1.13 billion. Moreover, the max pain price, or the level at which most losses will occur upon expiry, is around $37,000. This is slightly lower than the current spot BTC price, which is sitting slightly above $38,000.

The put/call ratio for today’s Bitcoin options batch is 0.58, meaning there are almost twice as many sellers of long (call) contracts than shorts (put).

Today’s batch is the second-largest expiration event of the month until December 29, which will see around 150,000 contracts expire.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

Greeks Live observed that market volatility has fallen this week, with BTC hitting resistance at $38,000 three times.

“Looking at the options data, we can see that Put/Call Ratio is low, suggesting that the main trades this week have been centered on calls, with Maxpain points close to the strike price.”

Greeks Live observed that the rally was becoming more tepid, adding:

“Fewer and fewer investors are bullish on the surge in the short term, with expectations of a rise focused on January ETF approvals.”

Ethereum Derivatives Outlook

In addition to the Bitcoin options, around 230,000 Ethereum contracts are also due to expire today. These have a notional value of $470 million, a put/call ratio of 0.49, and a max pain point of $2,100.

Comparatively, there has been very little interest in ETH contracts, with all eyes focused on BTC and the premise of spot ETF approval.

Crypto markets are up 1% on the day, lifting total capitalization back to its 2023 high of $1.5 trillion.

Bitcoin has gained a similar amount, mostly in the past couple of hours, pushing its price to $38,132. However, it has hit resistance here three times over the past week.

Ethereum has had a better day, with 2.8% gains to reach $2,093 at the time of writing. Most of the altcoins remain flat aside from Dogecoin, Avalanche, and Polkadot, making between 3.5% and 6%.