The bitcoin dominance rate (BTCD) has been decreasing throughout 2021 since being rejected by a long-term resistance area.

The bitcoin dominance rate is expected to resume its drop towards the next closest support levels.

Long-Term BTCD Rejection

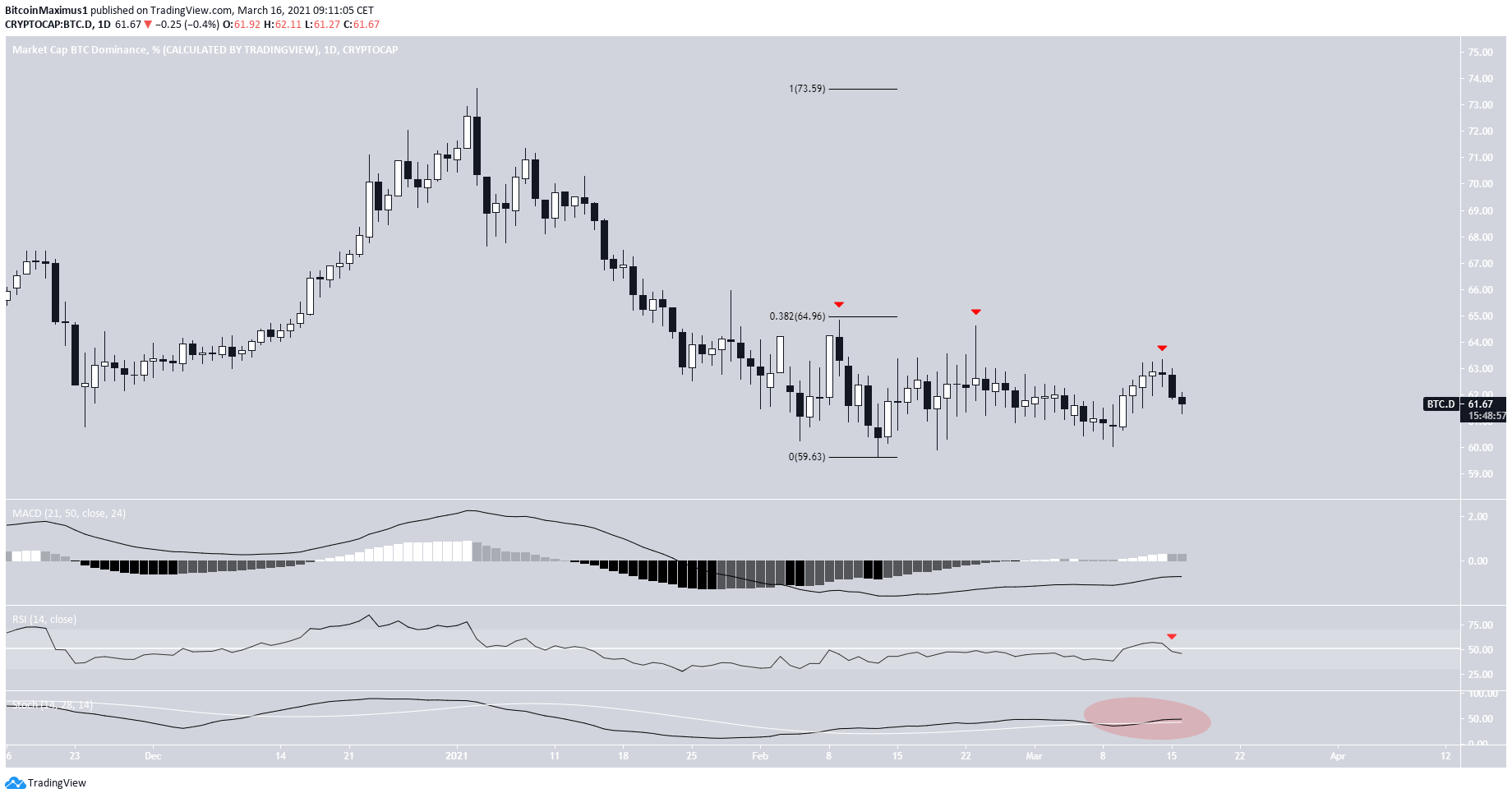

BTCD has been decreasing since December 2020 when a local high of 73.65% was reached. This left a long upper wick in place.

BTCD is currently approaching the 57.5% support area.

Technical indicators are bearish — suggesting that the trend is also bearish. The Stochastic oscillator has made a bearish cross, the MACD is negative, and RSI is below 50.

Falling below the 57.5% area would likely trigger a sharp drop.

The outlook from the daily time-frame is slightly more neutral. The RSI is freely crossing above and below 50. At the same time, the Stochastic oscillator has made both bullish and bearish crosses.

However, while the BTCD has bounced multiple times, each has been weaker than the previous. This is a sign of weakness, indicating that a drop is likely.

Short-Term Movement

Cryptocurrency trader @TradingTank outlined a BTCD chart, stating that a drop towards the 60% support area is likely.

The shorter-term MACD and RSI support this possibility. The MACD is decreasing and has nearly crossed into negative territory. In addition, the RSI has just crossed below 50.

Therefore, dropping back toward the 60% and 57.5% support area is likely.

The relationship between BTCD and the BTC price has been positive over the past ten days.

Although this may seem obvious, it’s not historically always been the case. As is visible by the correlation coefficient (red indicators), the relationship has fluctuated between positive and negative.

This is the longest period of time in 2021 in which the relationship has been positive. Therefore, it’s possible that it will soon flip — meaning that a BTC price increase could actually cause a BTCD decrease.

Conclusion

The BTCD is expected to decrease both in the short and the long-term. A fall back to the support levels at 60% and 57.5% is a likely scenario.

A decrease below the latter is likely to trigger a very sharp drop.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.